complete part 5

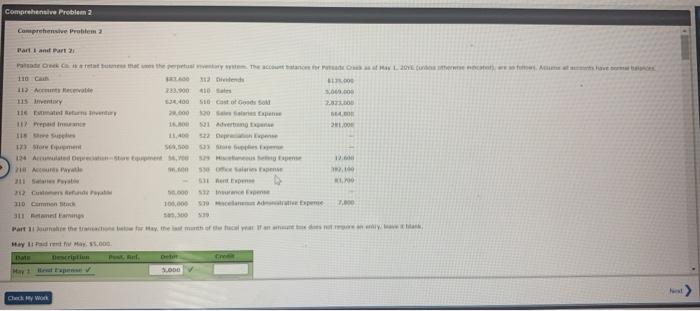

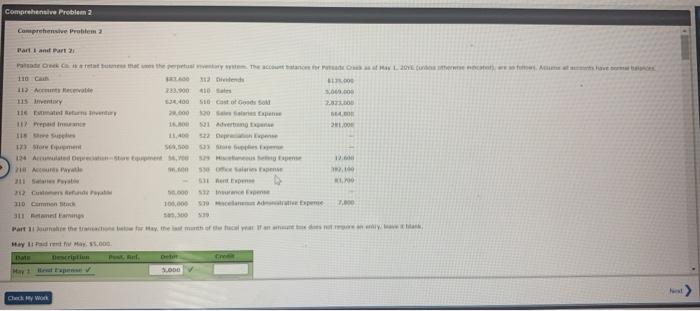

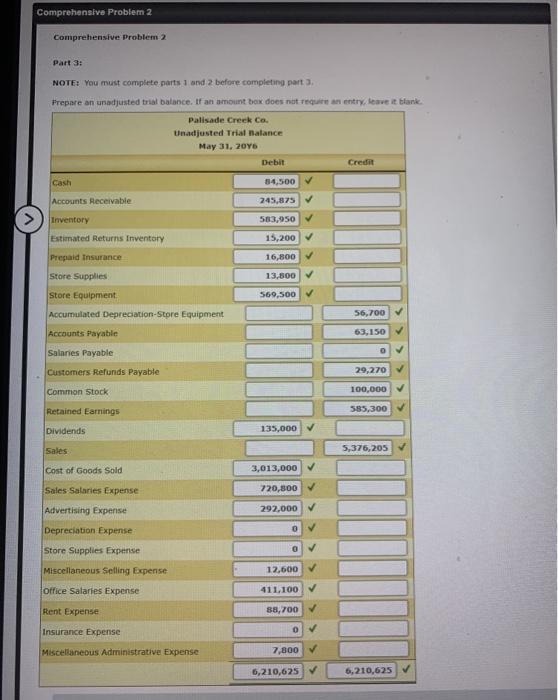

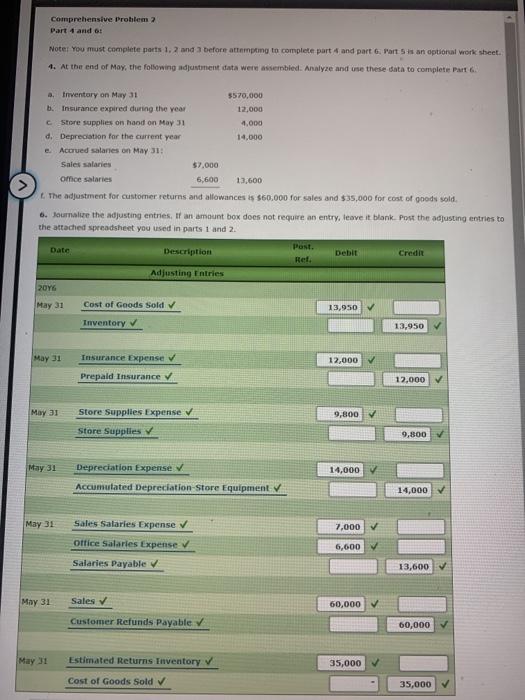

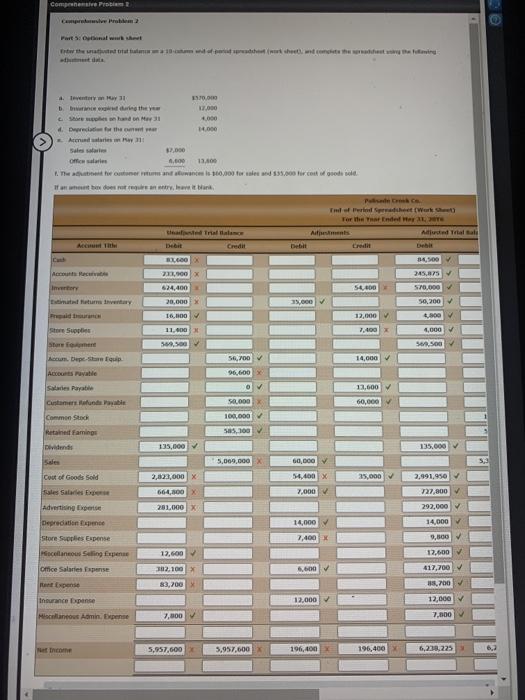

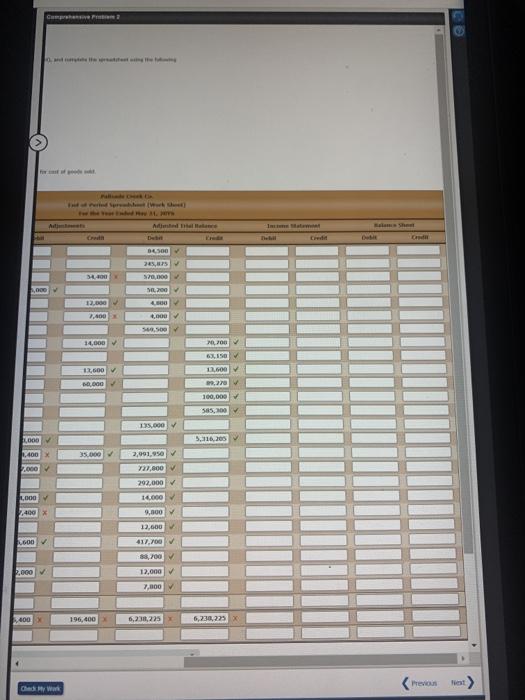

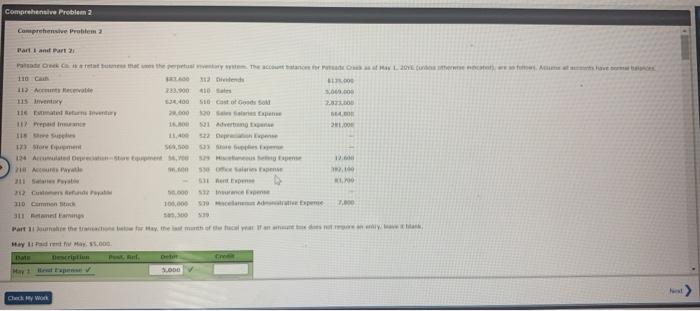

Comprehensive Problem 2 Comprehensive Problem Partland Part 2 the TOLM 110 C Dende 112 Acte 223.900 10 Sa s.co 115 ve 400 S10 Cast of God 1 turne 22.000 11din 21.00 IS 522 napp storen S, 14 Armed we 1. 21 Aral re . 11 >> Guns 5000 110 mm 100.000 de pere 311 min 005 DE My Party.000 SO Check WORK Comprehensive Problem 2 Comprehensive Problem 2 Part 3: NOTE: You must complete parts 1 and 2 before completing part Prepare an unadjusted trial balance. If an amount box does not require an entry leave it blank. Palisade Creek Co. Unadjusted Trial Balance May 31, 2016 Debit Credit (casti 34,500 Accounts Receivable 245,875 > Inventory 563,950 Estimated Returns Inventory 15,200 Prepaid Insurance 16,800 Store Supplies 13.800 569,500 Store Equipment Accumulated Depreciation Store Equipment Accounts Payable 56,700 63,150 Salaries Payable Customers Refunds Payable 29,270 Common Stock 100,000 Retained Earnings 585,300 Dividends 135,000 Sales 5,376,205 Cost of Goods Sold 3,013,000 Sales Salaries Expense 720,000 292.000 Advertising Expense