Answered step by step

Verified Expert Solution

Question

1 Approved Answer

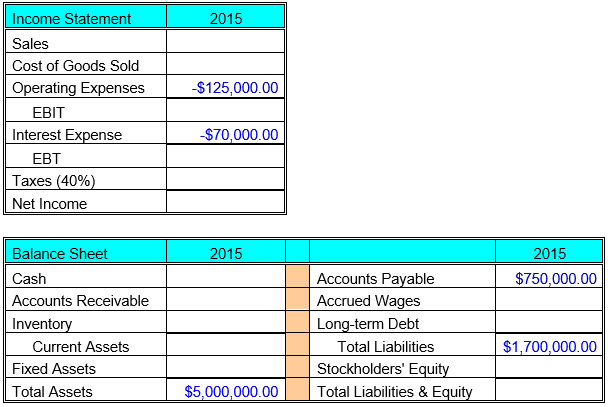

Complete the 2015 end of year balance sheet and income statement using the following financial data. Determine inventory at the end of 2015 as a

Complete the 2015 end of year balance sheet and income statement using the following financial data. Determine inventory at the end of 2015 as a percentage of sales for 2015 (i.e., inventory divided by sales). Current ratio: 2.20x Quick (Acid Test) Ratio: 1.20x Return on Assets: 15.36% Days Sales Outstanding (360-day year): 60 days [AR / (Sales / 360) ] Total Asset Turnover: 0.60x Interest rate on long-term debt: 10.0% F09E312.png Enter your answer to 4-decimal places. For example, if your answer is 8.22%, enter "0.0822".

Complete the 2015 end of year balance sheet and income statement using the following financial data. Determine inventory at the end of 2015 as a percentage of sales for 2015 (i.e., inventory divided by sales). Current ratio: 2.20x Quick (Acid Test) Ratio: 1.20x Return on Assets: 15.36% Days Sales Outstanding (360-day year): 60 days [AR / (Sales / 360) ] Total Asset Turnover: 0.60x Interest rate on long-term debt: 10.0% F09E312.png Enter your answer to 4-decimal places. For example, if your answer is 8.22%, enter "0.0822".

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started