complete as much as you can thank you in advance

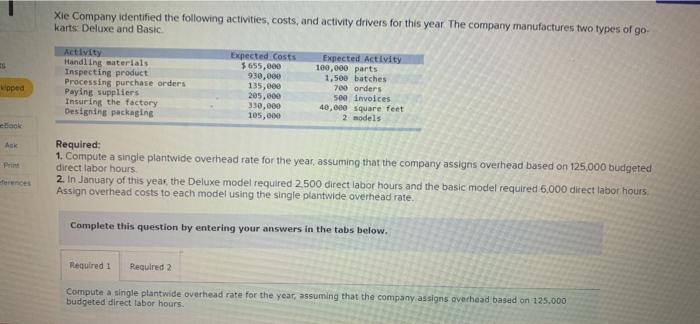

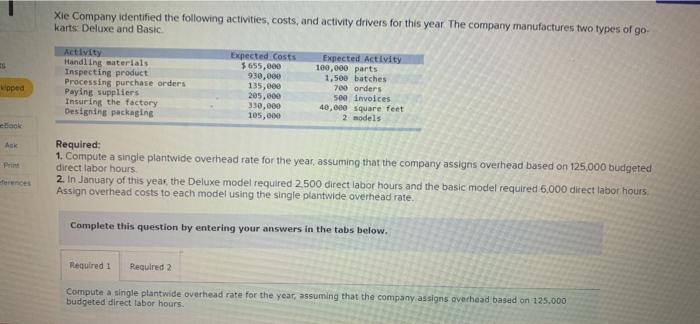

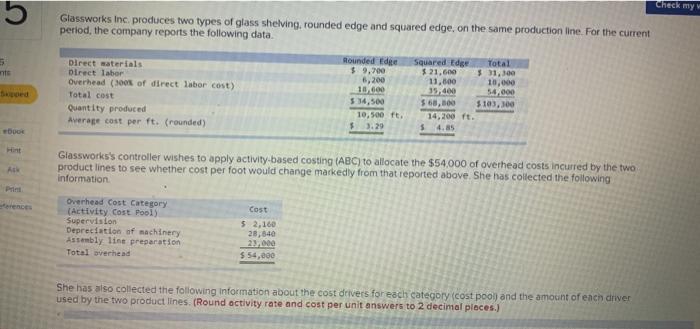

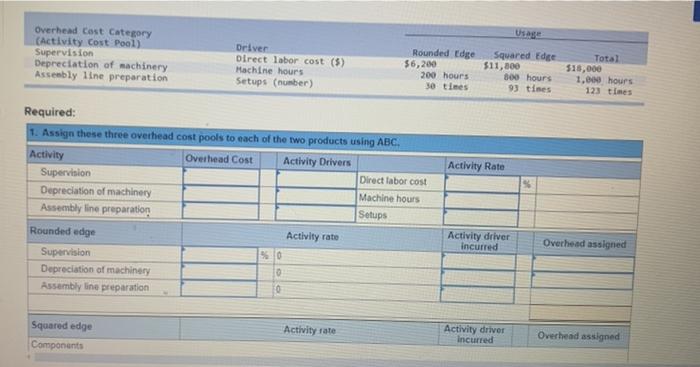

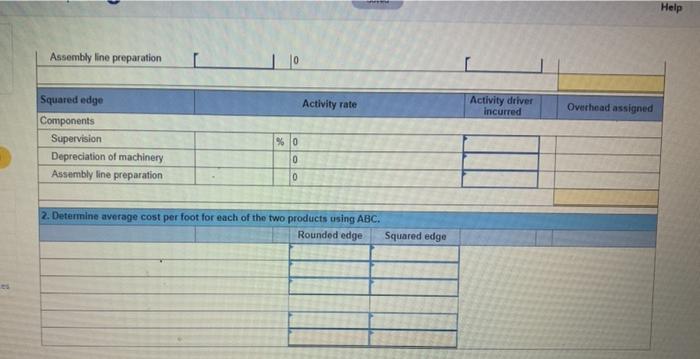

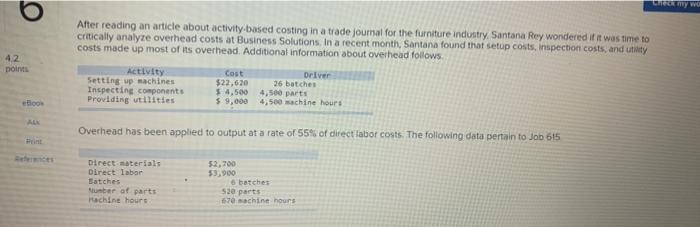

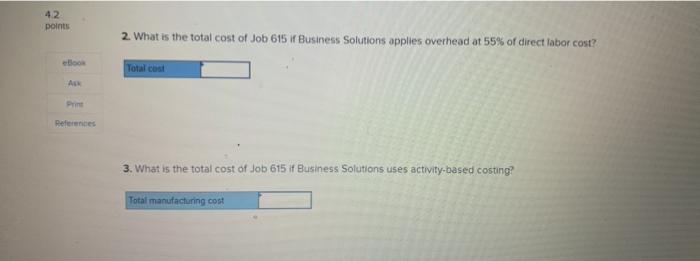

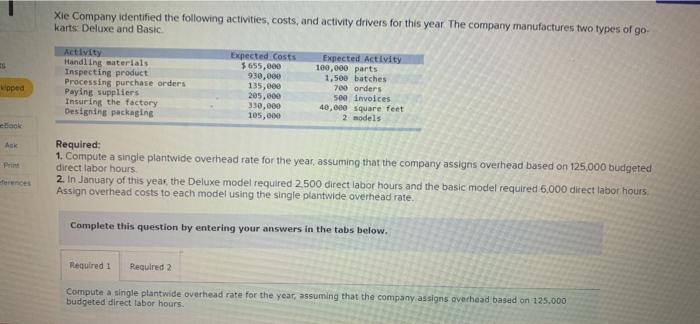

Xle Company identified the following activities, costs, and activity drivers for this year. The company manufactures two types of go karts: Deluxe and Basic vloped Activity Handling materials Inspecting product Processing purchase orders Paying suppliers Insuring the factory Designing packaging Expected Costs $ 655,000 930,000 135,000 205,000 330,000 105,000 Expected Activity 100,000 parts 1,500 batches 700 orders 500 invoices 40,000 square feet 2 models Back Ack Required: 1. Compute a single plantwide overhead rate for the year, assuming that the company assigns overhead based on 125.000 budgeted direct labor hours 2. In January of this year the Deluxe model required 2500 direct labor hours and the basic model required 6,000 direct labor hours Assign overhead costs to each model using the single plantwide overhead rate. Complete this question by entering your answers in the tabs below. Required: Required 2 Compute a single plantwide overhead rate for the year, assuming that the company assigns overhead based on 125.000 budgeted direct labor hours. Check my 5 Glassworks Inc. produces two types of glass shelving, rounded edge and squared edge, on the same production line. For the current period, the company reports the following data nts Direct materials Direct labor Overhead (300% of direct labor cost) Total cost Quantity produced Average cost per ft. (rounded) Rounded Edge $ 9,700 1,200 10.600 $ 34,500 10,500 ft. $3.29 Squared Edge Total $21,600 $ 11,300 11,800 10,000 35.400 54.000 $ 60,00 $103,300 14,200 ft. $ 4.85 woo Glassworks's controller wishes to apply activity-based costing (ABC) to allocate the $54,000 of overhead costs incurred by the two product lines to see whether cost per foot would change markedly from that reported above. She has collected the following information Overhead Cost Category (Activity Cost Pool) Supervision Depreciation of machinery Assembly line preparation Total overhead