Depreciation Expense Store Supplies Expense Miscellaneous Selling Expense 12,600 Office Salaries Expense 411,100 Rent Expense 88,700 Insurance Expense Miscellaneous Administrative Expense 7,800 6,210,625 6,210,625 comprehensive Problem? Part 4 and 1 Noter You must complete parts 1.2 and 3 before attempting to complete part 4 and part 6 Part 5 is an optional worksheet. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete Part 6 trventory on May 31 5570,000 b. Insurance expired during the year 12.000 Store supplies on hood on May 31 4.000 d. Depreciation for the current year 14,000 e Accrued salaries on May 31: Sales salaries $7.000 omce salaries 6,600 13,600 The adjustment for customer returns and allowance is $60.000 for sales and $35,000 for cost of goods sold 6. Journalize the adjusting entries. If an amount box does not require an entry, leave it blank. Post the adjusting entries to the attached spreadsheet you used in parts 1 and 2 Post. Date Description Debit Credit Ret Adjusting Entries 2016 May 31 13,950 Cost of Goods Sold Inventory 13,950 May 31 12,000 Insurance Expense Prepaid Insurance 12,000 May 31 Store Supplies Expense 9,800 Store Supplies 9,800 May 31 14,000 Depreciation Expense v Accumulated Depreciation Store Equipment 14,000 May 31 7.000 Sales Salaries Expense Office Salaries Expense Salaries Payable 6,600 13,600 May 31 Sales 60,000 Customer Refunds Payable 60,000 May 31 Estimated Returns Inventory 35,000 Cost of Goods Sold 35,000 Comprehensive Pro . 