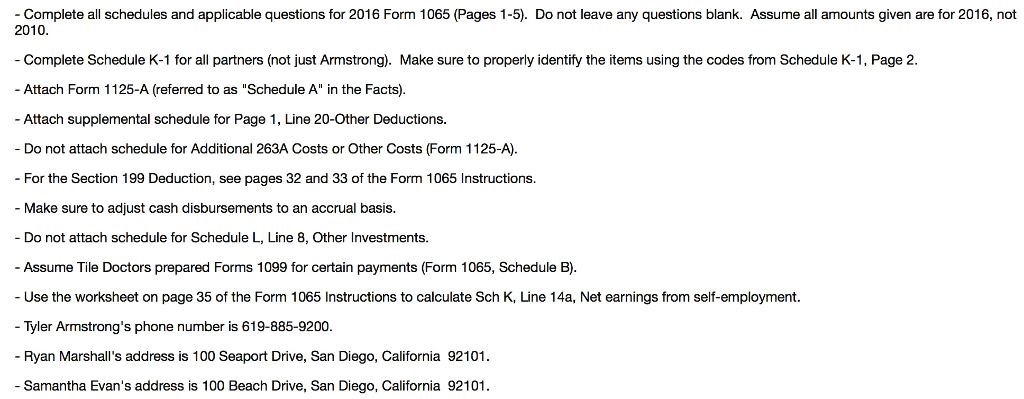

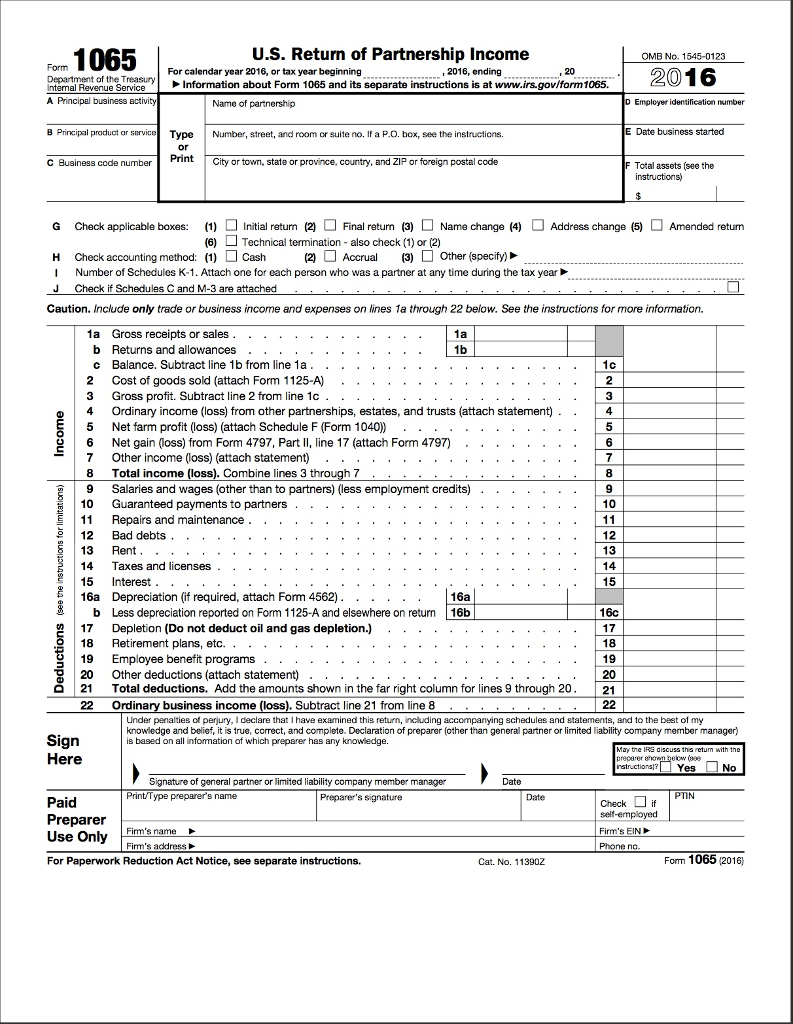

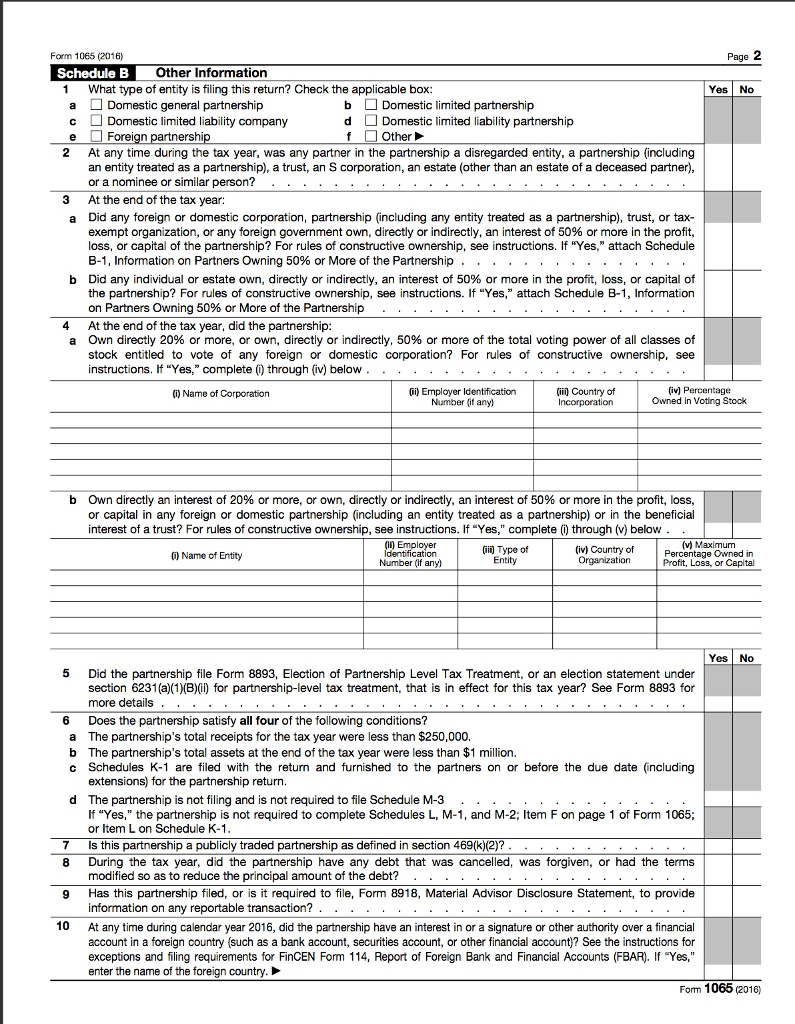

