Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete form W-2 you are just completing some sections of the torm not all the sections so basically that is all the question PSb 6-6

complete form W-2

you are just completing some sections of the torm not all the sections so basically that is all the question

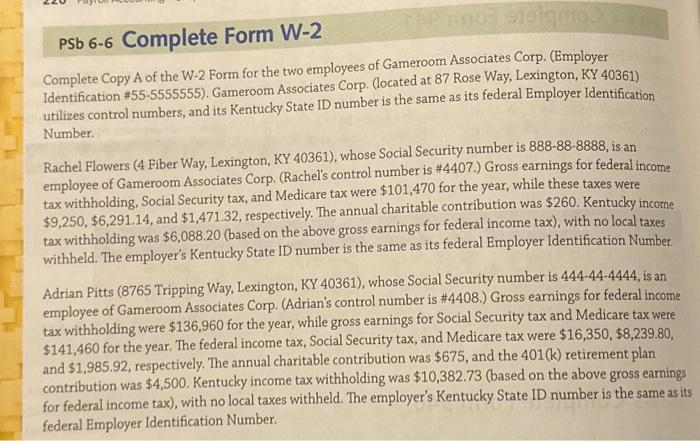

PSb 6-6 Complete Copy A of the W-2 Form for the two employees of Gameroom Associates Corp. (Employer Identification \#55-5555555). Gameroom Associates Corp. (located at 87 Rose Way, Lexington, KY 40361) utilizes control numbers, and its Kentucky State ID number is the same as its federal Employer Identification Number. Rachel Flowers (4 Fiber Way, Lexington, KY 40361), whose Social Security number is 888-88-8888, is an employee of Gameroom Associates Corp. (Rachel's control number is \#4407.) Gross earnings for federal income tax withholding, Social Security tax, and Medicare tax were $101,470 for the year, while these taxes were $9,250,$6,291.14, and $1,471.32, respectively. The annual charitable contribution was $260. Kentucky income tax withholding was $6,088.20 (based on the above gross earnings for federal income tax), with no local taxes withheld. The employer's Kentucky State ID number is the same as its federal Employer Identification Number. Adrian Pitts (8765 Tripping Way, Lexington, KY 40361), whose Social Security number is 444-44-4444, is an employee of Gameroom Associates Corp. (Adrian's control number is \#4408.) Gross earnings for federal income tax withholding were $136,960 for the year, while gross earnings for Social Security tax and Medicare tax were $141,460 for the year. The federal income tax, Social Security tax, and Medicare tax were $16,350,$8,239.80, and $1,985.92, respectively. The annual charitable contribution was $675, and the 401(k) retirement plan contribution was $4,500. Kentucky income tax withholding was $10,382.73 (based on the above gross earnings for federal income tax), with no local taxes withheld. The employer's Kentucky State ID number is the same as it: federal Employer Identification Number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started