Answered step by step

Verified Expert Solution

Question

1 Approved Answer

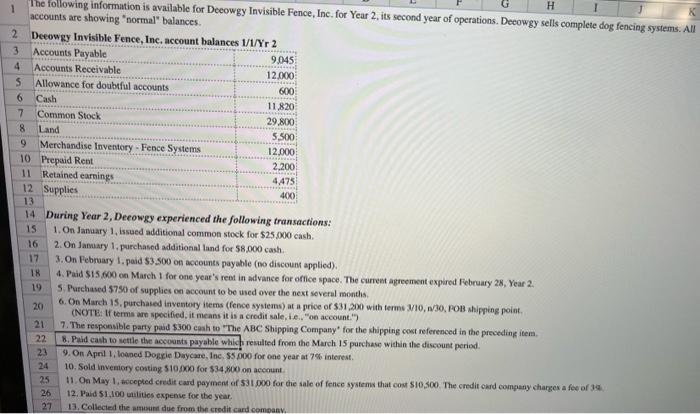

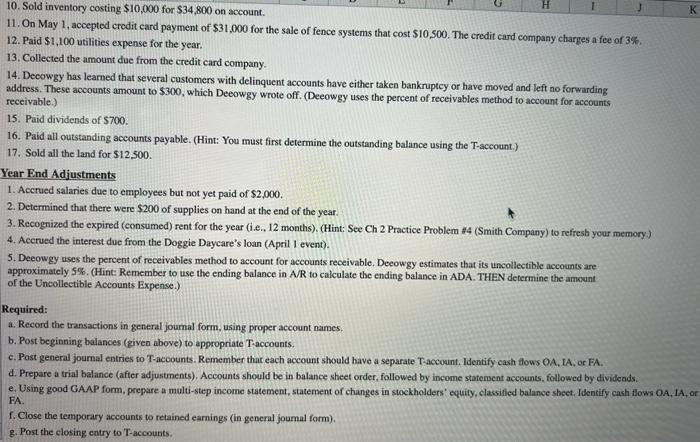

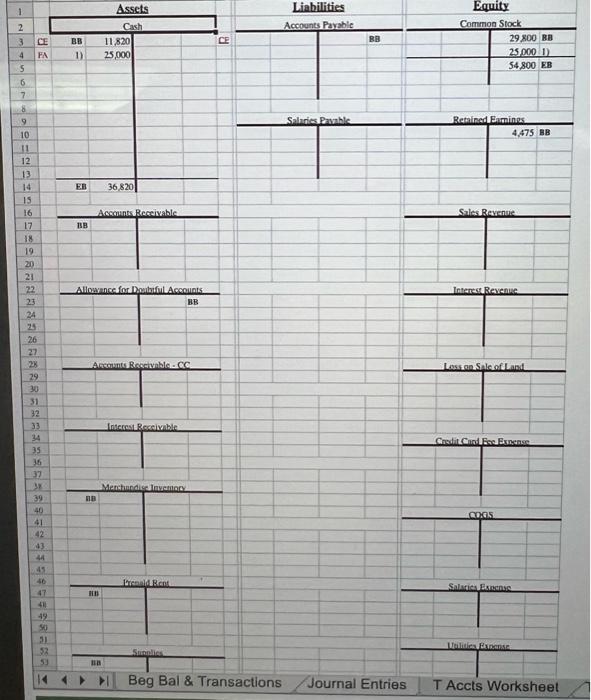

complete t-accounts The following information is available for Deeowgy Invisible Fence, Inc. for Year 2, its second year of operations. Decowgy sells complete dog fenciog

