Answered step by step

Verified Expert Solution

Question

1 Approved Answer

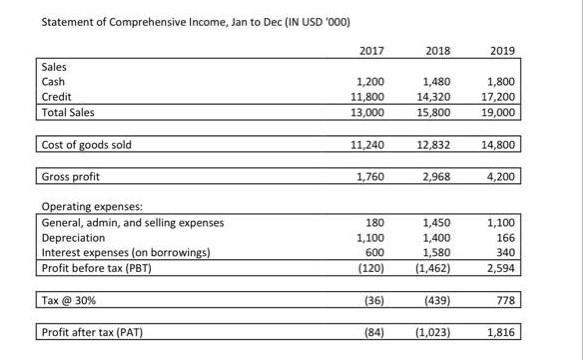

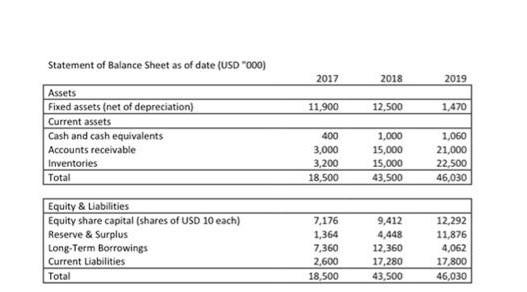

Complete all ratios below with all years and compare them with market benchmark stating your observation: 1- Return on fixed assets (13) 2-Return on equity

Complete all ratios below with all years and compare them with market benchmark stating your observation:

1- Return on fixed assets (13)

2-Return on equity (17%)

3-Gross profit ratio (25%0

4-Current asset turnover ratio (2)

Statement of Comprehensive Income, Jan to Dec (IN USD 000) 2017 2018 2019 Sales Cash Credit Total Sales 1,200 11,800 13,000 1,480 14,320 15,800 1,800 17,200 19,000 Cost of goods sold 11,240 12,832 14,800 Gross profit 1,760 2,968 4,200 Operating expenses: General, admin, and selling expenses Depreciation Interest expenses (on borrowings) Profit before tax (PBT) 180 1,100 600 (120) 1,450 1,400 1,580 (1,462) 1,100 166 340 2,594 Tax @ 30% (36) (439) 778 Profit after tax (PAT) (84) (1,023) 1,816 2017 2018 2019 11,900 12,500 1.470 Statement of Balance Sheet as of date (USD*000) Assets Fixed assets (net of depreciation) Current assets Cash and cash equivalents Accounts receivable Inventories Total 400 3,000 3,200 18,500 1,000 15,000 15,000 43.500 1,060 21,000 22,500 46,030 Equity & Liabilities Equity share capital (shares of USD 10 each) Reserve & Surplus Long-Term Borrowings Current Liabilities Total 7,176 1,364 7,360 2,600 18.500 9,412 4,448 12,360 17,280 43,500 12,292 11,876 4,062 17,800 46,030

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started