Answered step by step

Verified Expert Solution

Question

1 Approved Answer

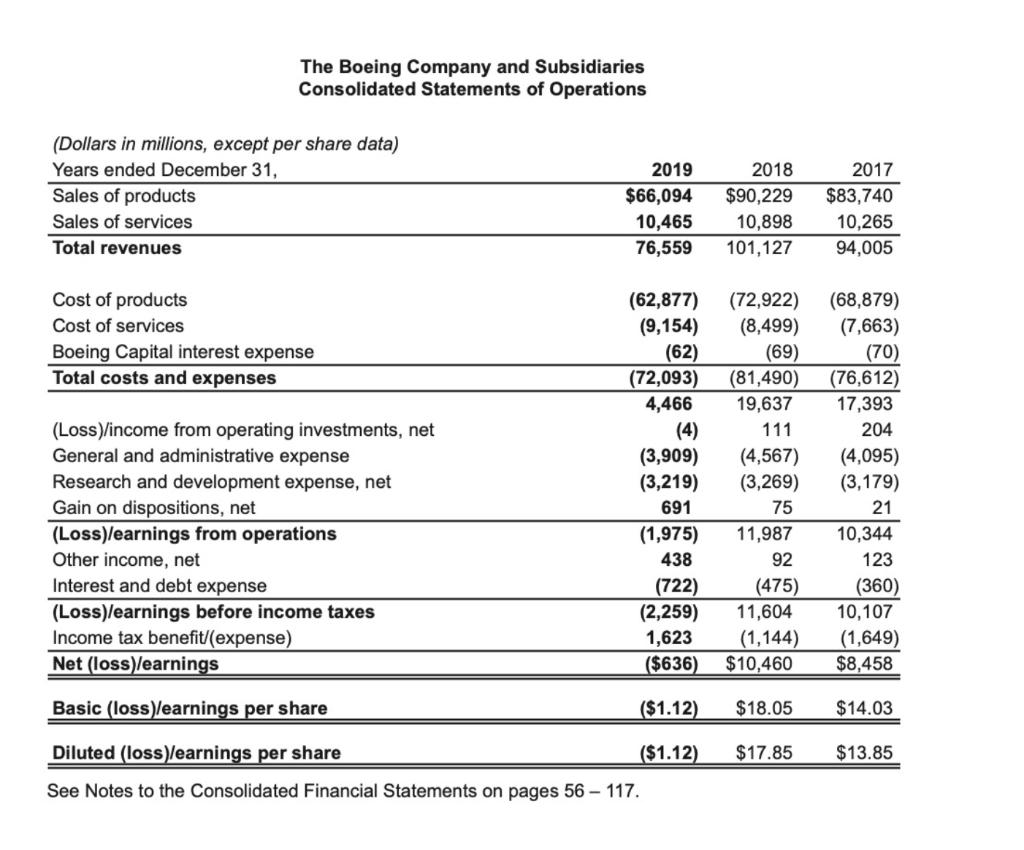

Complete a Vertical Analysis of The Boeing Companys Consolidated Statements of Financial Position and Consolidated Statements of Operations for both 2018 and 2019. Provide an

Complete a “Vertical Analysis” of The Boeing Company’s Consolidated Statements of Financial Position and Consolidated Statements of Operations for both 2018 and 2019. Provide an analysis of what your vertical analysis reveals about The Boeing Company’s financial position and profitability.

