Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete the balance sheet ASSETS = LIABILITIES & OWNERS' EQUITY Cash Filters Vehicles Prepaid Costs Debt Paid-in Capital Retained Earnings YEAR 3 Opening Balances $2,724,276

complete the balance sheet

| ASSETS | = | LIABILITIES & OWNERS' EQUITY | ||||||||||

| Cash | Filters | Vehicles | Prepaid Costs | Debt | Paid-in Capital | Retained Earnings | ||||||

| YEAR 3 | ||||||||||||

| Opening Balances | $2,724,276 | $472,334 | $406,000 | $34,666 | $0 | $225,000 | $3,412,276 | |||||

| Beginning-of-year activities | ||||||||||||

| 1 | Slowsand Filters | ($250,000) | $250,000 | |||||||||

| 2 | Motorcycles and Trucks | ($237,500) | $237,500 | |||||||||

| Through-the-year activities | ||||||||||||

| 7 | Revenues | $13,140,000 | ||||||||||

| Revenue Underreporting | ($1,971,000) | |||||||||||

| Cost of Revenue, Vendor Compensation | ($2,233,800) | |||||||||||

| 8 | Technicians' Wages | ($180,000) | ||||||||||

| 9 | Local Management Salaries | ($400,000) | ||||||||||

| 10 | Sales Staff Salaries | ($18,000) | ||||||||||

| 11 | Water Testing & Filter Maintenance | ($612,000) | ||||||||||

| 12 | Marketing Expenses | ($129,352) | ||||||||||

| 13 | Vehicle Expenses | ($110,000) | ||||||||||

| 14 | Other Costs | ($2,632,000) | ||||||||||

| Year-closing activities | ||||||||||||

| 15 | Depreciation | |||||||||||

| Blue Future Contract | ($2,667) | ($2,667) | ||||||||||

| Slowsand Filters | ($50,500) | |||||||||||

| Motorcycles and Trucks | ($150,000) | |||||||||||

| YEAR 3 CLOSING TOTALS | $7,090,624 | $671,834 | $493,500 | $31,999 | $0 | $225,000 | $3,409,609 |

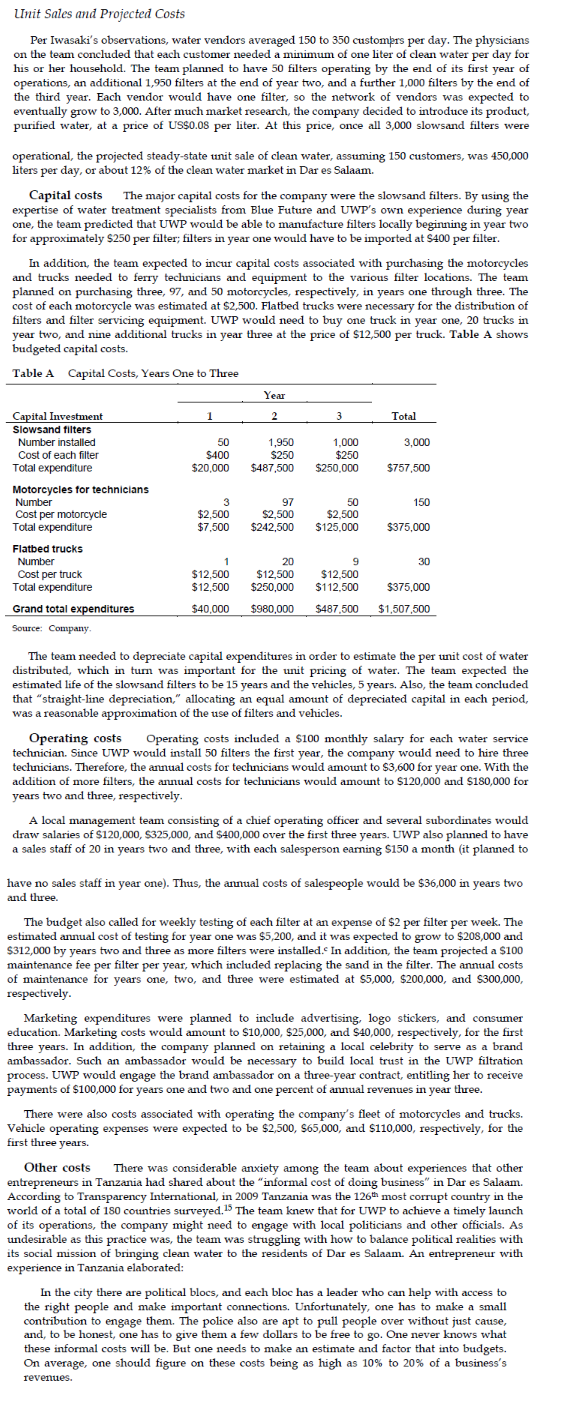

Unit Sales and Projected Costs Per Iwasaki's observations, water vendors averaged 150 to 350 customers per day. The physicians on the team concluded that each customer needed a minimum of one liter of clean water per day for his or her household. The team planned to have 50 filters operating by the end of its first year of operations, an additional 1,950 filters at the end of year two, and a further 1,000 filters by the end of the third year. Each vendor would have one filter, so the network of vendors was expected to eventually grow to 3,000. After much market research, the company decided to introduce its product, purified water, at a price of US$0.08 per liter. At this price, once all 3,000 slowsand filters were operational, the projected steady-state unit sale of clean water, assuming 150 customers, was 450,000 liters per day, or about 12% of the clean water market in Dar es Salaam. Capital costs The major capital costs for the company were the slowsand filters. By using the expertise of water treatment specialists from Blue Future and UWP's own experience during year one, the team predicted that UWP would be able to manufacture filters locally beginning in year two for approximately $250 per filter; filters in year one would have to be imported at $400 per filter. In addition, the team expected to incur capital costs associated with purchasing the motorcycles and trucks needed to ferry technicians and equipment to the various filter locations. The team planned on purchasing three, 97, and 50 motorcycles, respectively, in years one through three. The cost of each motorcycle was estimated at $2,500. Flatbed trucks were necessary for the distribution of filters and filter servicing equipment. UWP would need to buy one truck in year one, 20 trucks in year two, and nine additional trucks in year three at the price of $12,500 per truck. Table A shows budgeted capital costs. Table A Capital Costs, Years One to Three Year Capital Investment 1 2 3 Total Slowsand filters Number installed 50 Cost of each filter $400 1,950 $250 1,000 3,000 Total expenditure $20,000 $487,500 $250 $250,000 $757,500 Motorcycles for technicians Number 3 Cost per motorcycle $2,500 Total expenditure $7,500 97 $2,500 $242,500 50 $2,500 $125,000 150 $375,000 Flatbed trucks Number Cost per truck Total expenditure Grand total expenditures Source: Company. 