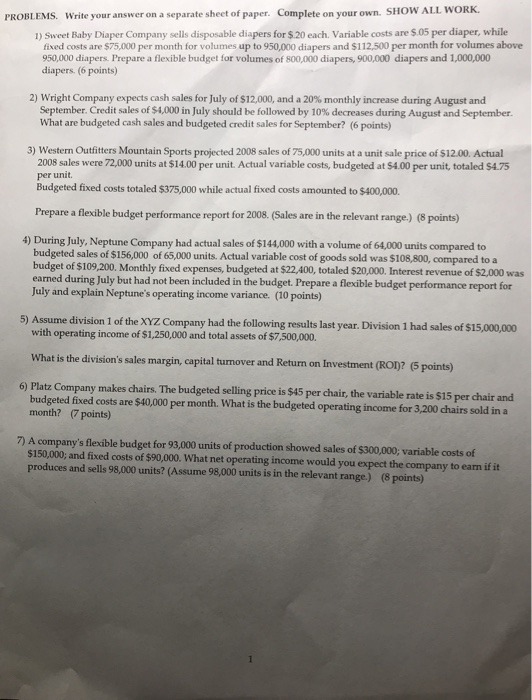

Complete on vour own. SHOW ALL WORK. PROBLEMS. Write your answer on a separate sheet of paper. 1) Sweet Baby Diaper Company sells disposable diapers for $.20 each. Variable costs are $.05 per diaper, while fixed costs are $75,000 per month for volumes up to 950,000 diapers and $112,500 per month for volumes above 950,000 diapers. Prepare a flexible budget for volumes of 800,000 diapers, 900,000 diapers and 1,000,000 diapers. (6 points) 2) Wright Company expects cash sales for July of $12.000, and a 20% monthly increase during August and September. Credit sales of $4,000 in July should be followed by 10% decreases during August and September. What are budgeted cash sales and budgeted credit sales for September? (6 points) 3) Western Outfitters Mountain Sports projected 2008 sales of 75,000 units at a unit sale price of $12.00. Actual 2008 sales were 72,000 units at $14.00 per unit. Actual variable costs, budgeted at $4.00 per unit, totaled SA.75 per unit. Budgeted fixed costs totaled $375,000 while actual fixed costs amounted to $400,000. Prepare a flexible budget performance report for 2008. (Sales are in the relevant range.) (8 points) 4) During July, Neptune Company had actual sales of $144,000 with a volume of 64,000 units compared to budgeted sales of $156,000 of 65,000 units. Actual variable cost of goods sold was $108,800, compared toa budget of $109,200. Monthly fixed expenses, budgeted at $22,400, totaled $20,000. Interest revenue of $2,000 was during July but had not been included in the budget. Prepare a flexible budget performance report for July and explain Neptune's operating income variance. (10 points) 5) Assume division 1 of the XYZ Company had the following results last year. Division 1 had sales of $15,0,000 with operating income of $1,250,000 and total assets of $7,500,000. Return on Investment (ROD? (5 points) 6) Platz Company makes chairs. The budgeted selling price is $45 per chair, the variable rate is $15 per chair and budgeted fixed costs are $40,000 per month. What is the budgeted operating income for 3,200 chairs sold in a month? (7 points) 7) A company's flexible budget for 93,000 units of production showed sales of $300,000 $150,000, and fixed costs of $90,000. What net operating income would you expect the company to earn if it produces and sells 98,000 units? (Assume 98,000 units is in the relevant range.) (8 points)