Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete Auto Supply distributes new auto parts to local dealers throughout the Southeast. Complete Auto's credit terms are 1/30. As of the end of business

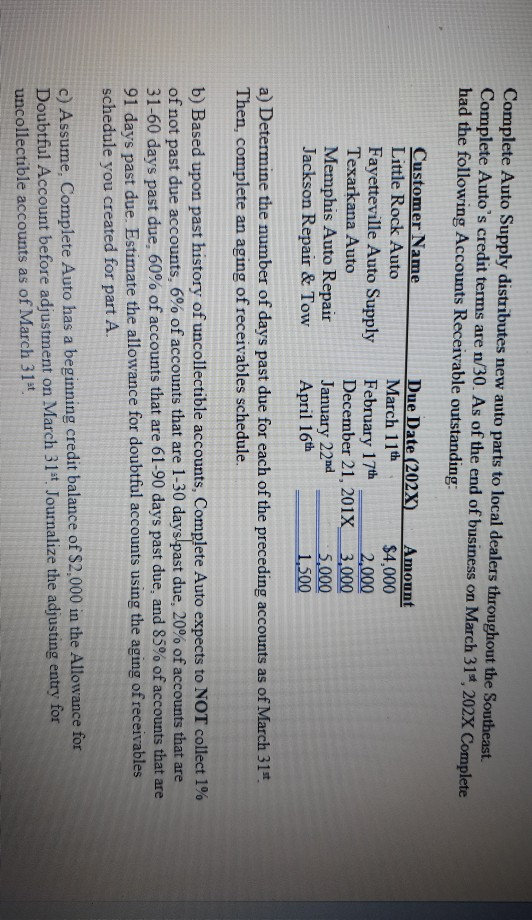

Complete Auto Supply distributes new auto parts to local dealers throughout the Southeast. Complete Auto's credit terms are 1/30. As of the end of business on March 31", 202X Complete had the following Accounts Receivable outstanding Customer Name Little Rock Auto Fayetteville Auto Supply Texarkana Auto Memphis Auto Repair Jackson Repair & Tow Due Date (202X) March 11th February 17th December 21, 2017 January 22nd April 16th Amount $4,000 2,000 3,000 5.000 1,500 a) Determine the number of days past due for each of the preceding accounts as of March 31st Then, complete an aging of receivables schedule. b) Based upon past history of uncollectible accounts, Complete Auto expects to NOT collect 1% of not past due accounts, 6% of accounts that are 1-30 days past due, 20% of accounts that are 31-60 days past due, 60% of accounts that are 61-90 days past due, and 85% of accounts that are 91 days past due. Estimate the allowance for doubtful accounts using the aging of receivables schedule you created for part A c) Assume. Complete Auto has a beginning credit balance of $2,000 in the Allowance for Doubtful Account before adjustment on March 31st Journalize the adjusting entry for uncollectible accounts as of March 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started