Answered step by step

Verified Expert Solution

Question

1 Approved Answer

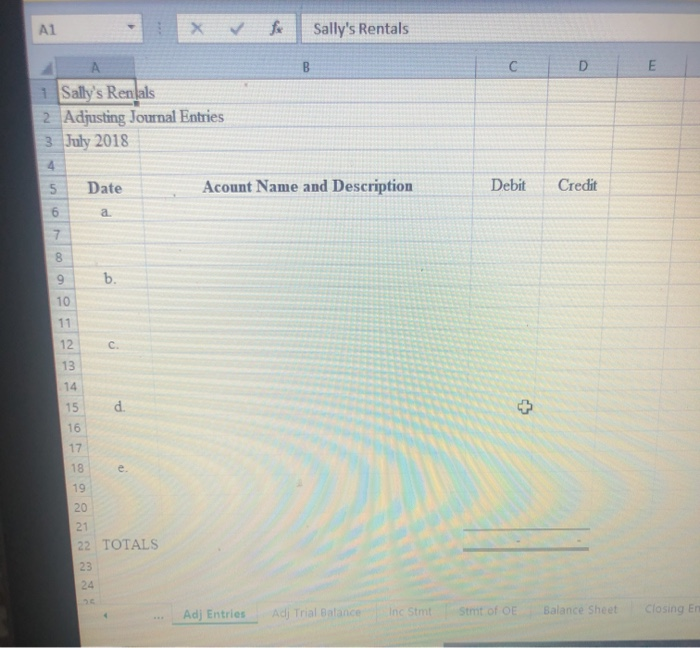

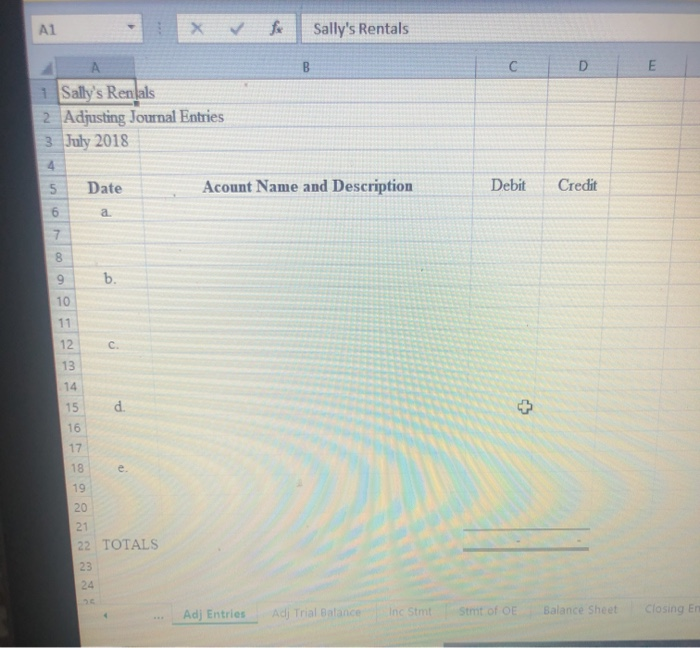

complete the 5 adjusting entries- A1 Sally's Rentals B C D E 1 Sally's Renals 2 Adjusting Journal Entries 3 July 2018 4 5 Date