complete t-accounts

The following information is available for Deeowgy Invisible Fence, Inc. for Year 2, its second year of operations. Decowgy sells complete dog fenciog systems. All accounts are showing "normal" balances. 15 1,On January 1, issued additional common stock for $2.5,000cash. 16 2. On Jamiary 1, parchased additional land for 58,000 cash. 3.On February 1, paid 53.500 oe accounts payable (no discount applied). 18 4. Paid $15,600 on March 1 for one year's reat in advance for office space. The curreat agrecment expired February 28 , Year 2. 19. 5. Purchased 5750 of supplies on account to be used over the next several montis. 6. On March 15, purchased inventory items (fence sysiems) at a price of 531,200 with terms M10, n30. FOB ahipping point. (NCTE: If terms are spocified, it means it is a crodit sale, i.e., "oo account.") 7. The responsible party pad $300 cash to "The ABC Shipping Company" for the shipping cost referenced in the preceding item. B. Puid casb to settle the accoosts payable whic remulted from the March 15 puechase within the discoust period. 9. On Apni 1, lowned Dogkie Daycane, Inc, 55,000 for oae year at 7% interest. 10. Sola inveatory costing 5109200 for $34,800 on account. 11. On May 1, mecepted credit card payment of 531,000 for the sale of fence systema that con 510,500 . The credir card company charger a fee af 3 a. 12. Pa:d 51,100 ualitics expente foe the year. 13. Collecied the amsunt due from the credit card combanv. 12. Paid \$1,100 utilities expense for the year. 13. Collected the amount due from the credit card company. 14. Decowgy has learned that several customers with delinquent accounts have either taken bankruptcy or have moved and left no forwarding address. These accounts amount to $300, which Deeowgy wrote off. (Deeowgy uses the percent of receivables method to account for accounts receivable.) 15. Paid dividends of 5700 . 16. Paid all outstanding accounts payable. (Hint: You must first determine the outstanding balance using the T-account.) 17. Sold all the land for $12.500. Year Eind Adjustments 1. Accrued salaries due to employees but not yet paid of $2,000. 2. Determined that there were $200 of supplies on hand at the end of the year. 3. Recognized the expired (consumed) rent for the year (i.e, 12 months), (Hint: See Ch2 Practice Problem 14 (Smith Company) to refresh your memory) 4. Acerued the interest due from the Doggie Daycare's loan (April I event). 5. Deeowgy uses the percent of receivables method to aceount for accounts receivable. Deeowgy estimates that its uncollectible accounts are approximately 5\%. (Hint: Remember to use the ending balance in A/R to calculate the ending balance in ADA. THEN determine the amsunt of the Uncollectible Accounts Expense.) Required: a. Record the transactions in general joumal form, using proper account names. b. Post beginning balances (given above) to appropriate Taccounts. c. Post general joumal entries to T-accounts. Remember that each account should have a separate Taccount. Identify cash tlows OA, LA, or EA. d. Prepare a trial balance (after adjustments). Accounts should be in balance sheet order, followed by income staternent accounts, followed by divideads. e. Using good GAAP form, prepare a multi-step income statement, statement of changes in stockholders' equity, classified balance sheet. Identify cash flows OA, L. FA. The following information is available for Deeowgy Invisible Fence, Inc. for Year 2, its second year of operations. Decowgy sells complete dog fenciog systems. All accounts are showing "normal" balances. 15 1,On January 1, issued additional common stock for $2.5,000cash. 16 2. On Jamiary 1, parchased additional land for 58,000 cash. 3.On February 1, paid 53.500 oe accounts payable (no discount applied). 18 4. Paid $15,600 on March 1 for one year's reat in advance for office space. The curreat agrecment expired February 28 , Year 2. 19. 5. Purchased 5750 of supplies on account to be used over the next several montis. 6. On March 15, purchased inventory items (fence sysiems) at a price of 531,200 with terms M10, n30. FOB ahipping point. (NCTE: If terms are spocified, it means it is a crodit sale, i.e., "oo account.") 7. The responsible party pad $300 cash to "The ABC Shipping Company" for the shipping cost referenced in the preceding item. B. Puid casb to settle the accoosts payable whic remulted from the March 15 puechase within the discoust period. 9. On Apni 1, lowned Dogkie Daycane, Inc, 55,000 for oae year at 7% interest. 10. Sola inveatory costing 5109200 for $34,800 on account. 11. On May 1, mecepted credit card payment of 531,000 for the sale of fence systema that con 510,500 . The credir card company charger a fee af 3 a. 12. Pa:d 51,100 ualitics expente foe the year. 13. Collecied the amsunt due from the credit card combanv. 12. Paid \$1,100 utilities expense for the year. 13. Collected the amount due from the credit card company. 14. Decowgy has learned that several customers with delinquent accounts have either taken bankruptcy or have moved and left no forwarding address. These accounts amount to $300, which Deeowgy wrote off. (Deeowgy uses the percent of receivables method to account for accounts receivable.) 15. Paid dividends of 5700 . 16. Paid all outstanding accounts payable. (Hint: You must first determine the outstanding balance using the T-account.) 17. Sold all the land for $12.500. Year Eind Adjustments 1. Accrued salaries due to employees but not yet paid of $2,000. 2. Determined that there were $200 of supplies on hand at the end of the year. 3. Recognized the expired (consumed) rent for the year (i.e, 12 months), (Hint: See Ch2 Practice Problem 14 (Smith Company) to refresh your memory) 4. Acerued the interest due from the Doggie Daycare's loan (April I event). 5. Deeowgy uses the percent of receivables method to aceount for accounts receivable. Deeowgy estimates that its uncollectible accounts are approximately 5\%. (Hint: Remember to use the ending balance in A/R to calculate the ending balance in ADA. THEN determine the amsunt of the Uncollectible Accounts Expense.) Required: a. Record the transactions in general joumal form, using proper account names. b. Post beginning balances (given above) to appropriate Taccounts. c. Post general joumal entries to T-accounts. Remember that each account should have a separate Taccount. Identify cash tlows OA, LA, or EA. d. Prepare a trial balance (after adjustments). Accounts should be in balance sheet order, followed by income staternent accounts, followed by divideads. e. Using good GAAP form, prepare a multi-step income statement, statement of changes in stockholders' equity, classified balance sheet. Identify cash flows OA, L. FA Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started