Answered step by step

Verified Expert Solution

Question

1 Approved Answer

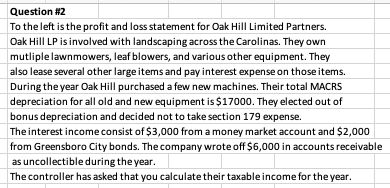

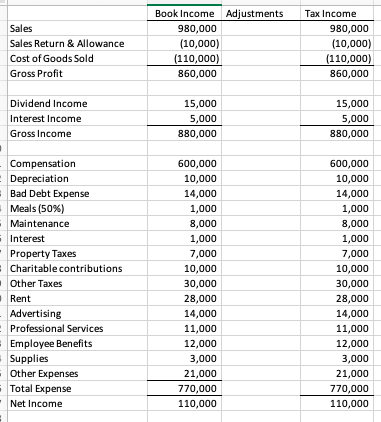

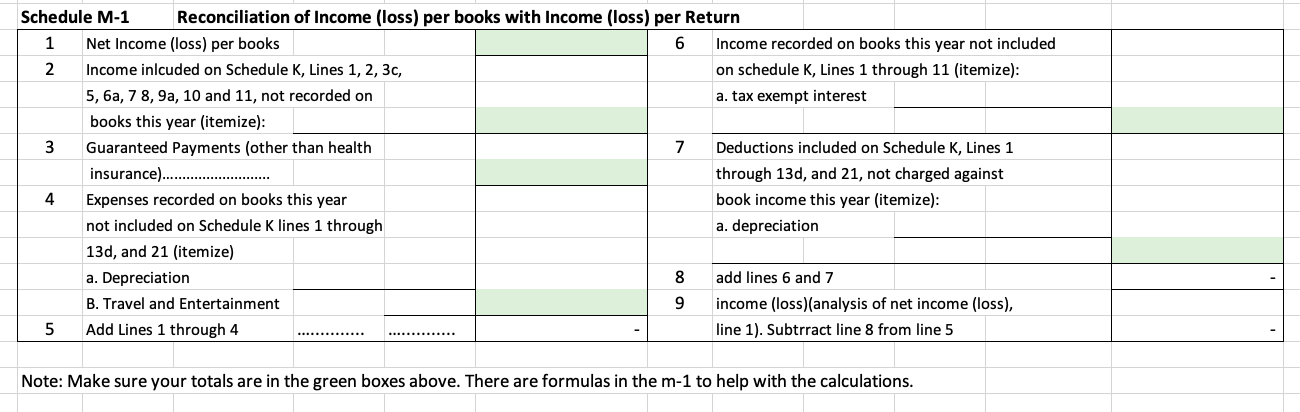

COMPLETE SCHEDULE M-1 Question H2 To the left is the profit and loss statement for Oak Hill Limited Partners. Oak Hill LP is involved with

COMPLETE SCHEDULE M-1

Question H2 To the left is the profit and loss statement for Oak Hill Limited Partners. Oak Hill LP is involved with landscaping across the Carolinas. They own mutliple lawnmowers, leaf blowers, and various other equipment. They also lease several other large items and pay interest expense on those items. During the year Oak Hill purchased a few new machines. Their total MACRS depreciation for all old and new equipment is $17000. They elected out of bonus depreciation and decided not to take section 179 expense. The interest income consist of $3,000 from a money market account and $2,000 from Greensboro City bonds. The company wrote off $6,000 in accounts receivable as uncollectible during the year. The controller has asked that you calculate their taxable income for the year. Schedule M-1 Reconciliation of Income (loss) per books with Income (loss) per Return Note: Make sure your totals are in the green boxes above. There are formulas in the m1 to help with the calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started