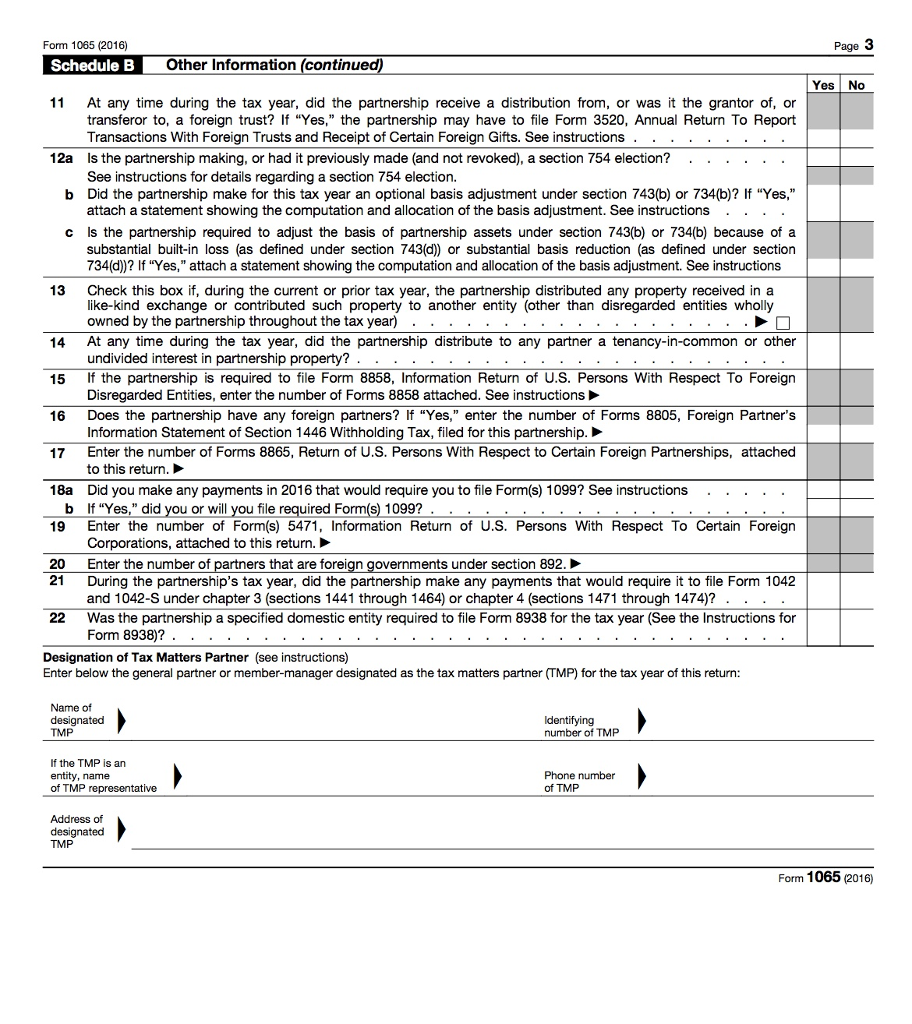

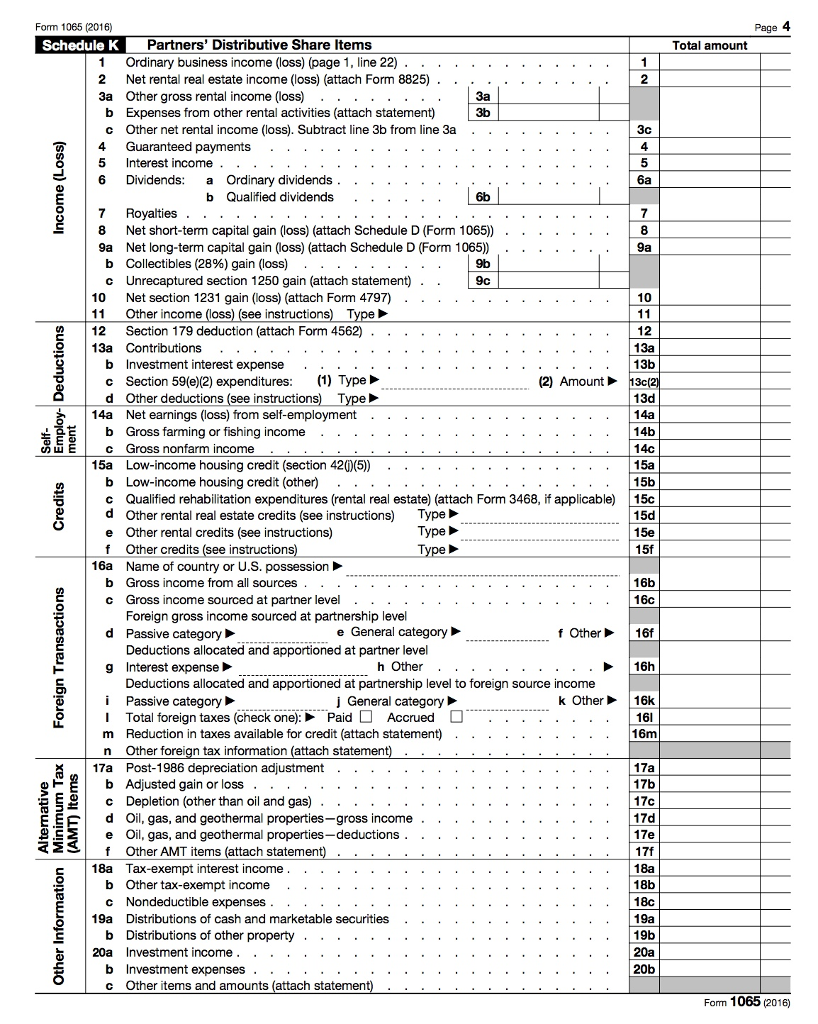

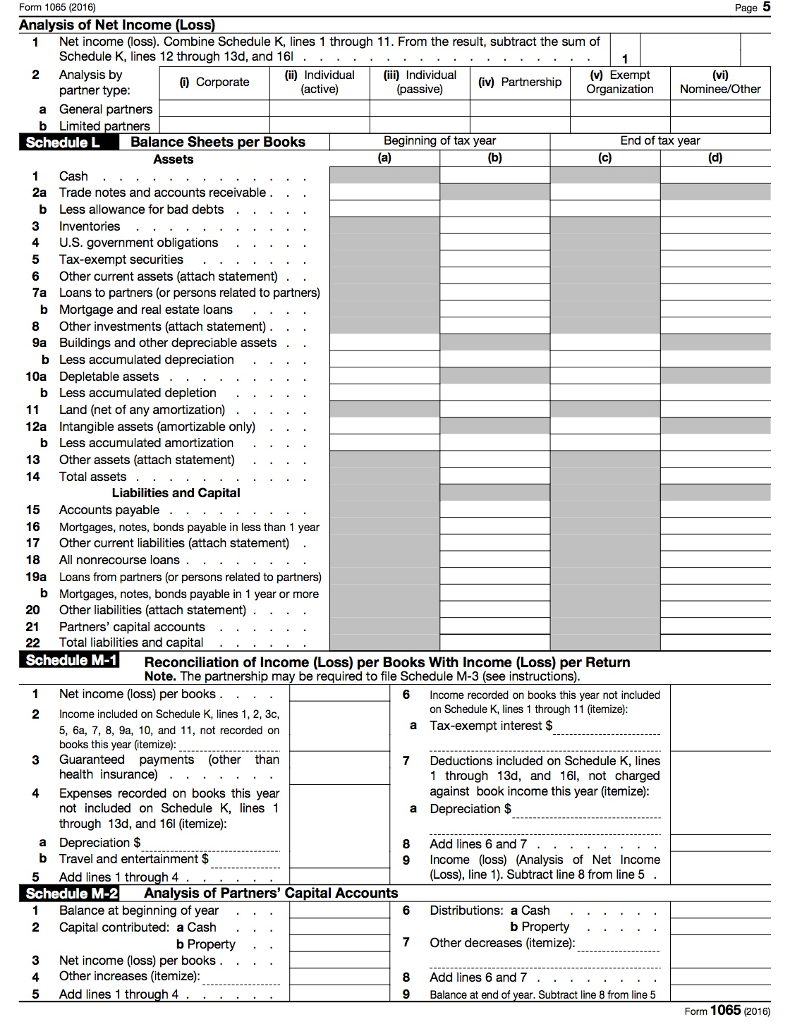

