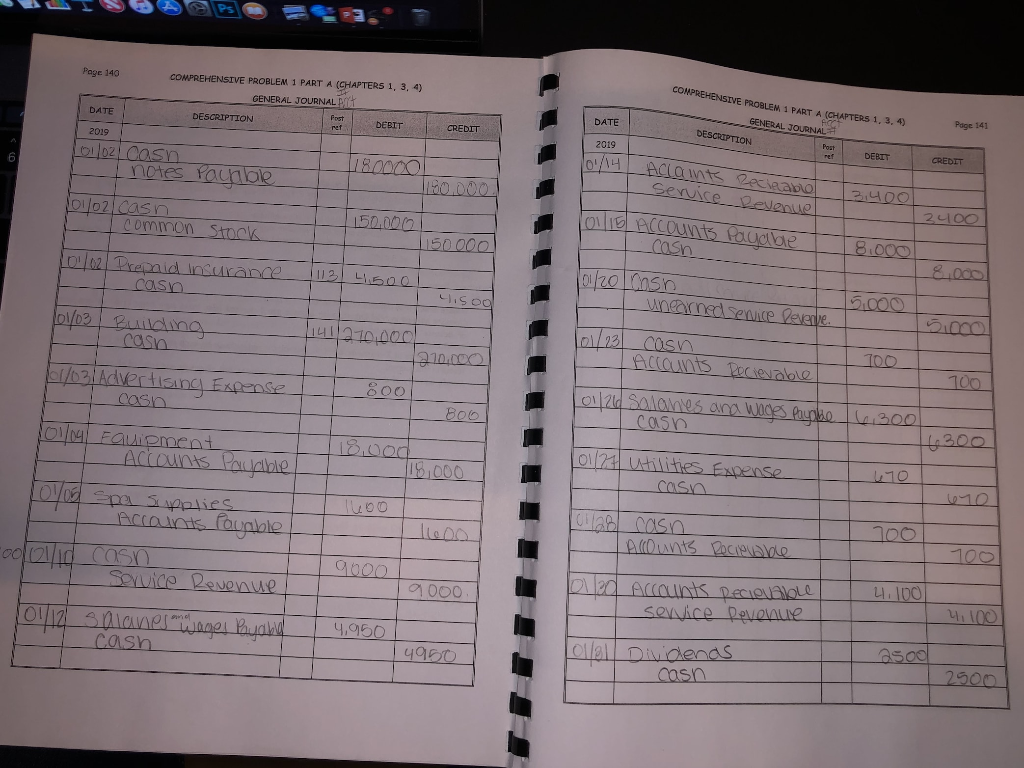

" Complete an Adjusting entries form for the General Journal. . "

I've attached what I attempted to do but couldn't understand.

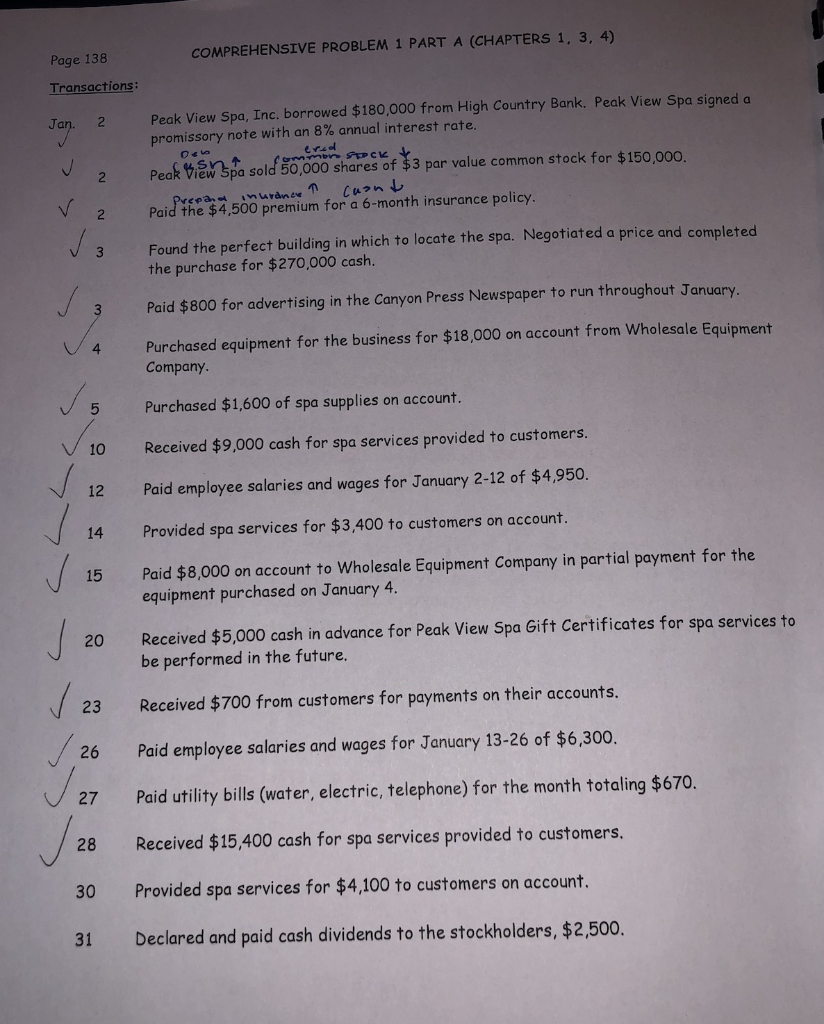

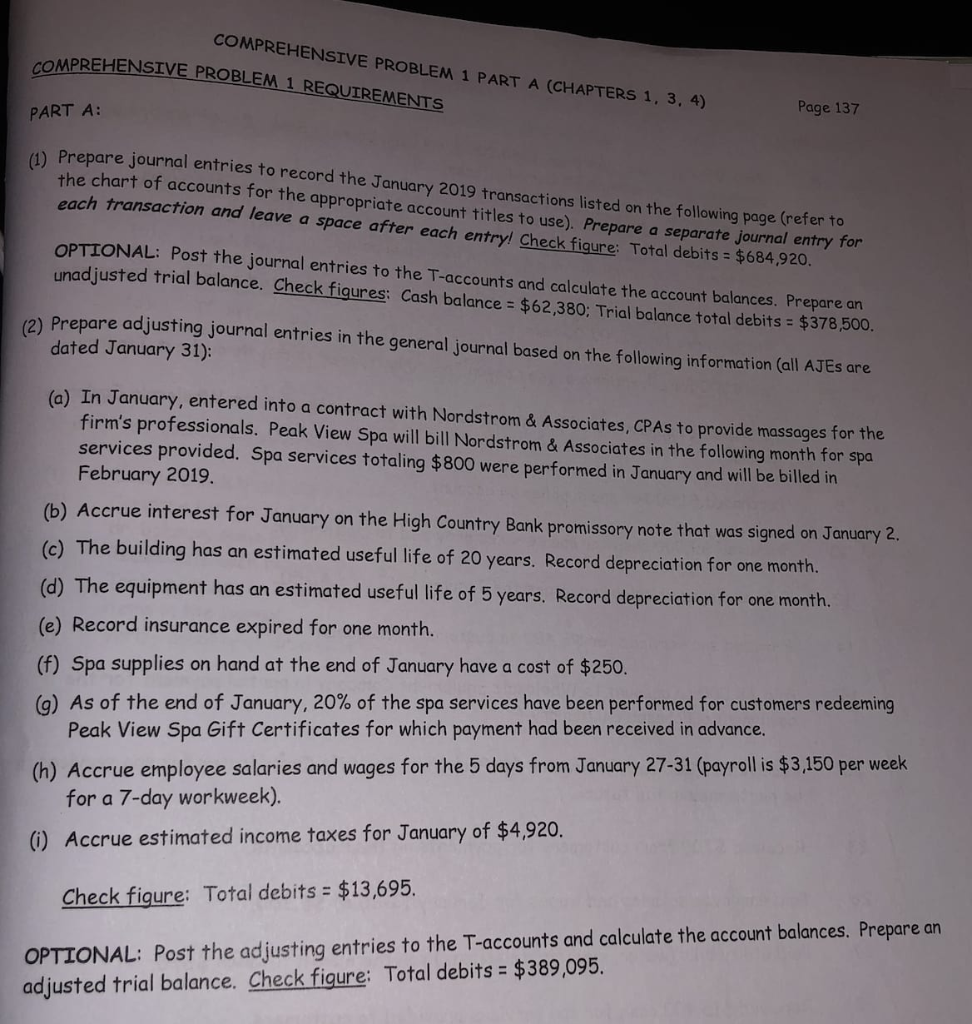

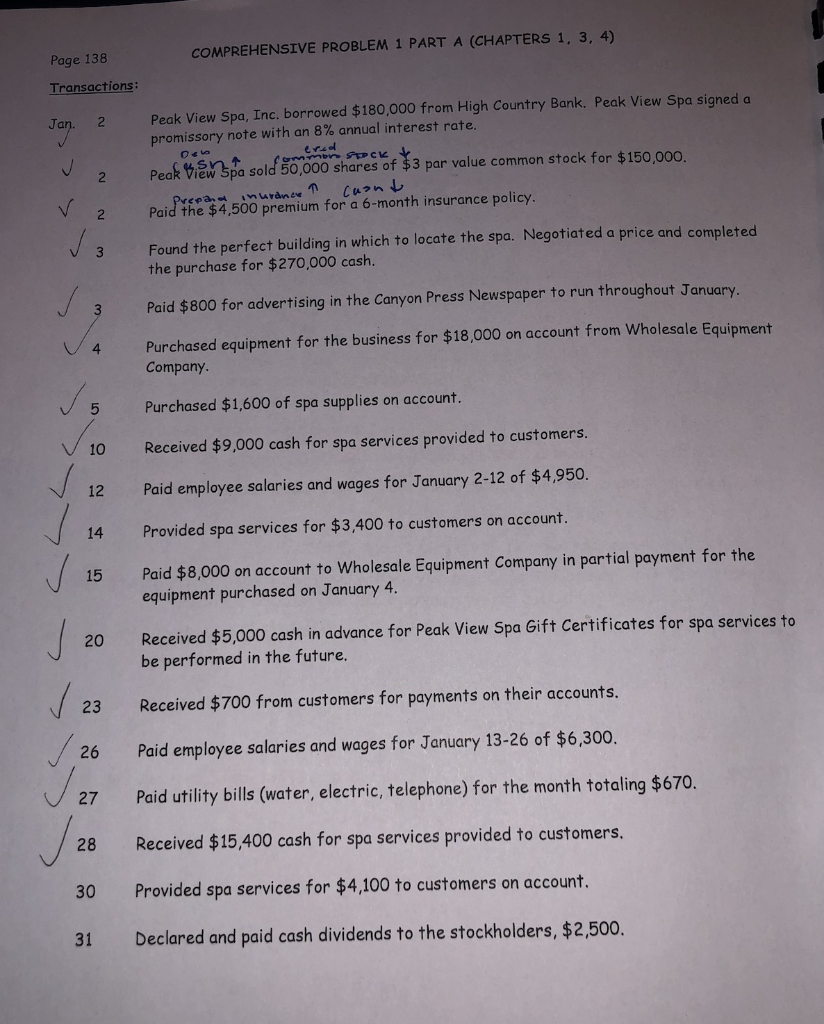

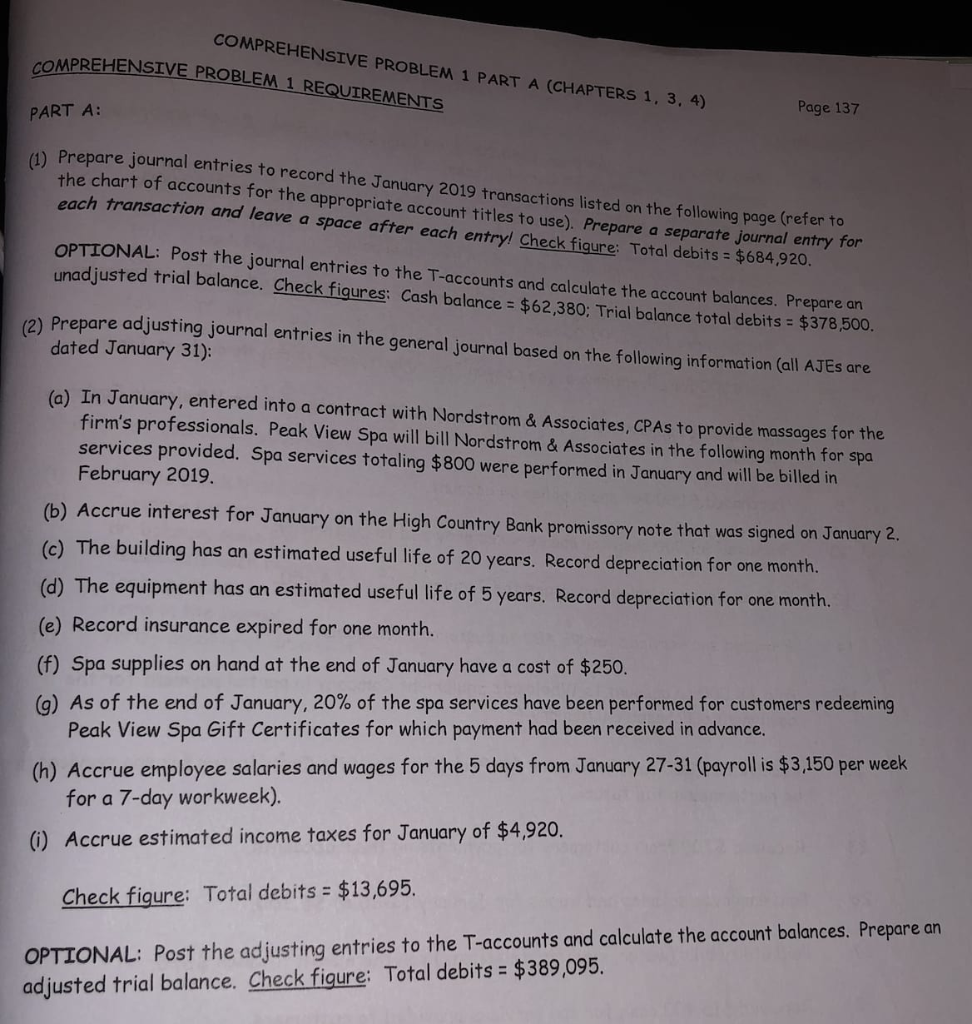

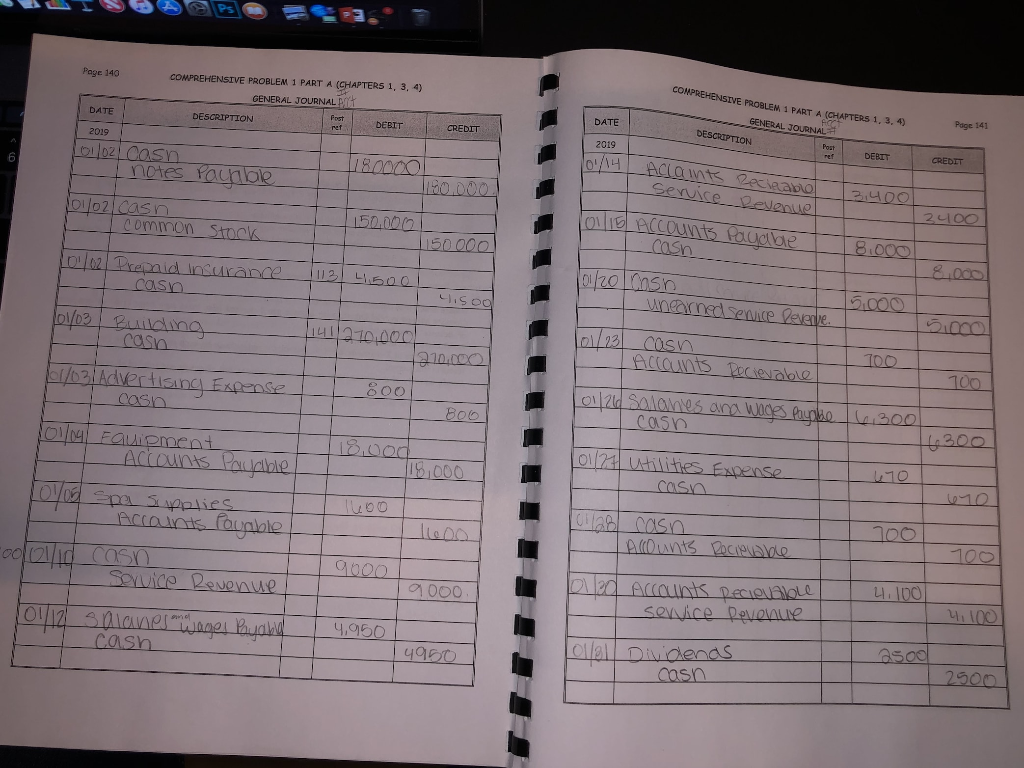

Page 138 COMPREHENSIVE PROBLEM 1 PART A (CHAPTERS 1, 3, 4) Transactions: Peak View Spa, Inc. borrowed $180,000 from High Country Bank. Peak View Spa signed a promissory note with an 8% annual interest rate. 2 ered 2 Peak VieWSpa sold 50,00) shares of $3 par value common stock for $150,000. Paid the $4,500 premium for a 6-month insurance policy. V3 Found the perfect building in which to locate the spa. Negotiated a price and completed the purchase for $270,000 cash 3 Paid $800 for advertising