Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the blanks in the Franking account of a proprietary non-BRE company based on the following information. A proprietary company's Dividend Franking Account information

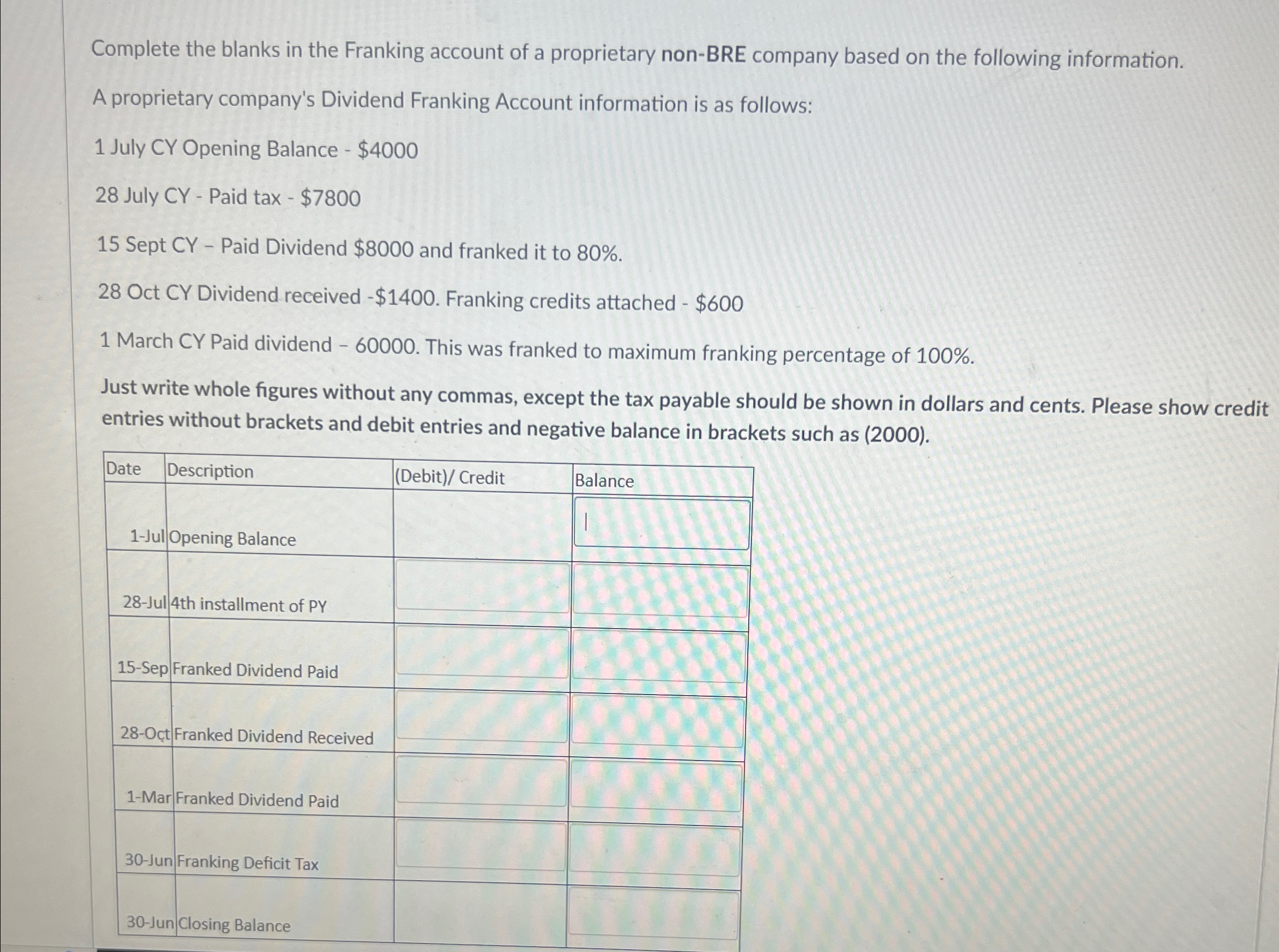

Complete the blanks in the Franking account of a proprietary non-BRE company based on the following information. A proprietary company's Dividend Franking Account information is as follows: 1 July CY Opening Balance - $4000 28 July CY- Paid tax - $7800 15 Sept CY- Paid Dividend $8000 and franked it to 80%. 28 Oct CY Dividend received -$1400. Franking credits attached - $600 1 March CY Paid dividend - 60000. This was franked to maximum franking percentage of 100%. Just write whole figures without any commas, except the tax payable should be shown in dollars and cents. Please show credit entries without brackets and debit entries and negative balance in brackets such as (2000). Date Description 1-Jul Opening Balance 28-Jul 4th installment of PY 15-Sep Franked Dividend Paid 28-Oct Franked Dividend Received 1-Mar Franked Dividend Paid 30-Jun Franking Deficit Tax 30-Jun Closing Balance (Debit)/Credit Balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started