complete the 5 adjusting entries-

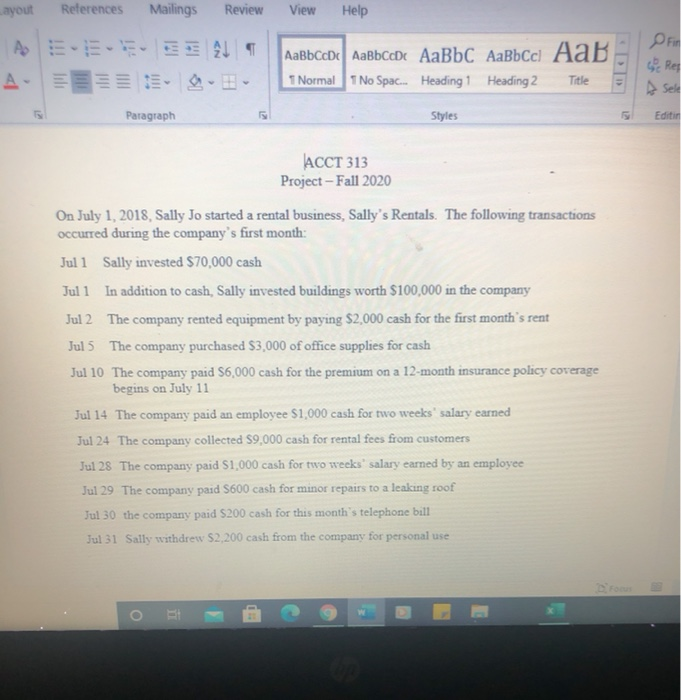

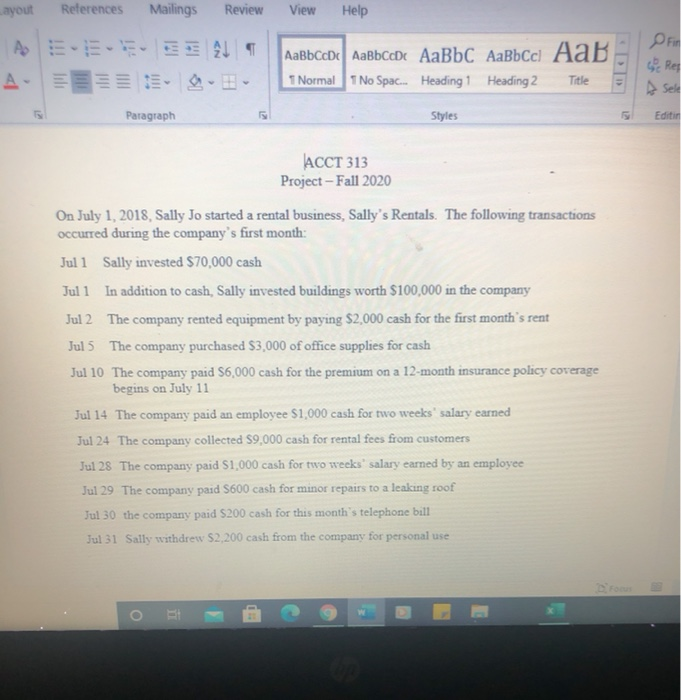

A1 Sally's Rentals B C D E 1 Sally's Renals 2 Adjusting Journal Entries 3 July 2018 4 5 Date Acount Name and Description Debit Credit 5 6 7 a 8 b. 10 11 12 C 13 14 15 d. 16 17 18 e 19 20 21 22 TOTALS 23 24 Adj Entries Adj Trial Balance Ine Stm Stmt of OE Balance Sheet Closing Er ayout References Mailings Review View Help A SEALT A AaBbcode AaBbccdc AaBbc Aabbcc Aab 1 No Spac... Heading 1 Heading 2 DF Ret 1 Normal Title Paragraph Styles Editin ACCT 313 Project - Fall 2020 On July 1, 2018, Sally Jo started a rental business, Sally's Rentals. The following transactions occurred during the company's first month: Jul i Sally invested $70,000 cash Jul 1 In addition to cash, Sally invested buildings worth $100,000 in the company Jul 2 The company rented equipment by paying $2,000 cash for the first month's rent Jul 5 The company purchased $3,000 of office supplies for cash Jul 10 The company paid $6,000 cash for the premium on a 12-month insurance policy coverage begins on July 11 Jul 14 The company paid an employee $1,000 cash for two weeks' salary earned Jul 24 The company collected $9,000 cash for rental fees from customers Jul 28 The company paid $1,000 cash for two weeks' salary earned by an employee Jul 29 The company paid S600 cash for minor repairs to a leaking roof Jul 30 the company paid $200 cash for this month's telephone bill Jul 31 Sally withdrew $2,200 cash from the company for personal use O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started