Question

Complete Fern Corporations Schedule M-1 (Form 1120) using the following information. Enter the appropriate amounts in the shaded cells below. Round answers to the nearest

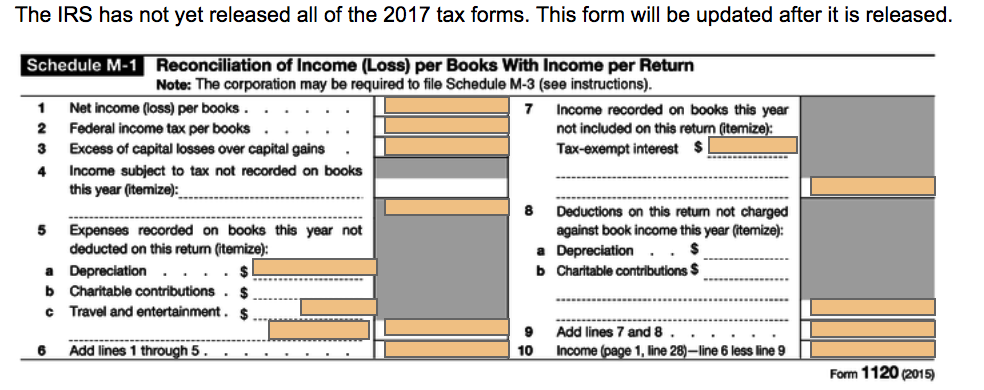

Complete Fern Corporations Schedule M-1 (Form 1120) using the following information. Enter the appropriate amounts in the shaded cells below. Round answers to the nearest dollar. If no entry is necessary or the answer is zero, enter a zero (0).

Ferns net income per books (after tax expenses) is $150,000.

The federal income tax expense per Fern's books is $24,580.

Fern received $40,000 of interest income of which $24,000 relates to municipal bonds owned.

Fern received $2,000 in prepaid rent in the current year.

Fern's books showed a $4,000 short-term capital gain distribution from a mutual fund corporation and a $5,000 loss on the sale of Retro stock that was purchased in 2015. The stock was an investment in an unrelated corporation. There were no other 2017 gains or losses and no loss carryovers from prior years.

Ferns distributions included reimbursed employee expenses in 2017 for travel of $100,000 and business meals of $30,000. The reimbursed expense met the conditions of deductibility and were properly substantiated under an accountable plan. The reimbursement was not treated as employee compensation.

Fern expensed $7,000 in 2017 for the term life insurance premiums on the corporation officers. Fern was the policy owner and the beneficiary.

Book depreciation on computers for 2017 was $10,000. These computers, which cost $50,000, were placed in service on January 2, 2017. Tax depreciation used MACRS with the half-year convention. No election was made to expense part of the computer cost or to use a straight-line method or the alternative depreciation system.

The IRS has not yet released all of the 2017 tax forms. This form will be updated after it is released.

Fill in the shaded blank in Orange Color

Fill in the shaded blank in Orange Color

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started