Required

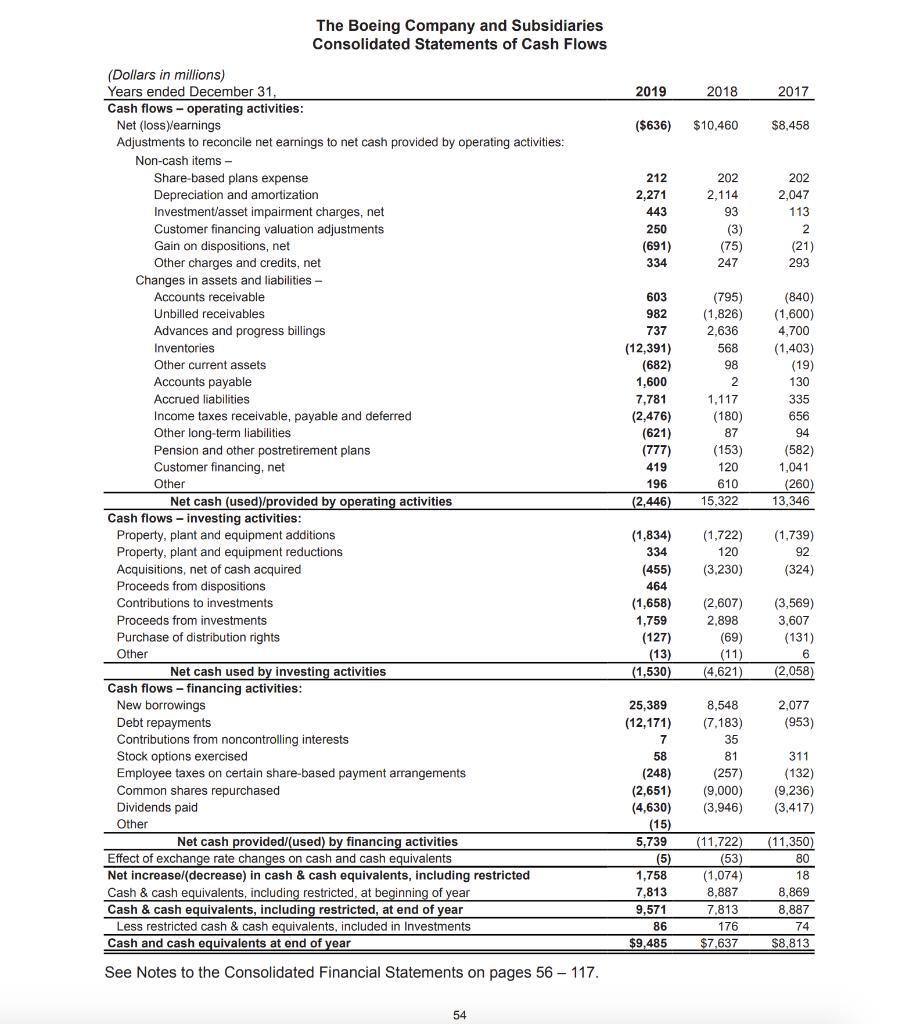

1. The vertical analysis for the Balance Sheets and Income Statements for the years 2018 and 2019 was completed

2. An analysis of the results was completed

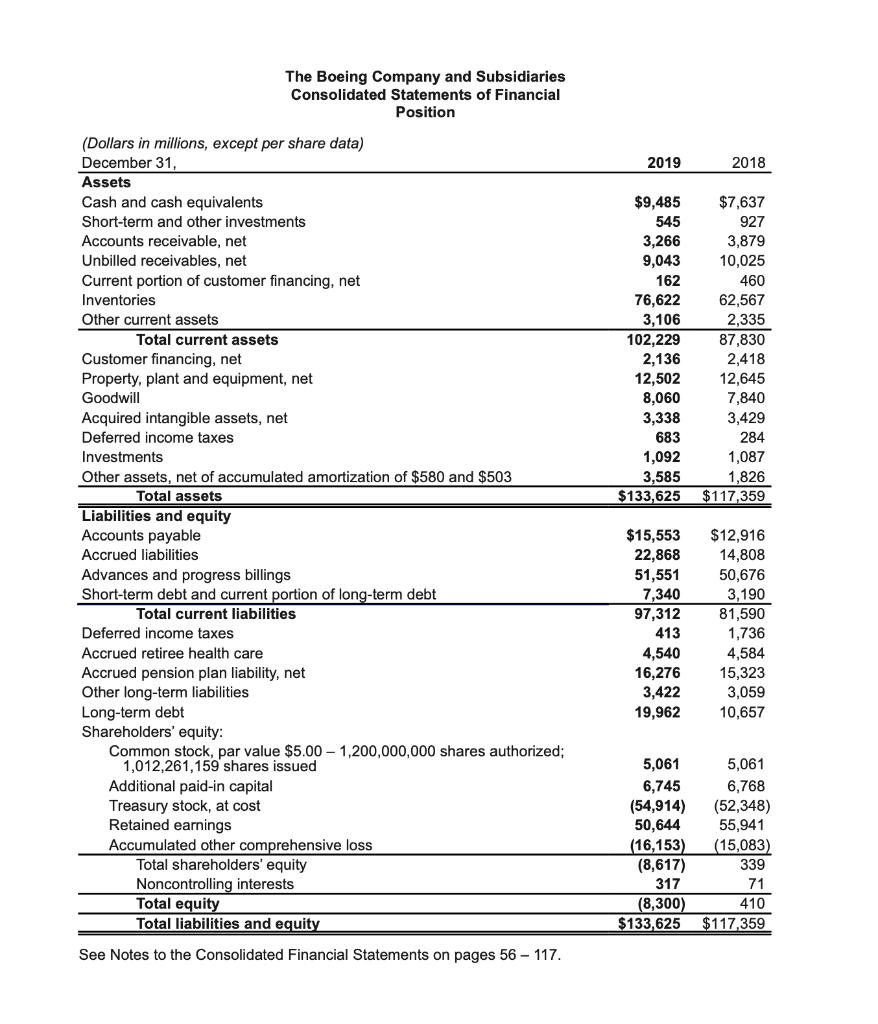

The Boeing Company and Subsidiaries Consolidated Statements of Financial Position (Dollars in millions, except per share data) December 31, Assets 2019 2018 Cash and cash equivalents $9,485 $7,637 Short-term and other investments 545 927 Accounts receivable, net 3,266 3,879 Unbilled receivables, net Current portion of customer financing, net 9,043 10,025 460 162 Inventories 76,622 3,106 102,229 2,136 12,502 8,060 3,338 62,567 Other current assets 2,335 Total current assets 87,830 Customer financing, net Property, plant and equipment, net 2,418 12,645 7,840 Goodwill Acquired intangible assets, net 3,429 Deferred income taxes 683 284 Investments 1,092 1,087 3,585 $133,625 Other assets, net of accumulated amortization of $580 and $503 1,826 $117,359 Total assets Liabilities and equity Accounts payable $15,553 $12,916 14,808 Accrued liabilities 22,868 Advances and progress billings Short-term debt and current portion of long-term debt 51,551 50,676 7,340 97,312 3,190 81,590 1,736 Total current liabilities Deferred income taxes 413 Accrued retiree health care 4,540 16,276 4,584 Accrued pension plan liability, net Other long-term liabilities Long-term debt Shareholders' equity: Common stock, par value $5.00 1,200,000,000 shares authorized; 1,012,261,159 shares issued Additional paid-in capital Treasury stock, at cost Retained earnings 15,323 3,059 3,422 19,962 10,657 5,061 5,061 6,745 (54,914) 50,644 6,768 (52,348) 55,941 Accumulated other comprehensive loss Total shareholders' equity Noncontrolling interests Total equity Total liabilities and equity (16,153) (8,617) (15,083) 339 317 71 410 (8,300) $133,625 $117,359 See Notes to the Consolidated Financial Statements on pages 56 - 117.

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

126 Liabilities and Equity 127 Accounts Payable 15553 1164 12916 1101 128 Accrued Labilities 22868 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started