1. Garies that 17.000 4.000 4. De them 14.000 Armands 2.000 on salaris 13.00 Tweeters and want is 160.000 for $35.000 .co good w does it in The Perheet Work For the That Ender Atems Med Total salg teatrallas Credit Debat BO 2,000 34,500 245,875 570.000 Inn 64.400 5600 20,000 25,000 56,200 16,000 12,000 4,00 11.000 7.400 4,000 Store mere 569.00 5.500 cun. Depesti 56,700 14,000 96.000 Ses Payable 07 13,000 60,000 Cuntamer und Commen Stock 50.000 100.000 55,100 Retained famins Dividende 135,000 135,000 Seles 5,099.000 Cost of Goods sold 2,823,000 X 60,000 54,400 x 7.000 35,000 2,991,950 664,800 X 727,000 281.000 X 292,000 14,000 14,000 Advertising Expert Deprecate Store Supplies Expense Pocellaneous Saling Expense Office Sales Expense 7,400 5,000 12,600 12.6.00 112.100 > 009 417,700 83,700 200 12,000 12,000 Insurance Expense Miscellaneous Aomin, Experte 7,500 7.000 etcome 5,957.600 5,957,600 196,400 196,400 6,239,225 02 Chademy W Previous 6,230,225 SHE'S 00961 400 A 000 Act 0.000 00/ AD 4600 Anser 006 2,400 14.000 1,000 A'zo 000 008 056156 A DO SE 1.400 5,16,205 LOGO 135.000 585,100 ADOR 000 A DE 12,600 62,50 700 14,000 5.500 4,000 . AD 1,000 SL200 570,000 DORT 'RE Do Credit IPT / At w