Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete can you complete requirement 2 and solve requirement 3. thank you. Student Finance (StuFi) is a startup that aims to use the power of

complete

complete  can you complete requirement 2 and solve requirement 3.

can you complete requirement 2 and solve requirement 3.

thank you.

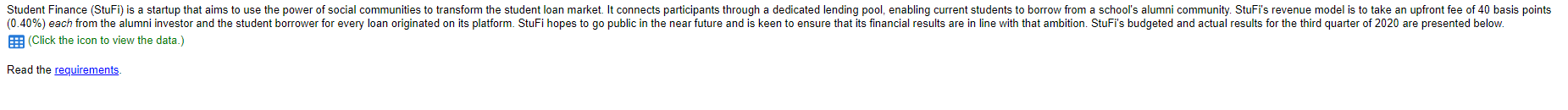

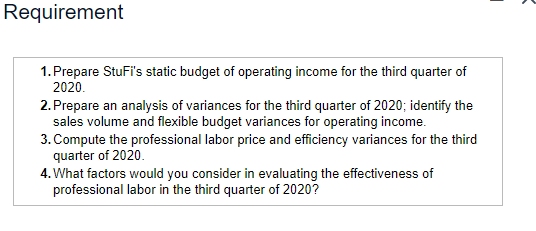

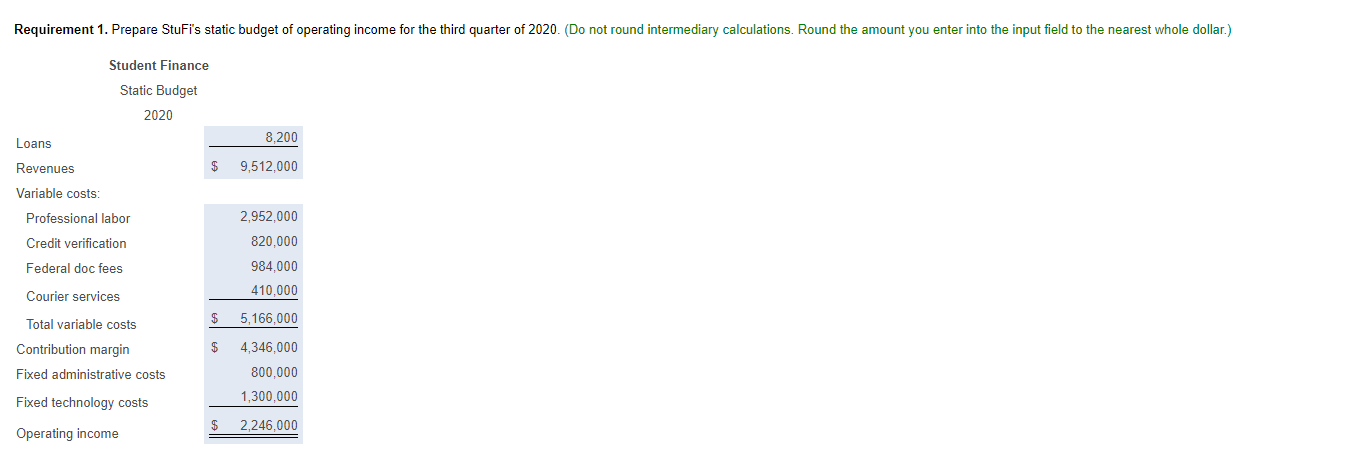

Student Finance (StuFi) is a startup that aims to use the power of social communities to transform the student loan market. It connects participants through a dedicated lending pool, enabling current students to borrow from a school's alumni community. StuFi's revenue model is to take an upfront fee of 40 basis points (0.40%) each from the alumni investor and the student borrower for every loan originated on its platform. StuFi hopes to go public in the near future and is keen to ensure that its financial results are in line with that ambition. StuFi's budgeted and actual results for the third quarter of 2020 are presented below. (Click the icon to view the data.) Read the requirements. Requirement 1. Prepare StuFi's static budget of operating income for the third quarter of 2020. 2. Prepare an analysis of variances for the third quarter of 2020; identify the sales volume and flexible budget variances for operating income. 3. Compute the professional labor price and efficiency variances for the third quarter of 2020. 4. What factors would you consider in evaluating the effectiveness of professional labor in the third quarter of 2020? Requirement 1. Prepare StuFi's static budget of operating income for the third quarter of 2020. (Do not round intermediary calculations. Round the amount you enter into the input field to the nearest whole dollar.) Student Finance Static Budget 2020 8,200 Loans Revenues 9,512,000 Variable costs: 2,952,000 820,000 984,000 410,000 5,166,000 4,346,000 800,000 1,300,000 2,246,000 Professional labor Credit verification Federal doc fees Courier services Total variable costs Contribution margin Fixed administrative costs Fixed technology costs Operating income $ $ $ $ Requirement 2. Prepare an analysis of variances for the third quarter of 2020; identify the sales volume and flexible budget variances for operating income. (For variances with a $0 balance, make sure to enter "0" in the appropriate input field. If the variance is zero, do not select a label. Do not round intermediary calculations. Round the amount entered into the input field to the nearest whole dollar.) Flexible Flexible Static Actual Results Budget Variances Budget Sales Volume Variances 10,250 11,890,000 Budget 10,250 0 Loans Revenues $ 13,284,000 $ 1,394,000 Variable costs: 3,690,000 1,025,000 4,868,750 1,025,000 1,281,250 553,500 $ 7,728,500 $ 1,230,000 512,500 6,457,500 5,432,500 800,000 $ 5,555,500 $ 945,000 1,415,000 1,300,000 3,195,500 $ 3,332,500 Professional labor Credit verification Federal doc fees Courier services Total variable costs Contribution margin Fixed administrative costs Fixed technology costs Operating income $ $ 1,178,750 U 0 51,250 U 41,000 U U $ 123,000 F $ 145.000 U 115,000 U 137,000 $ 1,271,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started