1 20 9 30 $12,500 $12,500 $12,500 $250,000 $12,500 $112,500 $375,000 $40,000 $980,000 $487,500 $1,507,500 The team needed to depreciate capital expenditures in order to estimate the per unit cost of water distributed, which in turn was important for the unit pricing of water. The team expected the estimated life of the slowsand filters to be 15 years and the vehicles, 5 years. Also, the team concluded that "straight-line depreciation," allocating an equal amount of depreciated capital in each period, was a reasonable approximation of the use of filters and vehicles. Operating costs Operating costs included a $100 monthly salary for each water service technician. Since UWP would install 50 filters the first year, the company would need to hire three technicians. Therefore, the annual costs for technicians would amount to $3,600 for year one. With the addition of more filters, the annual costs for technicians would amount to $120,000 and $180,000 for years two and three, respectively. A local management team consisting of a chief operating officer and several subordinates would draw salaries of $120,000, $325,000, and $400,000 over the first three years. UWP also planned to have a sales staff of 20 in years two and three, with each salesperson earning $150 a month (it planned to have no sales staff in year one). Thus, the annual costs of salespeople would be $36,000 in years two and three. The budget also called for weekly testing of each filter at an expense of $2 per filter per week. The estimated annual cost of testing for year one was $5,200, and it was expected to grow to $208,000 and $312,000 by years two and three as more filters were installed. In addition, the team projected a $100 maintenance fee per filter per year, which included replacing the sand in the filter. The annual costs of maintenance for years one, two, and three were estimated at $5,000, $200,000, and $300,000, respectively. Marketing expenditures were planned to include advertising, logo stickers, and consumer education. Marketing costs would amount to $10,000, $25,000, and $40,000, respectively, for the first three years. In addition, the company planned on retaining a local celebrity to serve as a brand ambassador. Such an ambassador would be necessary to build local trust in the UWP filtration process. UWP would engage the brand ambassador on a three-year contract, entitling her to receive payments of $100,000 for years one and two and one percent of annual revenues in year three. There were also costs associated with operating the company's fleet of motorcycles and trucks. Vehicle operating expenses were expected to be $2,500, $65,000, and $110,000, respectively, for the first three years. Other costs There was considerable anxiety among the team about experiences that other entrepreneurs in Tanzania had shared about the "informal cost of doing business" in Dar es Salaam. According to Transparency International, in 2009 Tanzania was the 126th most corrupt country in the world of a total of 180 countries surveyed.15 The team knew that for UWP to achieve a timely launch of its operations, the company might need to engage with local politicians and other officials. As undesirable as this practice was, the team was struggling with how to balance political realities with its social mission of bringing clean water to the residents of Dar es Salaam. An entrepreneur with experience in Tanzania elaborated: In the city there are political blocs, and each bloc has a leader who can help with access to the right people and make important connections. Unfortunately, one has to make a small contribution to engage them. The police also are apt to pull people over without just cause, and, to be honest, one has to give them a few dollars to be free to go. One never knows what these informal costs will be. But one needs to make an estimate and factor that into budgets. On average, one should figure on these costs being as high as 10% to 20% of a business's revenues.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started