Question

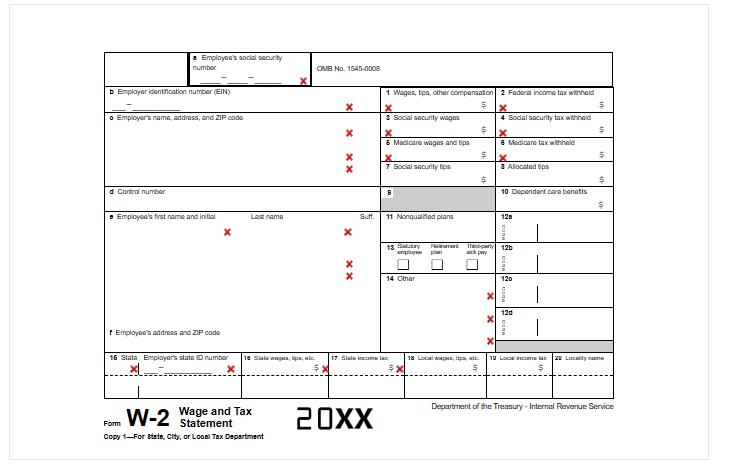

Complete Form W-2 for Michael Sierra of TCLH Industries (Located at: 202 Whitmore Avenue, Durham, NC 27701; Employer Identification #44-4444444). The company does not use

Complete Form W-2 for Michael Sierra of TCLH Industries (Located at: 202 Whitmore Avenue, Durham, NC 27701; Employer Identification #44-4444444). The company does not use control numbers, and its state identification number is the same as its federal identification number. Note that the state withholding tax rate for regular earnings is 5%. Additionally, assume that Michael Sierra earns the same amount for each of the final three weeks of the year and that the other three employees earned the same amount during each of the 52 weeks of the year. Note that Michael Sierra requests additional withholding of $50 each pay period for a Flexible Spending Account. The information you need to complete this exercise can be found by clicking the links below.

Notes:

- For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

- You may need to scroll within the employee earnings records to find the needed employee.

- Remember, the Additional Withholding amount for Michael Sierra is comprised of flexible spending account contributions. Consider whether these are taxable when completing the necessary forms and calculations.

- Payroll Register

- Employee Earnings Records for Pay Period Ending 12/12/2021

- Employee Earnings Records Year to Date

- 4th Quarter Taxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started