Answered step by step

Verified Expert Solution

Question

1 Approved Answer

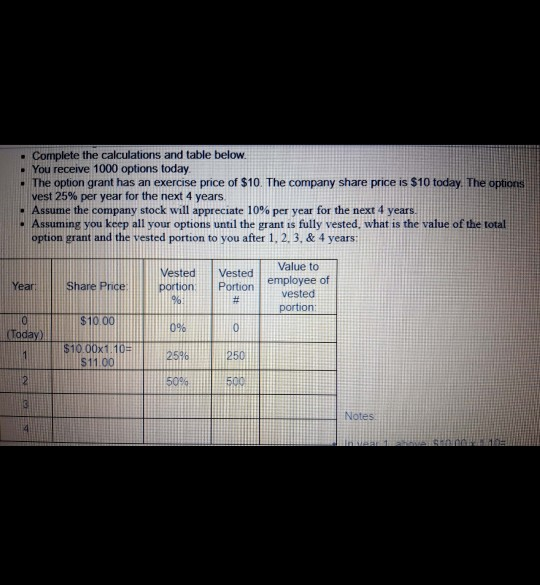

. Complete the calculations and table below You receive 1000 options today The option grant has an exercise price of $10. The company share price

. Complete the calculations and table below You receive 1000 options today The option grant has an exercise price of $10. The company share price is $10 today. The options vest 25% per year for the next 4 years . Assume the company stock will appreciate 10% per year for the next 4 years. Assuming you keep all your options until the grant is fully vested, what is the value of the total option grant and the vested portion to you after 1, 2, 3, & 4 years: Year Share Price Vested portion 96 Vested Portion # Value to employee of vested portion $10.00 0 (Today) 0% 0 1 $10.00x1.10 $11.00 2596 250 12 50% 500 5 Notes 4 In year 1 above $10.00 x 1.10= $11.00: the 1.10 comes from the instruction: the company stock will appreciate 10% per year. The 10% per year is a compounding rate, so for year 2 you need to multiply $11.00 by 11, and so on to find your share price for each year. The value to the employee is the market value of the share x the number of shares, less the price paid for the shares (that is the exercise price). . For this exercise we will assume that there are no taxes or fees payable ate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started