in the Canyon Press Newspaper to run throughout January. V4 Purchased equipment for the business for $18,000 on account from Wholesale Equipment Company 5 10 12 14 15 Purchased $1,600 of spa supplies on account. Received $9,000 cash for spa services provided to customers. Paid employee salaries and wages for January 2-12 of $4,950. Provided spa services for $3,400 to customers on account. Paid $8,000 on account to Wholesale Equipment Company in partial payment for the equipment purchased on January4 20 Received $5,000 cash in advance for Peak View Spa Gift Certificates for spa services to be performed in the future. Received $700 from customers for payments on their accounts. 23 26 27 28 30 Paid employee salaries and wages for January 13-26 of $6,300. Paid utility bills (water, electric, telephone) for the month totaling $670 Received $15,400 cash for spa services provided to customers. Provided spa services for $4,100 to customers on account. Declared and paid cash dividends to the stockholders, $2,500. 31 COMPREHENSIVE PROBLEM 1 PART A (C MPREHENSIVE PROBLEM 1 REQUIREMENTS co PART A: (1) Prepare journal entries to record the January 2019 transactions listed on the following page (refer to HAPTERS 1, 3 Page 137 the chart of accounts for the appropriate account titles to use). Prepare a separate journal entry for each transaction and leave a space after each entry! Check figure: Total debits $684920 OPTIONAL: Post the journal entries to the T-accounts and calculate the account balances. Prepare on unadjusted trial balance. Checek fiaures: Cash balance $62,380, Trial balance total debits $378,500 (2) Prepare adjusting journal entries in the general journal based on the following information (all AJEs are dated January 31): (a) In