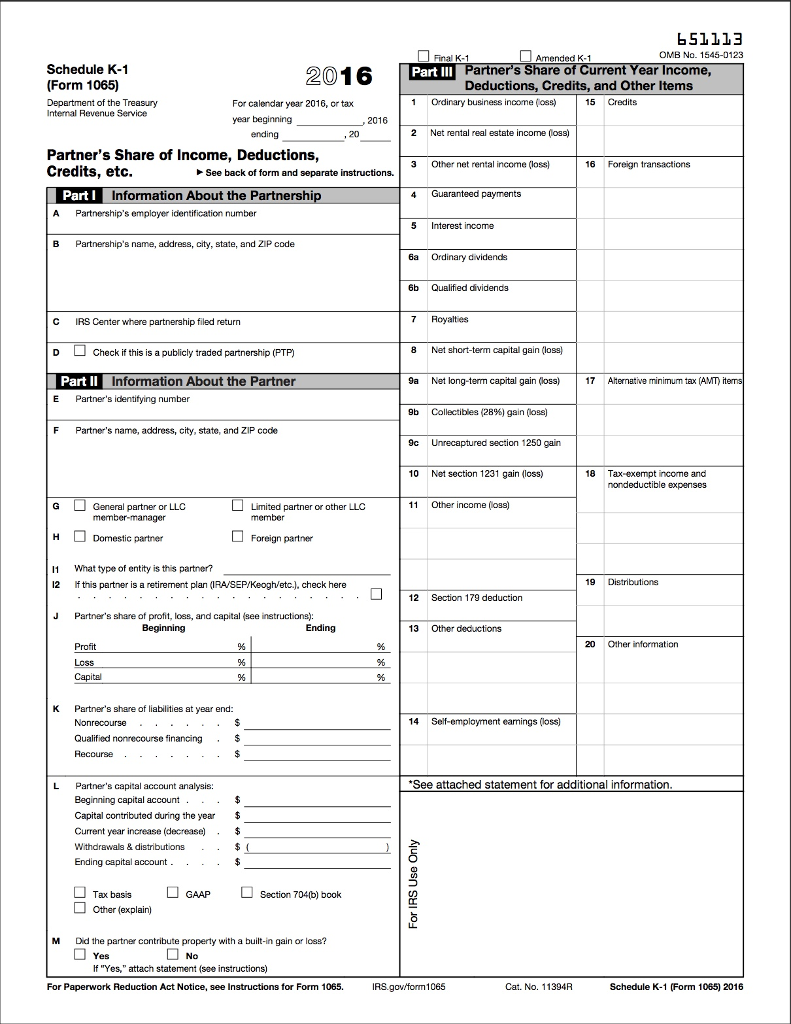

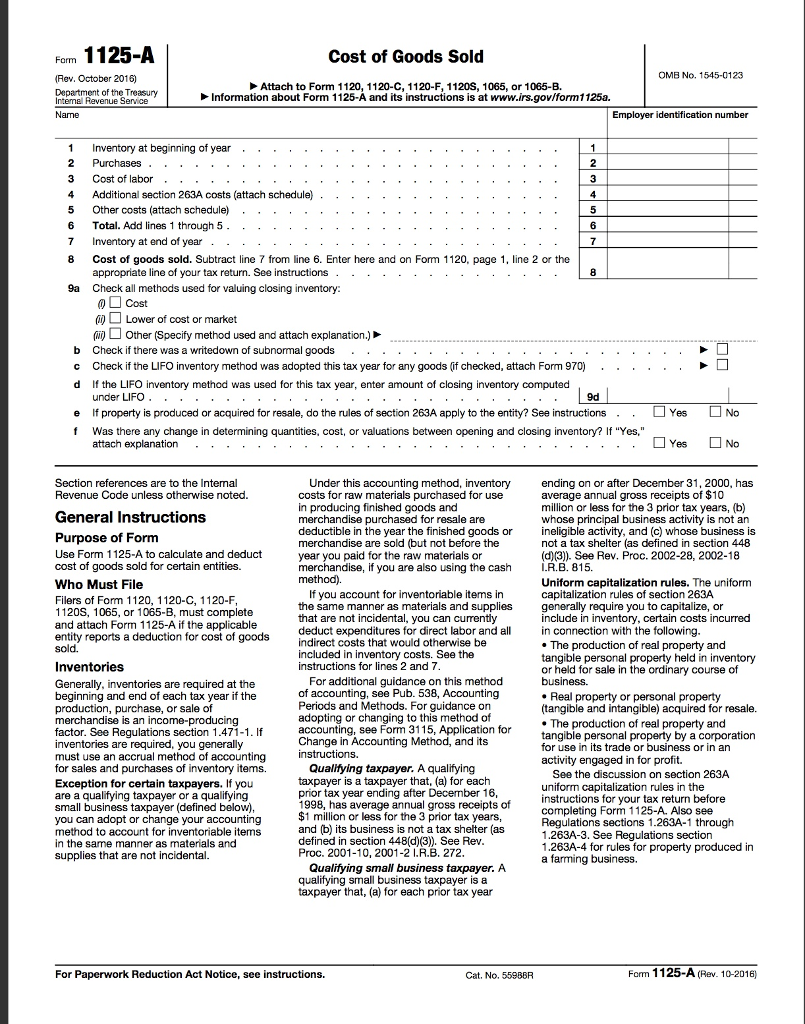

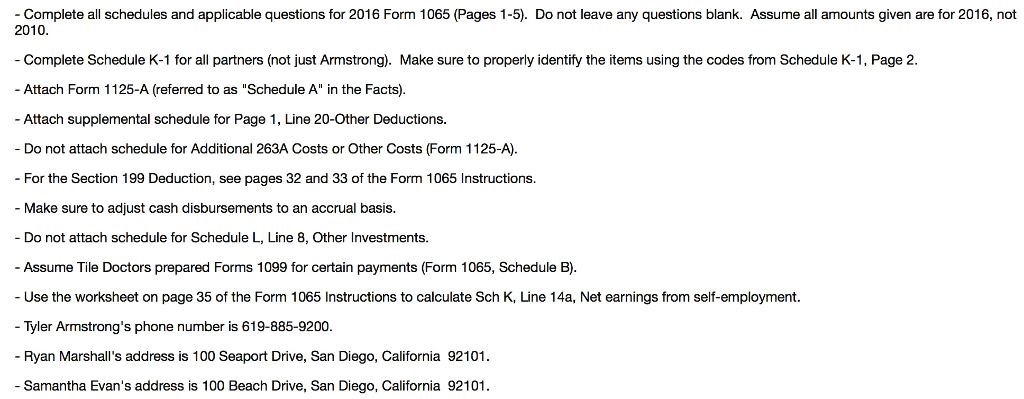

