Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete all parts A, B, C, and D please make all answers clear Please label everything Bonita Beauty Corporation manufactures cosmetic products that are sold

Complete all parts A, B, C, and D

Complete all parts A, B, C, and D

please make all answers clear

Please label everything

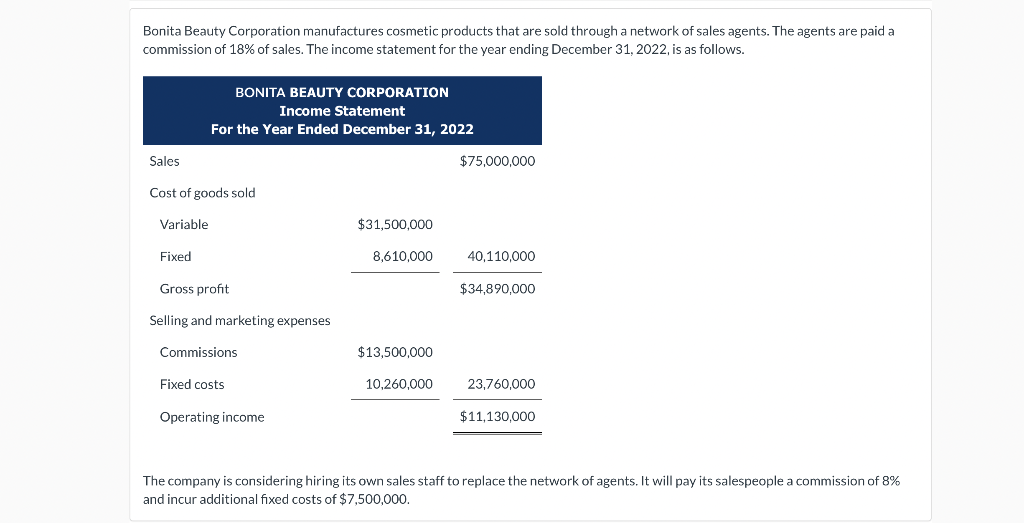

Bonita Beauty Corporation manufactures cosmetic products that are sold through a network of sales agents. The agents are paid a commission of 18% of sales. The income statement for the year ending December 31,2022 , is as follows. The company is considering hiring its own sales staff to replace the network of agents. It will pay its salespeople a commission of 8% and incur additional fixed costs of $7,500,000. Under the current policy of using a network of sales agents, calculate the Bonita Beauty Corporation's break-even point in sales dollars for the year 2022. Break-even point $ Calculate the company's break-even point in sales dollars for the year 2022 if it hires its own sales force to replace the network of agents. Break-even point $ Calculate the degree of operating leverage at sales of $75,000,000 if (1) Bonita Beauty uses sales agents, and (2) Bonita Beauty employs its own sales staff. (Round answers to 2 decimal places, e.g. 1.25.) Calculate the sales dollars that would generate an identical net income for the year ending December 31 , 2022, regardless of whether Bonita Beauty Corporation employs its own sales staff and pays them an 8% commission or continues to use the independent network of agents. Estimated sales volumeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started