Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete questions 1-6 Now we'll switch back to the Snoball Stand. Since the end of March, there have been some exciting developments! The first few

Complete questions 1-6

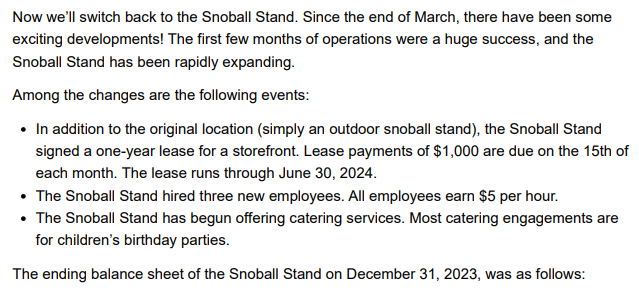

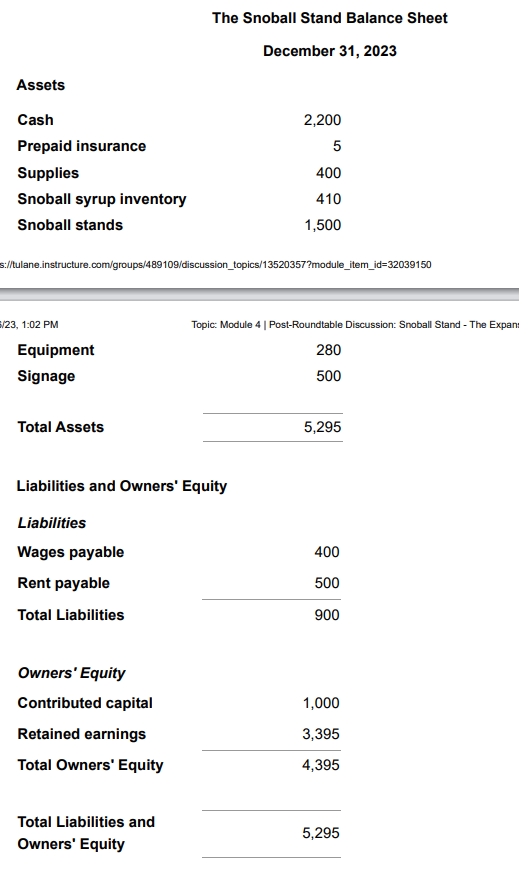

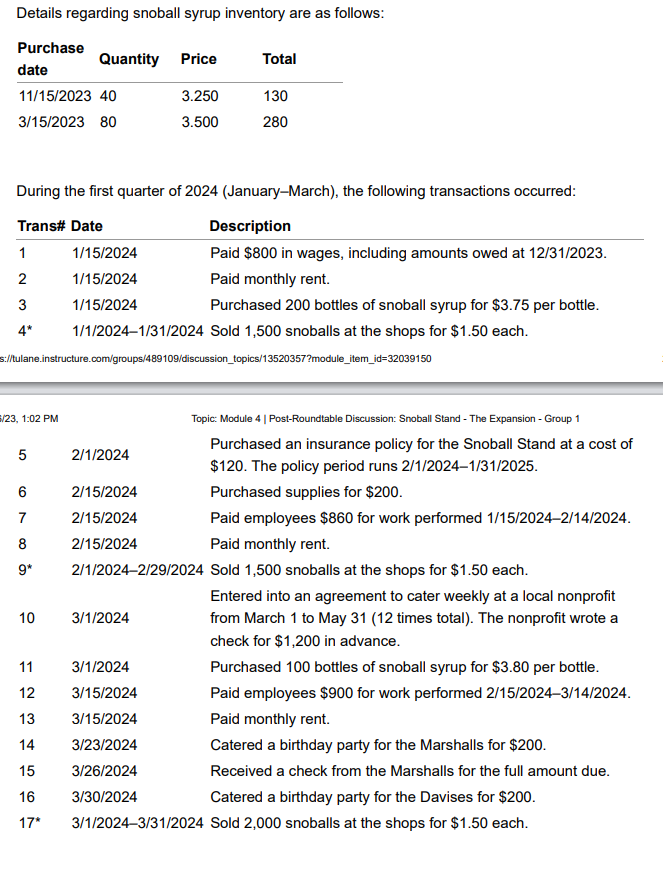

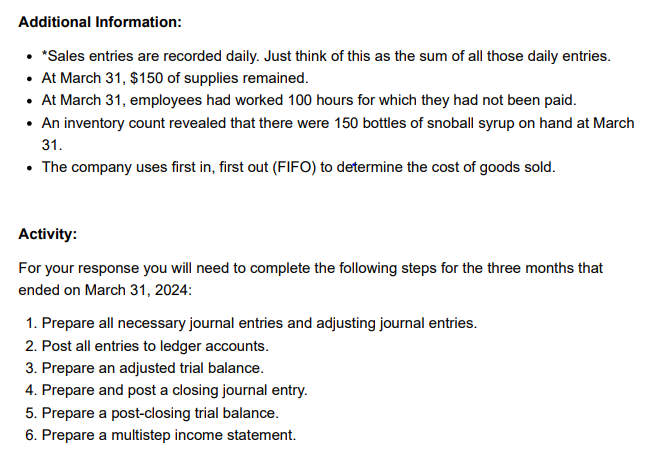

Now we'll switch back to the Snoball Stand. Since the end of March, there have been some exciting developments! The first few months of operations were a huge success, and the Snoball Stand has been rapidly expanding. Among the changes are the following events: - In addition to the original location (simply an outdoor snoball stand), the Snoball Stand signed a one-year lease for a storefront. Lease payments of $1,000 are due on the 15 th of each month. The lease runs through June 30, 2024. - The Snoball Stand hired three new employees. All employees earn $5 per hour. - The Snoball Stand has begun offering catering services. Most catering engagements are for children's birthday parties. The ending balance sheet of the Snoball Stand on December 31, 2023, was as follows: s:/tulane.instructure.com/groups/489109/discussion_topics/13520357?module_item_id=32039150 Details regarding snoball syrup inventory are as follows: During the first quarter of 2024 (January-March), the following transactions occurred: Additional Information: - *Sales entries are recorded daily. Just think of this as the sum of all those daily entries. - At March 31, \$150 of supplies remained. - At March 31, employees had worked 100 hours for which they had not been paid. - An inventory count revealed that there were 150 bottles of snoball syrup on hand at March 31. - The company uses first in, first out (FIFO) to determine the cost of goods sold. Activity: For your response you will need to complete the following steps for the three months that ended on March 31, 2024: 1. Prepare all necessary journal entries and adjusting journal entries. 2. Post all entries to ledger accounts. 3. Prepare an adjusted trial balance. 4. Prepare and post a closing journal entry. 5. Prepare a post-closing trial balance. 6. Prepare a multistep income statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started