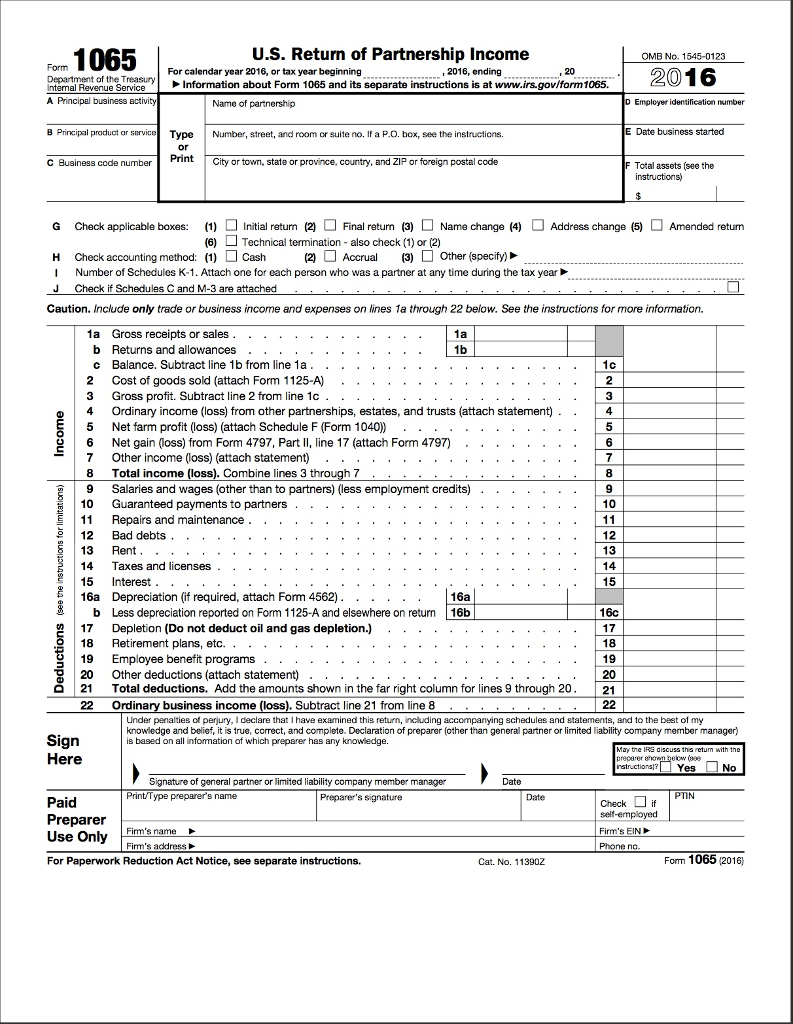

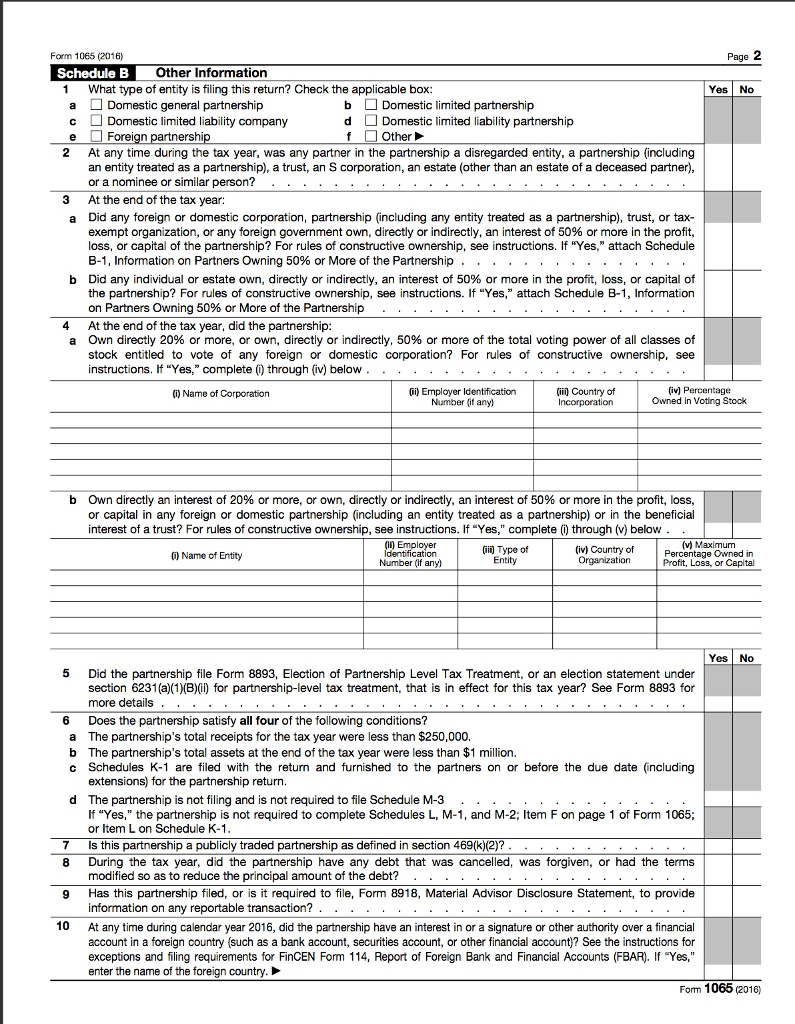

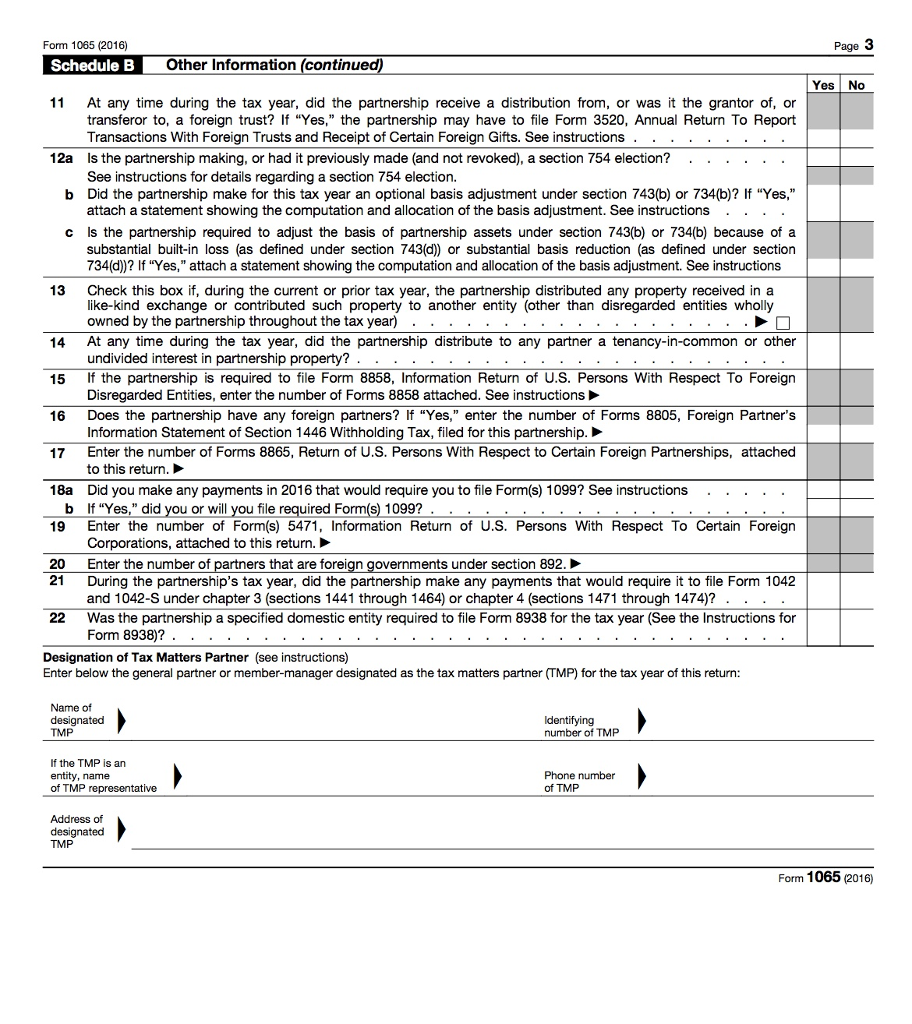

