Answered step by step

Verified Expert Solution

Question

1 Approved Answer

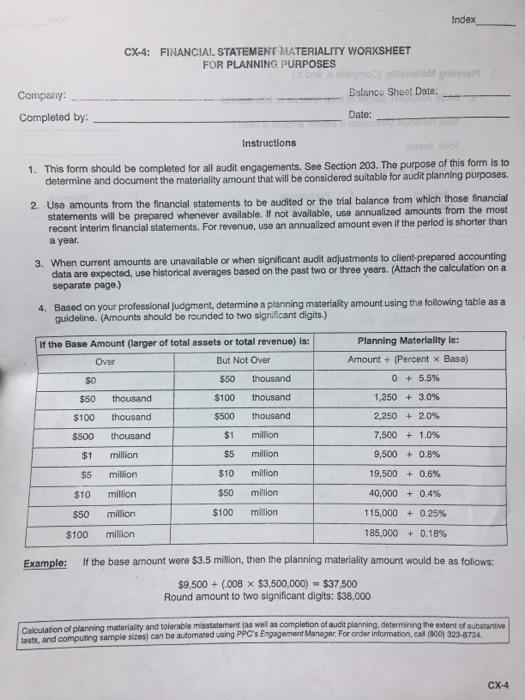

Complete Materiality worksheet using the trial balance. Index CX-4: FINANCIAL STATEMENT MATERIALITY WORKSHEET FOR PLANNING PURPOSES Company: Dalance Sheet Date: Completed by: Date: Instructions 1.

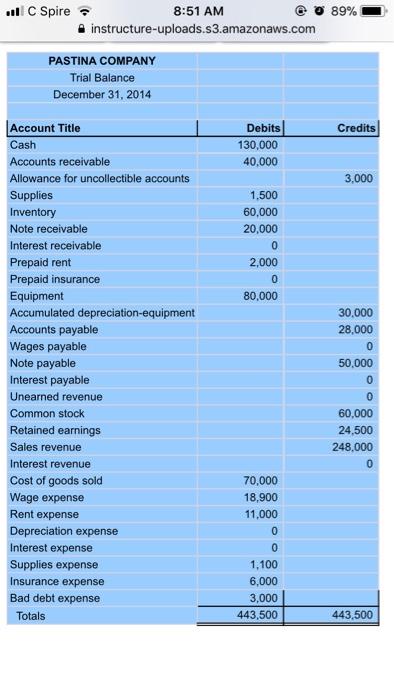

Complete Materiality worksheet using the trial balance.

Index CX-4: FINANCIAL STATEMENT MATERIALITY WORKSHEET FOR PLANNING PURPOSES Company: Dalance Sheet Date: Completed by: Date: Instructions 1. This form should be completed for all audit engagements. See Section 203. The purpose of this form is to determine and document the materiality amount that will be considered suitable for audit planning purposes. 2. Use amounts from the financial statements to be audited or the trial balance from which those financial statements will be prepared whenever available. If not available, use annualized amounts from the most recent interim financial statements. For revenue, use an annualized amount even if the period is shorter than a year. 3. When current amounts are unavailable or when significant audit adjustments to client-prepared accounting data are expected, use historical averages based on the past two or three years. (Attach the calculation on a separate page.) 4. Based on your professional judgment, determine a planning materiality amount using the following table as a guideline. (Amounts should be rounded to two signilicant digits.) If the Base Amount (larger of total assets or total revenue) is: Planning Materiality le: Over But Not Over Amount + (Percent x Basa) So $50 thousand 0 + 5.5% $50 thousand $100 thousand 1,250 + 3.0% $100 thousand $500 thousand 2,250 + 2.0% $500 thousand $1 million 7,500 + 1.0% $1 million $5 million 9,500 + 0.8% $5 milion $10 million 19,500 + 0.6% $10 million $50 milion 40,000 + 0.4% $50 million $100 milion 115,000 + 0.25% $100 million 185,000 + 0.18% Example: If the base amount were $3.5 million, then the planning materiality amount would be as follows: $9.500 + (008 x $3,500,000) = $37,500 Round amount to two significant digits: $38,000 Calculation of planning materiality and tolerable misstatement (as well as completion of audit planning, determining the extent of subatantive tasts, and computing sample sizes) can be automated uaing PPC's Engagement Managar. For order information, cal (800) 323-8724 CX-4

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started