Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete both required parts Exercise 12-15 (Algo) Equity investments; fair value through net income (LO12-5) On March 31, 2021, Chow Brothers, Inc., bought 6% of

complete both required parts

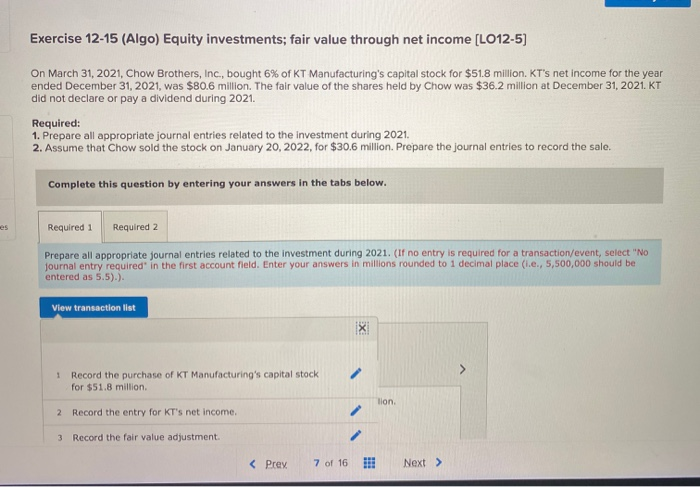

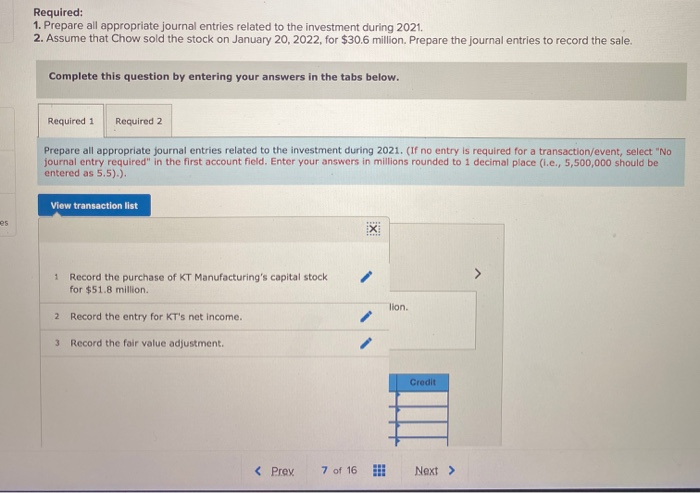

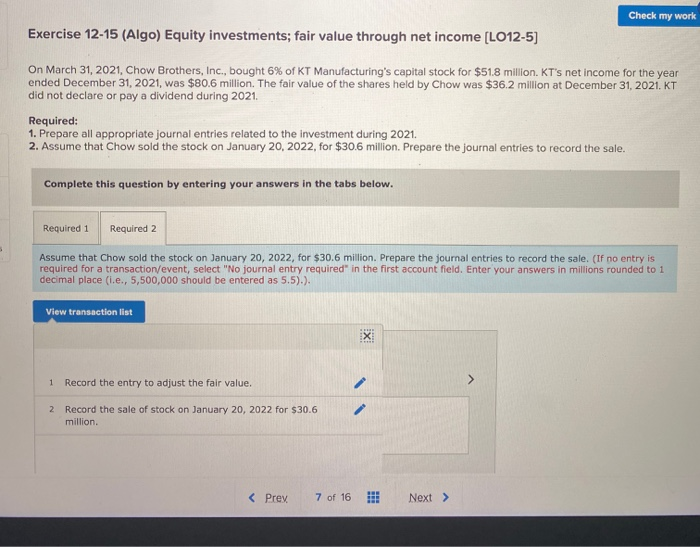

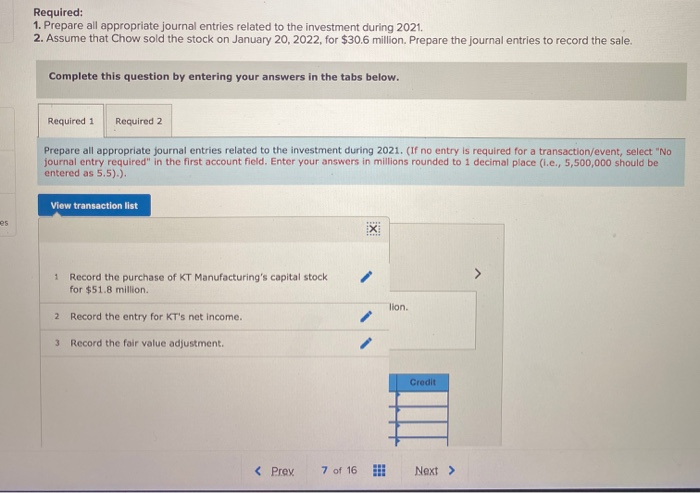

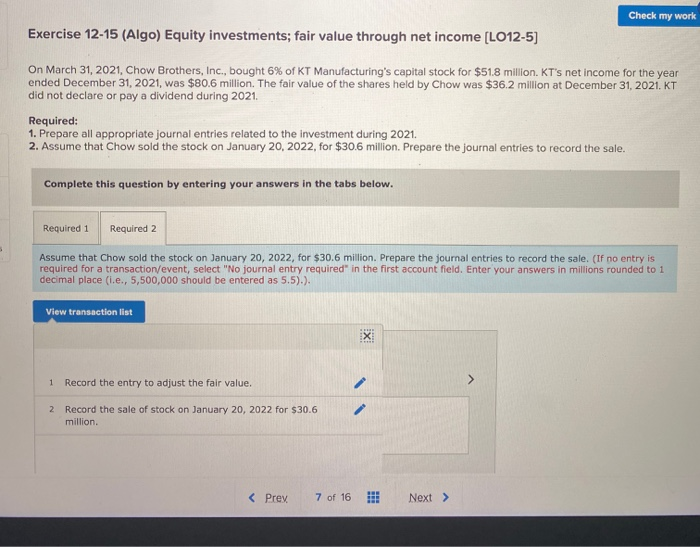

Exercise 12-15 (Algo) Equity investments; fair value through net income (LO12-5) On March 31, 2021, Chow Brothers, Inc., bought 6% of KT Manufacturing's capital stock for $51.8 million. KT's net income for the year ended December 31, 2021, was $80.6 million. The fair value of the shares held by Chow was $36.2 million at December 31, 2021. KT did not declare or pay a dividend during 2021. Required: 1. Prepare all appropriate journal entries related to the investment during 2021. 2. Assume that Chow sold the stock on January 20, 2022, for $30.6 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare all appropriate journal entries related to the investment during 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions rounded to 1 decimal place (.e., 5,500,000 should be entered as 5.5).). View transaction list 1 Record the purchase of KT Manufacturing's capital stock for $51.8 million 2 Record the entry for KT's net income. 3 Record the fair value adjustment. Required: 1. Prepare all appropriate journal entries related to the investment during 2021. 2. Assume that Chow sold the stock on January 20, 2022, for $30.6 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare all appropriate journal entries related to the investment during 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (1.e., 5,500,000 should be entered as 5.5).). View transaction list 1 Record the purchase of KT Manufacturing's capital stock for $51.8 million 2 Record the entry for KT's net income. 3 Record the fair value adjustment. Credit Check my work Exercise 12-15 (Algo) Equity investments; fair value through net income (L012-5] On March 31, 2021, Chow Brothers, Inc., bought 6% of KT Manufacturing's capital stock for $51.8 million. KT's net income for the year ended December 31, 2021, was $80.6 million. The fair value of the shares held by Chow was $36.2 million at December 31, 2021. KT did not declare or pay a dividend during 2021. Required: 1. Prepare all appropriate journal entries related to the investment during 2021. 2. Assume that Chow sold the stock on January 20, 2022, for $30.6 million. Prepare the journal entries to record the sale. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that Chow sold the stock on January 20, 2022, for $30.6 million. Prepare the journal entries to record the sale. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).). View transaction list 1 Record the entry to adjust the fair value. 2 Record the sale of stock on January 20, 2022 for $30.6 million.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started