Answered step by step

Verified Expert Solution

Question

1 Approved Answer

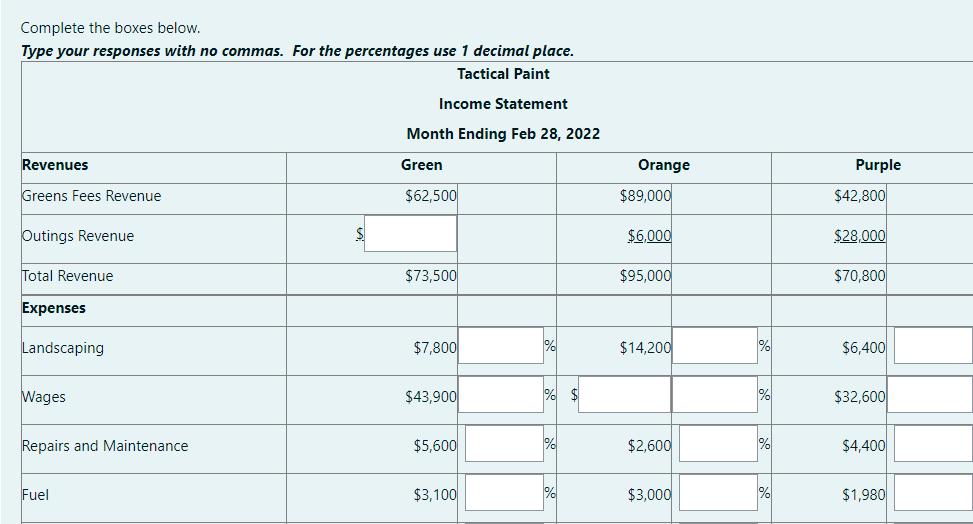

Complete the boxes below. Type your responses with no commas. For the percentages use 1 decimal place. Tactical Paint Income Statement Month Ending Feb

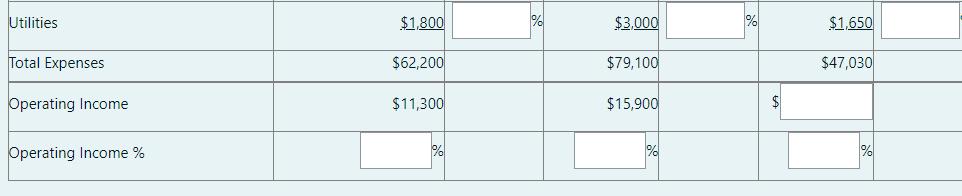

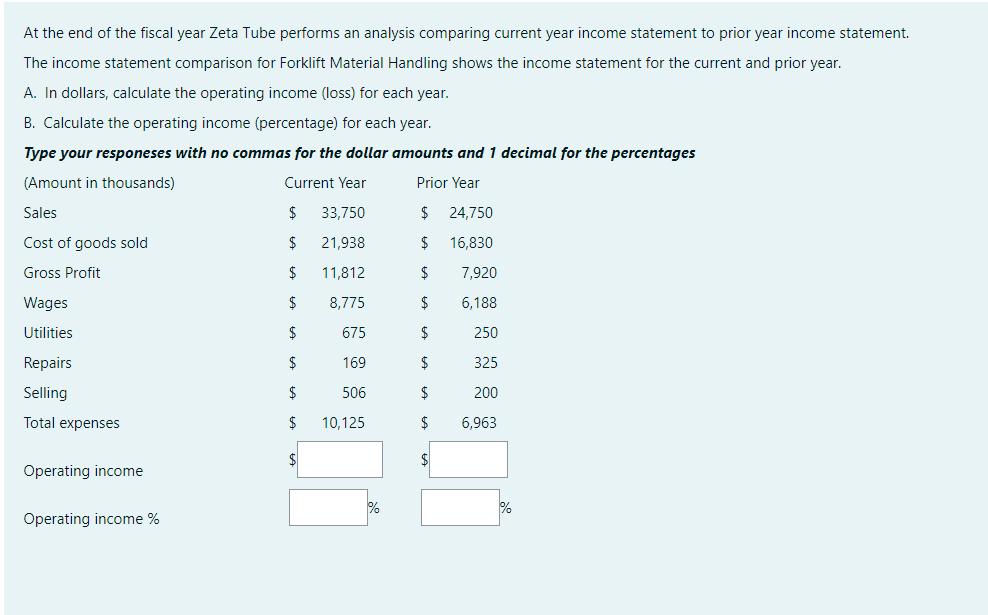

Complete the boxes below. Type your responses with no commas. For the percentages use 1 decimal place. Tactical Paint Income Statement Month Ending Feb 28, 2022 Green $62,500 Revenues Greens Fees Revenue Outings Revenue Total Revenue Expenses Landscaping Wages Repairs and Maintenance Fuel $73,500 $7,800 $43,900 $5,600 $3,100 1% 1% $ 1% Orange $89,000 $6,000 $95,000 $14,200 $2,600 $3,000 Purple $42,800 $28,000 $70,800 $6,400 $32,600 $4,400 $1,980 Utilities Total Expenses Operating Income Operating Income % $1,800 $62,200 $11,300 1% $3,000 $79,100 $15,900 1% $ $1,650 $47,030 At the end of the fiscal year Zeta Tube performs an analysis comparing current year income statement to prior year income statement. The income statement comparison for Forklift Material Handling shows the income statement for the current and prior year. A. In dollars, calculate the operating income (loss) for each year. B. Calculate the operating income (percentage) for each year. Type your responeses with no commas for the dollar amounts and 1 decimal for the percentages (Amount in thousands) Current Year Prior Year 33,750 $ $ 21,938 $ 11,812 $ 8,775 $ 675 $ 169 $ 506 $ 10,125 Sales Cost of goods sold Gross Profit Wages Utilities Repairs Selling Total expenses Operating income Operating income % $ $ 24,750 $ 16,830 $ $ $ $ $ $ $ 7,920 6,188 250 325 200 6,963

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the missing values as follows 1 E...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started