Complete the Cash Collections Schedule: Provide the formula cell view rather than the numerical answer.

Cash Collections Schedule

| | January | February | March |

| 60% of current months sale | | | |

| 30% of previous months sale | | | |

| 10% of second previous months sale | | | |

| Total collections | | | |

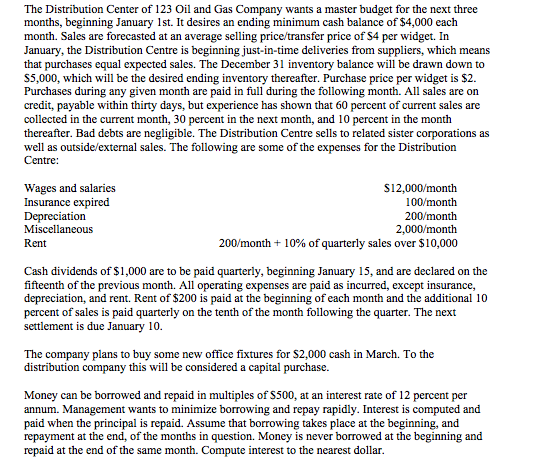

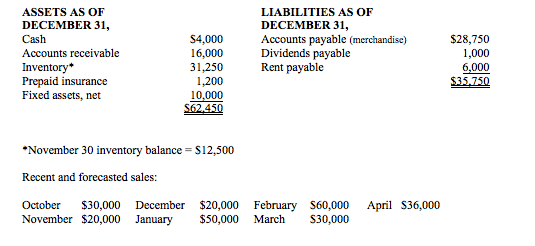

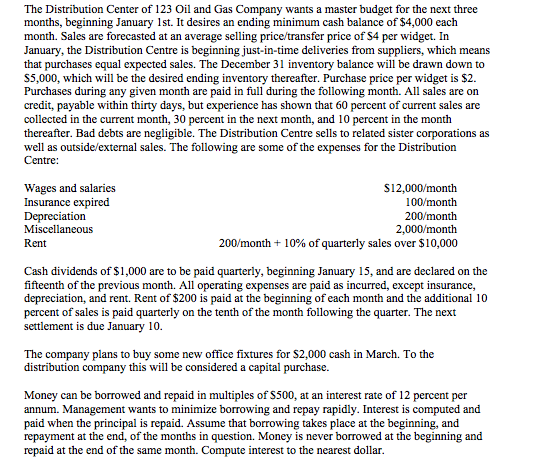

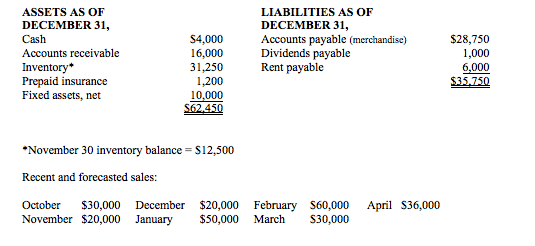

The Distribution Center of 123 Oil and Gas Company wants a master budget for the next three months, beginning January 1st. It desires an ending minimum cash balance of $4,000 each month. Sales are forecasted at an average selling price/transfer price of S4 per widget. In January, the Distribution Centre is beginning just-in-time deliveries from suppliers, which means that purchases equal expected sales. The December 31 inventory balance will be drawn down to $5,000, which will be the desired ending inventory thereafter. Purchase price per widget is $2. Purchases during any given month are paid in full during the following month. All sales are on credit, payable within thirty days, but experience has shown that 60 percent of current sales are collected in the current month, 30 percent in the next month, and 10 percent in the month thereafter. Bad debts are negligible. The Distribution Centre sells to related sister corporations as well as outside/external sales. The following are some of the expenses for the Distribution Centre: Wages and salaries Insurance expired Depreciation Miscellaneous Rent $12,000/month 100/month 200/month 2,000/month 200/month + 10% of quarterly sales over $10,000 Cash dividends of $1,000 are to be paid quarterly, beginning January 15, and are declared on the fifteenth of the previous month. All operating expenses are paid as incurred, except insurance, depreciation, and rent. Rent of $200 is paid at the beginning of each month and the additional 10 percent of sales is paid quarterly on the tenth of the month following the quarter. The next settlement is due January 10. The company plans to buy some new office fixtures for $2.000 cash in March. To the distribution company this will be considered a capital purchase. Money can be borrowed and repaid in multiples of $500, at an interest rate of 12 percent per annum. Management wants to minimize borrowing and repay rapidly. Interest is computed and paid when the principal is repaid. Assume that borrowing takes place at the beginning, and repayment at the end, of the months in question. Money is never borrowed at the beginning and repaid at the end of the same month. Compute interest to the nearest dollar. ASSETS AS OF DECEMBER 31, Cash Accounts receivable Inventory Prepaid insurance Fixed assets, net $4,000 16,000 31,250 1,200 10,000 S62.450 LIABILITIES AS OF DECEMBER 31, Accounts payable (merchandise) Dividends payable Rent payable $28,750 1,000 6,000 $35.750 *November 30 inventory balance = $12,500 Recent and forecasted sales: April S36,000 October $30,000 November $20,000 December January $20,000 February $50,000 March $60,000 30,000