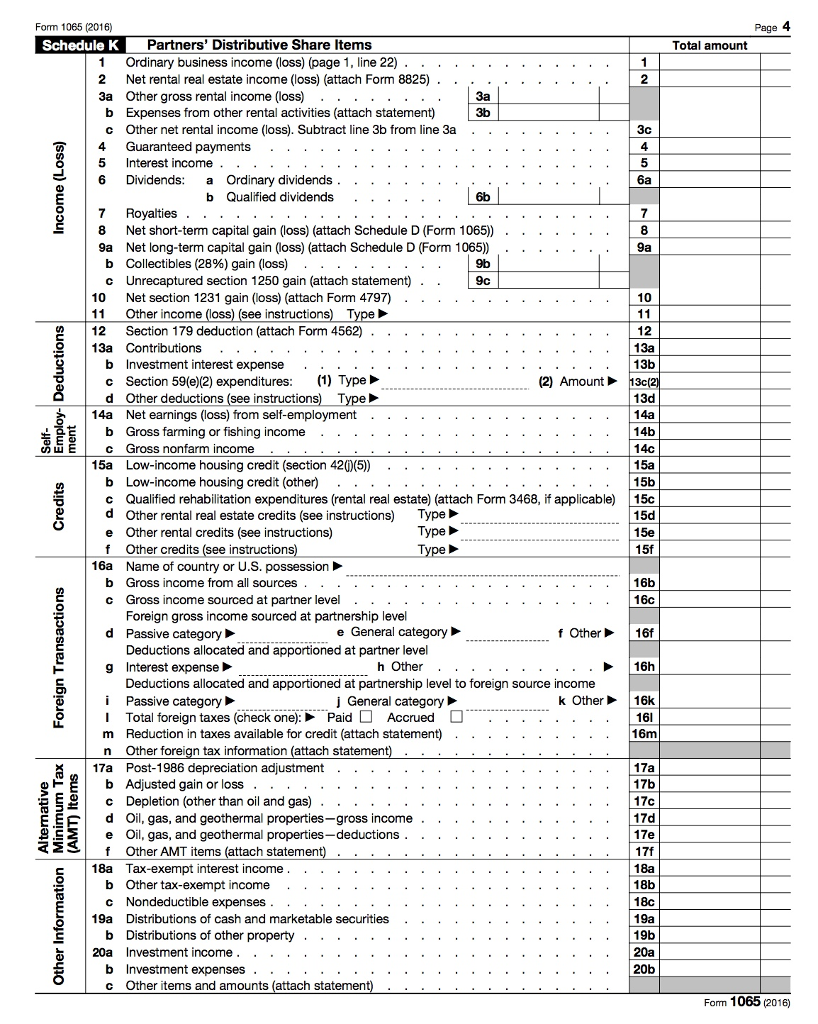

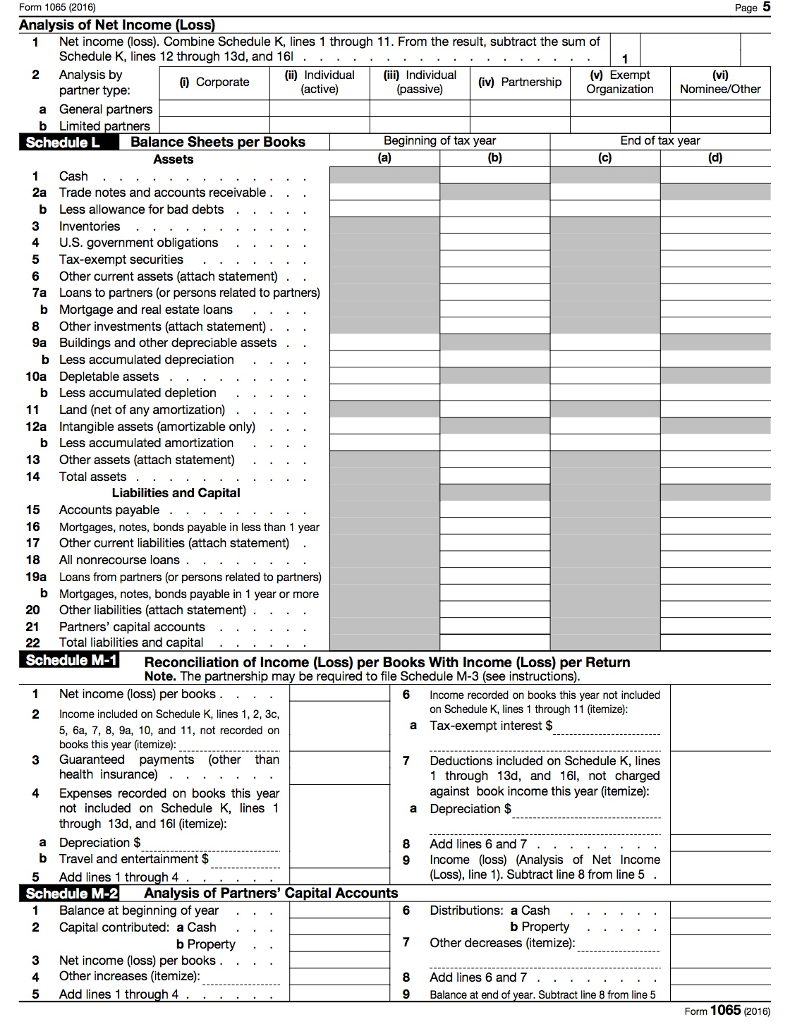

Complete all forms for the problem.