January, entered into a contract with Nordstrom & Associates, CPAs to provide massages for the firm's professionals. Peak View Spa will bill Nordstrom & Associates in the following month for spa services provided. Spa services totaling $800 were performed in January and will be billed irn February 2019. (b) Accrue interest for January on the High Country Bank promissory note that was signed on Jonuary 2. (e) The building has an estimated useful life of 20 years. Record depreciation for one month. (d) The equipment has an estimated useful life of 5 years. Record depreciation for one month (e) Record insurance expired for one month. (f) Spa supplies on hand at the end of January have a cost of $250. (g) As of the end of January, 20% of the spa services have been performed for customers redeeming Peak View Spa Gift Certificates for which payment had been received in advance. (h) Accrue employee salaries and wages for the 5 days from January 27-31 (payrollis $3,150 per week for a 7-day workweek). () Accrue estimated income taxes for January of $4,920. OPTIONAL: Post the adjusting entries to the T-accounts and calculate the account balances, Prepare an adjusted trial balance. Check figure: Total debits $389,095. Check figure: Total debits $13,695. Page 140 COMPREHENSIVE PROBLEN 1 PT CHAPTERS 1, 3, 4) PROBLEM 1 PART A (CHAPTERS 1, 3, 4) GENERAL JOURNAL Pit Page 141 ENERAL DATE DATE DESCRIPTION DEBIT CREDIT 2019 DEBTT 2019 6 notes racn rn ommon s mmon Sto 31000 zo linsr iso 10 Casa 100 ,100 000 ,050 sco cash 0 asn /400 Page 142 1 2 20 DATE COMPREHENSIVE PROBLEM 1 PART A (CHAPTERS 1, 3, 4) GENERAL JOURNAL CREDIT Post ref ACCOUNT TITLES DEBIT mn 2019 ADJUSTING ENTRIES oaliatest Expense 01 131 1125 7 prepaid InsuvaNO 790 350 nome taaker payave