Answered step by step

Verified Expert Solution

Question

1 Approved Answer

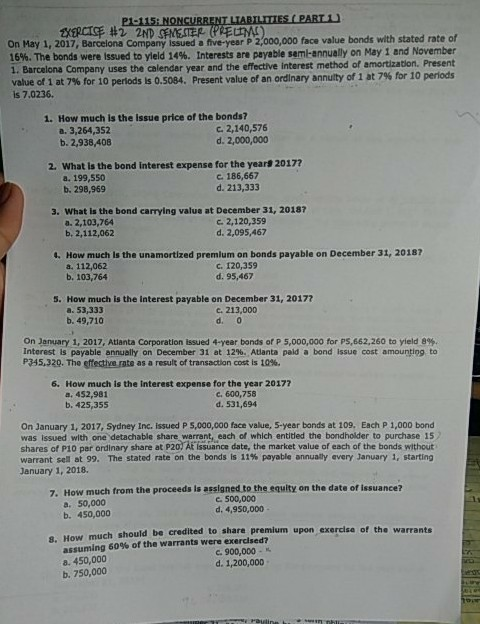

P1-115: NONCURRENT LTABILITIES( PART U On May 1, 2017, Barcelona Company issued a five-year P 2,000,000 face value bonds with stated rate of 16%. The

P1-115: NONCURRENT LTABILITIES( PART U On May 1, 2017, Barcelona Company issued a five-year P 2,000,000 face value bonds with stated rate of 16%. The bonds were issued to yield 14%. Interests are payable samtannually on May 1 and November 1. Barcelona Company uses the calendar year and the effective interest method of amortization. Present value of 1 at 796 for 10 periods ls 0.5084. Present value of an ordinary annuity of 1 at 7% for 10 periods is 7,0236. 1. How much is the issue price of the bonds? a. 3,264,352 b. 2,938,408 C. 2,140,576 d. 2,000,000 2. What is the bond interest expense for the years 20177 a. 199,550 b. 298,969 c. 186,667 d. 213,333 3. What is the bond carrying value at December 31, 20187 a. 2,103,764 b, 2,112,062 c 2,120,359 d. 2,095,467 4. How much is the unamortized premium on bonds payable on December 31, 20187 a. 112,062 b. 103,764 c. 120,359 d. 95,467 5. How much is the interest payable on December 31, 20177 a. 53,333 b. 49,710 c. 213,000 d. 0 On January 1, 2017, Atlanta Corporation issued 4-year bonds or 5,000,000 for PS,662,260 to yield 8%. Interest ls payable annually on December 31 at 12%. Atlanta paid a bond issue cost amounting to P345.320. The emetiverate as a result of transaction cost is 10%. 6. How much is the Interest expense for the year 2017 a. 452,981 b. 425,355 . 600,758 d. 531,694 On January 1, 2017, Sydney Inc. issued P 5,000,000 face value, S-year bonds at 109. Each P 1,000 bond was issued with one detachable share warrant, each of which entided the bondholder to purchase 15 shares of P10 per ordinary share at P20 Af issuance date, the market value of each of the bonds without warrant sea at 99. The stated rate on the bonds is 11% payable annually every January 1, starting Jenuary 1, 2018. How much from the proceeds is assigned to the equity on the date of issuance? e. 500,000 7. a. 50,000 b. 450,000 d: 4,950,000 much should be credited to share premium upon exercise of the warrants assuming 60% of the warrants were exercised? 8. 450,000 b. 750,000 8. How c. 900,000 . d. 1,200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started