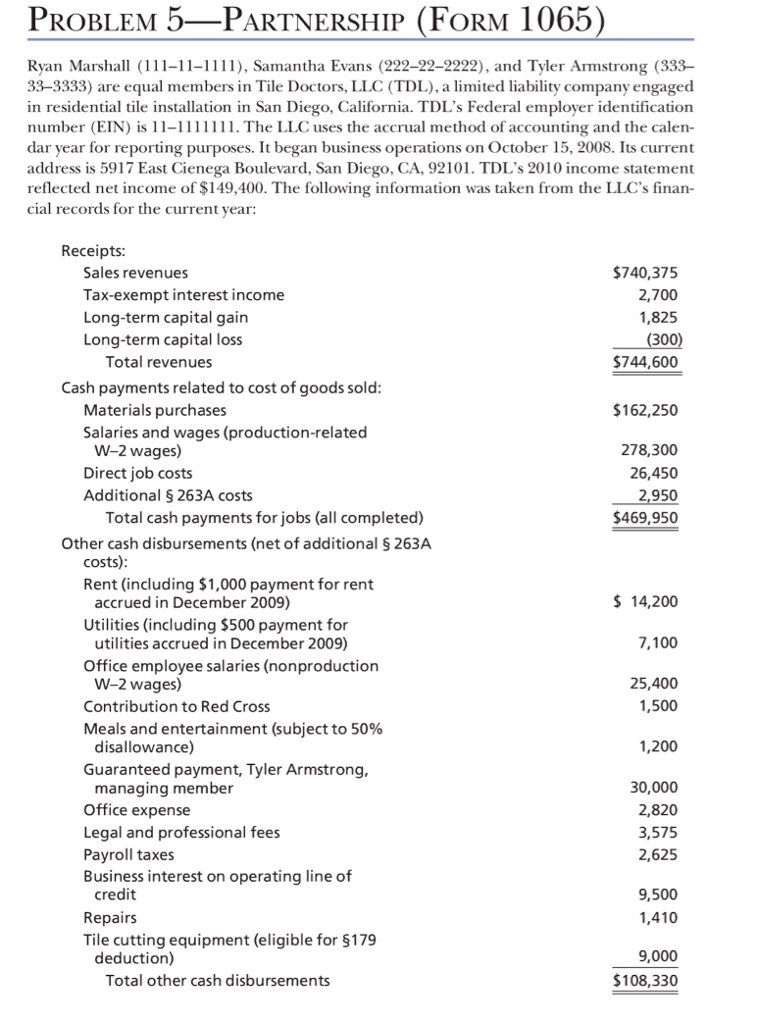

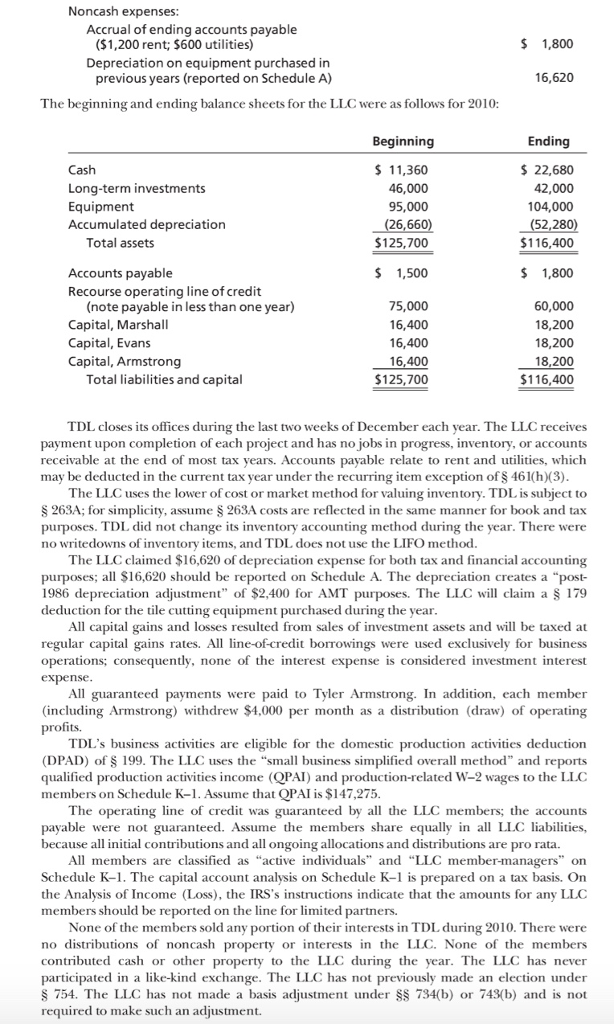

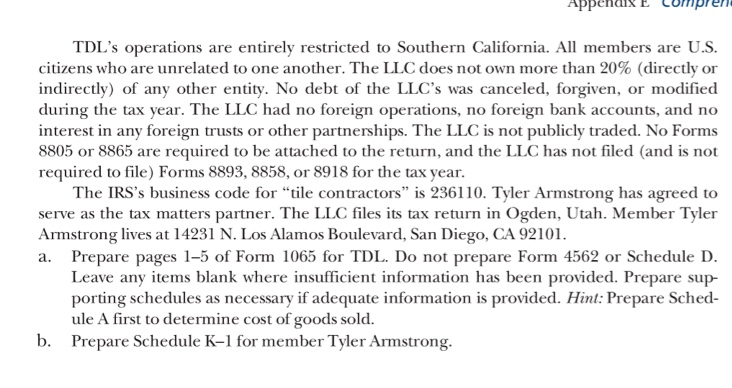

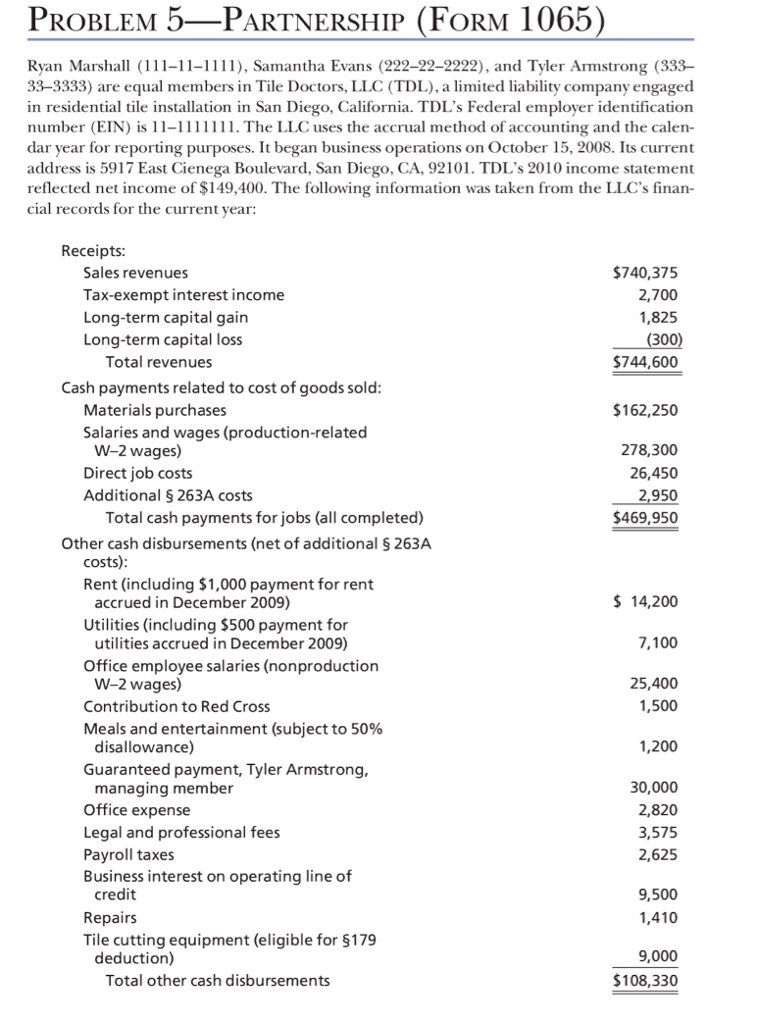

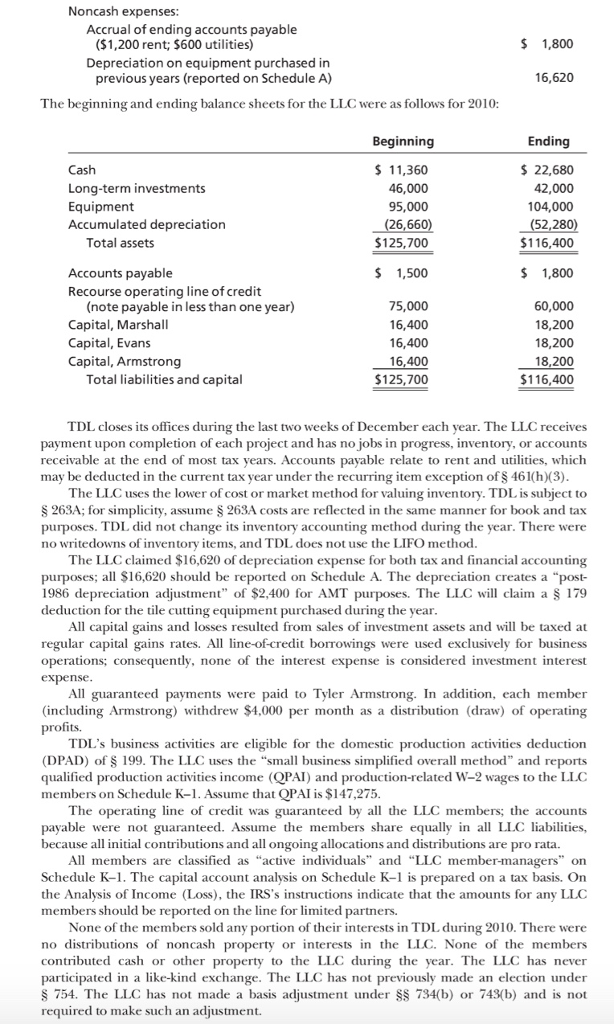

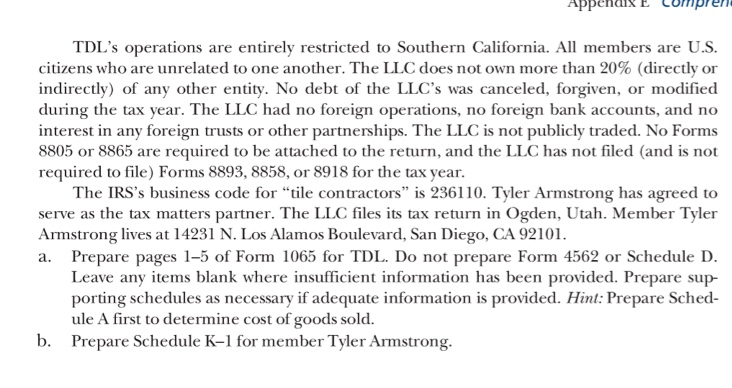

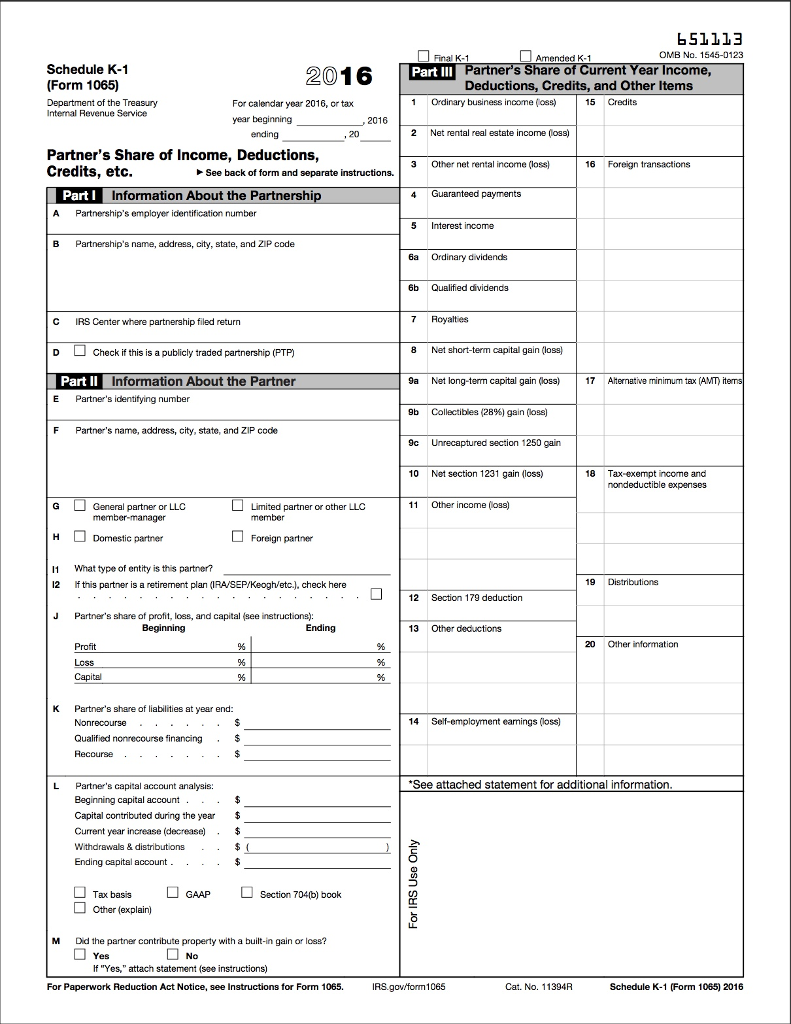

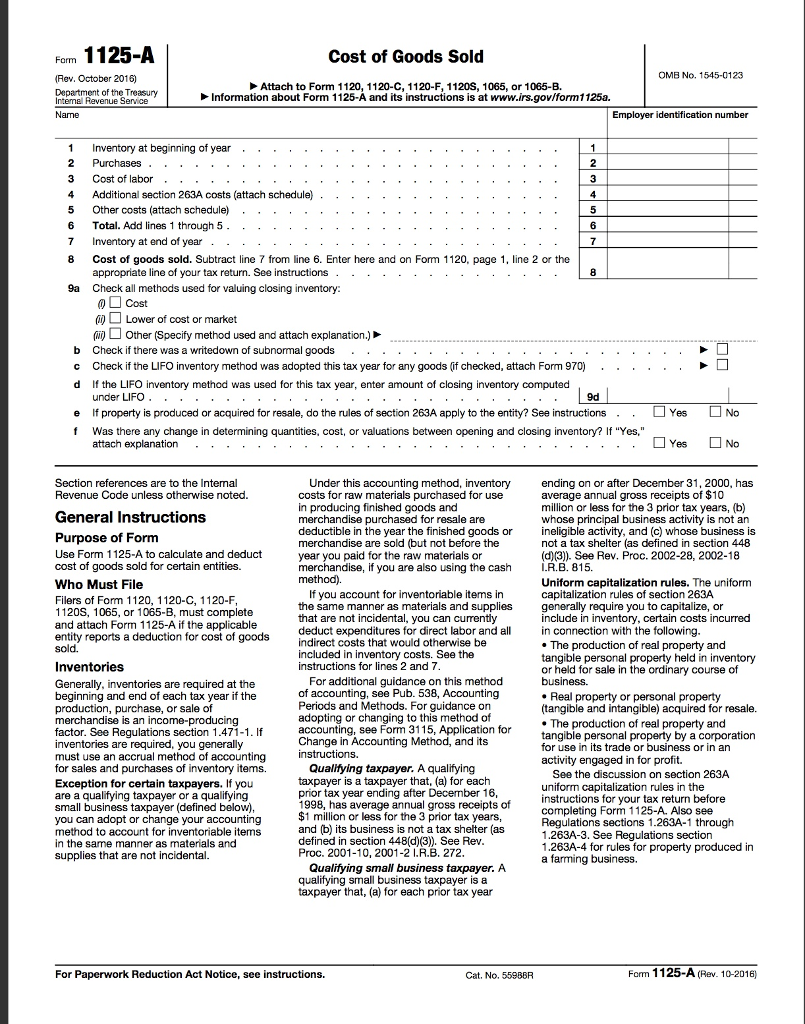

PrObleM 5-PARTNERSHIP (FORM 1065 Ryan Marshall (111), Samantha Evans (222-22-2222), and Tyler Amstrong (333- 33-3333) are equal members in Tile Doctors, LLC (TDL), a limited liability company engaged in residential tile installation in San Diego, California. TDL's Federal employer identification number (EIN) is 11. The LLC uses the accrual method of accounting and the calen dar year for reporting purposes. It began business operations on October 15, 2008. Its current address is 5917 East Cienega Boulevard, San Diego, CA, 92101. TDL's 2010 income statement reflected net income of $149,400. The following information was taken from the LLC's finan- cial records for the current year: Receipts: Sales revenues Tax-exempt interest income Long-term capital gain Long-term capital loss $740,375 2,700 1,825 300 $744,600 Total revenues Cash payments related to cost of goods sold $162,250 Materials purchases Salaries and wages (production-related W-2 wages) Direct job costs Additional 263A costs 278,300 26,450 2,950 $469,950 Total cash payments for jobs (all completed) Other cash disbursements (net of additional 263A costs) Rent (including $1,000 payment for rent 14,200 accrued in December 2009) Utilities (including $500 payment for 7,100 utilities accrued in December 2009) Office employee salaries (nonproduction W-2 wages) Contribution to Red Cross Meals and entertainment (subject to 50% 25,400 1,500 1,200 disallowance) Guaranteed payment, Tyler Armstrong, managing member Office expense Legal and professional fees Payroll taxes Business interest on operating line of 30,000 2,820 3,575 2,625 credit Repairs Tile cutting equipment (eligible for 5179 9,500 1,410 deduction) 9,000 Total other cash disbursements $108,330 PrObleM 5-PARTNERSHIP (FORM 1065 Ryan Marshall (111), Samantha Evans (222-22-2222), and Tyler Amstrong (333- 33-3333) are equal members in Tile Doctors, LLC (TDL), a limited liability company engaged in residential tile installation in San Diego, California. TDL's Federal employer identification number (EIN) is 11. The LLC uses the accrual method of accounting and the calen dar year for reporting purposes. It began business operations on October 15, 2008. Its current address is 5917 East Cienega Boulevard, San Diego, CA, 92101. TDL's 2010 income statement reflected net income of $149,400. The following information was taken from the LLC's finan- cial records for the current year: Receipts: Sales revenues Tax-exempt interest income Long-term capital gain Long-term capital loss $740,375 2,700 1,825 300 $744,600 Total revenues Cash payments related to cost of goods sold $162,250 Materials purchases Salaries and wages (production-related W-2 wages) Direct job costs Additional 263A costs 278,300 26,450 2,950 $469,950 Total cash payments for jobs (all completed) Other cash disbursements (net of additional 263A costs) Rent (including $1,000 payment for rent 14,200 accrued in December 2009) Utilities (including $500 payment for 7,100 utilities accrued in December 2009) Office employee salaries (nonproduction W-2 wages) Contribution to Red Cross Meals and entertainment (subject to 50% 25,400 1,500 1,200 disallowance) Guaranteed payment, Tyler Armstrong, managing member Office expense Legal and professional fees Payroll taxes Business interest on operating line of 30,000 2,820 3,575 2,625 credit Repairs Tile cutting equipment (eligible for 5179 9,500 1,410 deduction) 9,000 Total other cash disbursements $108,330