Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete accrual and cash balance sheet at jan 31 On January 1, 2017, Norma Smith and Grant Wood formed a computer sales and service company

Complete accrual and cash balance sheet at jan 31

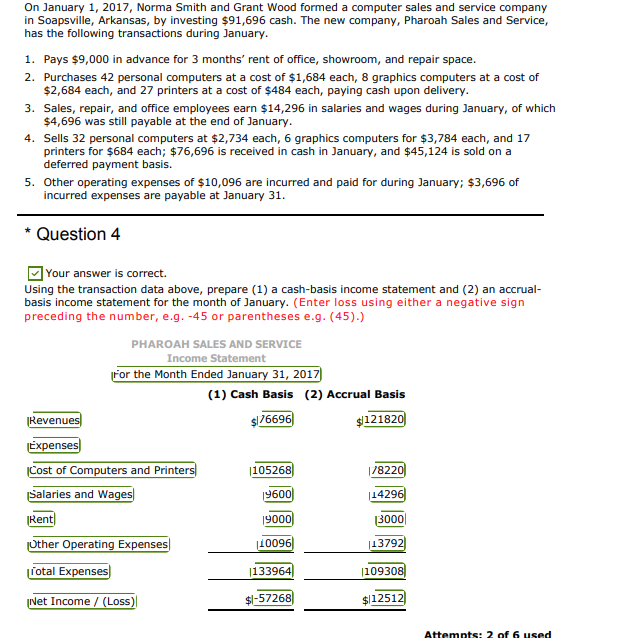

On January 1, 2017, Norma Smith and Grant Wood formed a computer sales and service company in Soapsville, Arkansas, by investing $91,696 cash. The new company, Pharoah Sales and Service, has the following transactions during January 1. Pays $9,000 in advance for 3 months' rent of office, showroom, and repair space 2. Purchases 42 personal computers at a cost of $1,684 each, 8 graphics computers at a cost of $2,684 each, and 27 printers at a cost of $484 each, paying cash upon delivery 3. Sales, repair, and office employees earn $14,296 in salaries and wages during January, of which $4,696 was still payable at the end of January 4. Sells 32 personal computers at $2,734 each, 6 graphics computers for $3,784 each, and 17 printers for $684 each; $76,696 is received in cash in January, and $45,124 is sold on a deferred payment basis. Other operating expenses of $10,096 are incurred and paid for during January: $3,696 of incurred expenses are payable at January 31 5. * Question 4 Your answer is correct. Using the transaction data above, prepare (1) a cash-basis income statement and (2) an accrual basis income statement for the month of January. (Enter loss using either a negative sign preceding the number, e.g. -45 or parentheses e.g. (45).) PHAROAH SALES AND SERVICE Income Statement the Month Ended January 31, 2017 (1) Cash Basis (2) Accrual Basis sl7669 12182 even Expenses ost of Computers and Printe 10526 78220 laries and Wa 960 1429 9000 her Operating Expenses Total Expenses Net Income/(Loss) 1379 10930 $11251 1009 1339 $1-5726Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started