Cost 52,160 28,840 20,000 $ 54,000 She has also collected the following information about the cost drivers for each category (cost pool and the amount of each driver used by the two product lines (Round activity rate and cost per unit answers to 2 decimal places.) Usage Overhead Cost Category Activity Cost Pool) Supervision Depreciation of machinery Assembly line preparation Driver Direct labor cost (5) Machine hours Setups (number) Rounded Edge $6,200 200 hours 30 times Squared Edge $11,500 800 hours 93 times Total $15,000 1.000 hours 123 times Activity Rate Required: 1. Assign these three overhead cost pools to each of the two products using ABC Activity Overhead Cost Activity Drivers Supervision Direct labor cost Depreciation of machinery Machine hours Assembly line preparation Setups Rounded edge Activity rate Supervision 50 Depreciation of machinery 10 Assembly line preparation 0 Activity driver incurred Overhead assigned Squared edge Components Activity rate Activity driver incurred Overhead assigned Help Assembly line preparation Activity rate Activity driver incurred Overhead assigned Squared edge Components Supervision Depreciation of machinery Assembly line preparation % 0 0 0 2. Determine average cost per foot for each of the two products using ABC. Rounded edge Squared edge my w 6 After reading an article about activity based costing in a trade journal for the furniture industry Santana Rey wondered if it was time to critically analyze overhead costs at Business Solutions. In a recent month, Santana found that setup costs, inspection costs and utility costs made up most of its overhead. Additional information about overhead follows 42 nointi Activity Setting up machines Inspecting components Providing utilities Cost Driver $22,620 26 batches $ 4,500 4,500 parts $ 9,000 4,500 machine hours AN Overhead has been applied to output at a rate of 55% of direct labor costs. The following data pertain to Job 615 Direct materials Direct laban Batches Number of parts Machine hours 52,200 59,900 6 batches 520 parts 70 sachine hours 42 points 2. What is the total cost of Job 615 i Business Solutions applies overhead at 55% of direct labor cost? Total cost References 3. What is the total cost of Job 615 if Business Solutions uses activity-based costing? Total manufacturing cost