Answered step by step

Verified Expert Solution

Question

1 Approved Answer

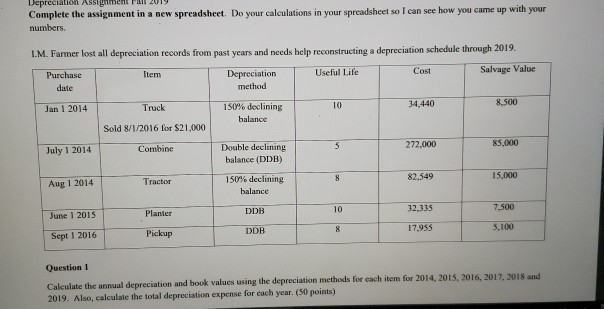

Complete the assignment in a new spreadsheet. Do your calculations in your spreadsheet so I can see how you came up with your numbers IM.

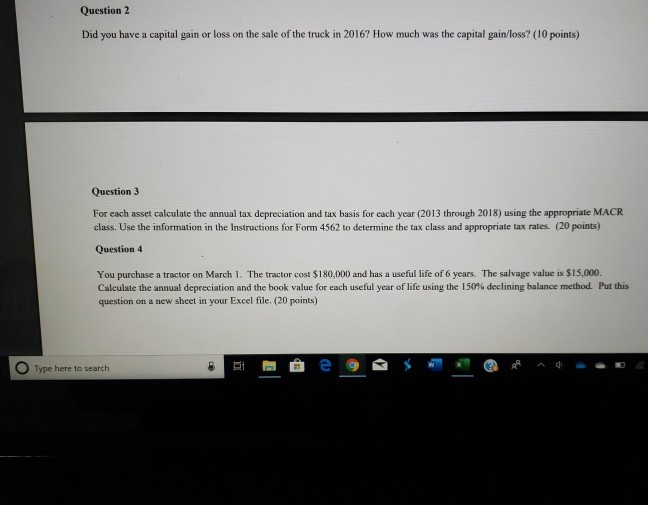

Complete the assignment in a new spreadsheet. Do your calculations in your spreadsheet so I can see how you came up with your numbers IM. Farmer lost all depreciation records from past years and needs help reconstructing a depreciation schedule through 2019 Purchase Item Depreciation I EC Cost Salvage Value date method Jan 1 2014 Truck 150% declining 34.440 8.500 Sold 8/1/2016 for $21.000 July 1 2014 Combine Double declining 272,000 85,000 balance (DDB) balance Aug 1 2014 Tractor 1509 declining balance 82.549 15.000 Planter DDB 7.500 June 1 2015 Sept 1 2016 32,335 17.955 Pickup DDB 5.100 Question 1 Calculate the annual depreciation and book values using the depreciation methods for each item for 2014, 2015, 2016, 2017, 2018 2019. Also, calculate the total depreciation expense for each year. (50 points) Question 2 Did you have a capital gain or loss on the sale of the truck in 2016? How much was the capital gain/loss? (10 points) Question 3 For each asset calculate the annual tax depreciation and tax basis for each year (2013 through 2018) using the appropriate MACR class. Use the information in the Instructions for Form 4562 to determine the tax class and appropriate tax rates. (20 points) Question 4 You purchase a tractor on March 1. The tractor cost $180,000 and has a useful life of 6 years. The salvage value is $15,000. Calculate the annual depreciation and the book value for each useful year of life using the 150% declining balance method. Put this question on a new sheet in your Excel file. (20 points) Type here to search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started