Answered step by step

Verified Expert Solution

Question

1 Approved Answer

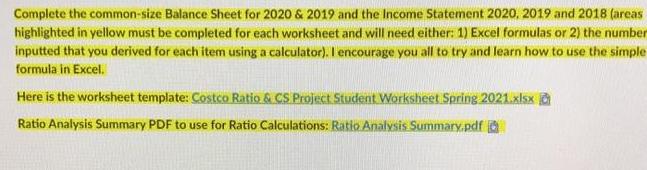

Complete the common-size Balance Sheet for 2020 & 2019 and the Income Statement 2020, 2019 and 2018 (areas highlighted in yellow must be completed

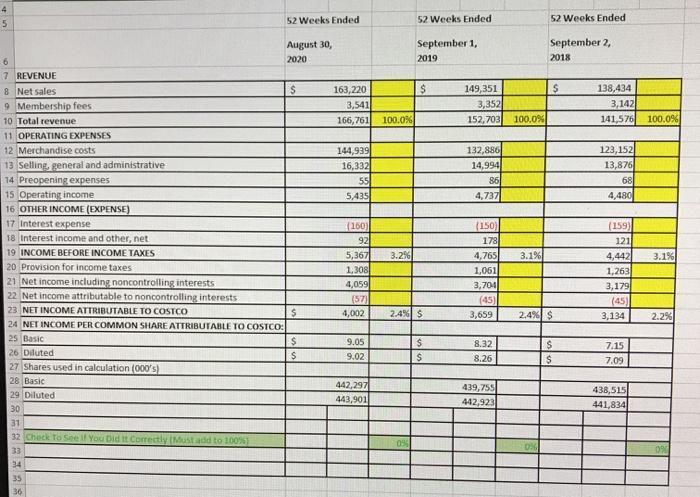

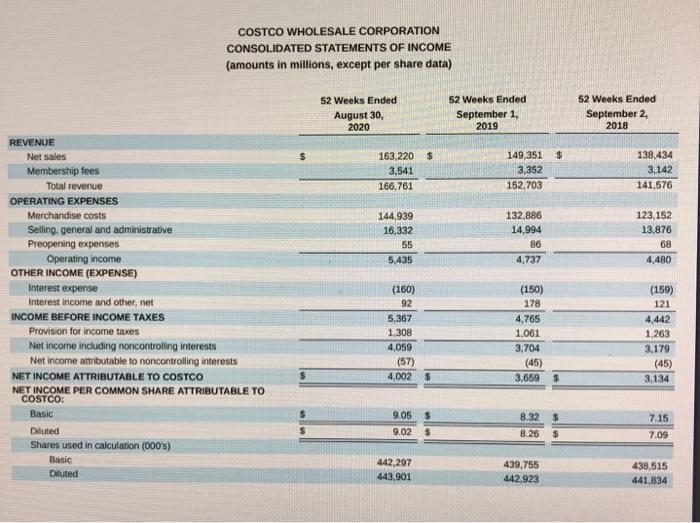

Complete the common-size Balance Sheet for 2020 & 2019 and the Income Statement 2020, 2019 and 2018 (areas highlighted in yellow must be completed for each worksheet and will need either: 1) Excel formulas or 2) the number inputted that you derived for each item using a calculator). I encourage you all to try and learn how to use the simple formula in Excel. Here is the worksheet template: Costco Ratio & CS Project Student Worksheet Spring 2021.xlsx Ratio Analysis Summary PDF to use for Ratio Calculations: Ratio Analysis Summary.pdf 4 5 6 7 REVENUE 8 Net sales 9 Membership fees 10 Total revenue 11 OPERATING EXPENSES 52 Weeks Ended 52 Weeks Ended August 30, 2020 September 1, 2019 52 Weeks Ended September 2, 2018 $ 163,220 $ 149,351 $ 3,541 3,352 138,434 3,142 166,761 100.0% 152,703 100.0% 141,576 100.0% 12 Merchandise costs 13 Selling, general and administrative 14 Preopening expenses 15 Operating income 16 OTHER INCOME (EXPENSE) 17 Interest expense 18 Interest income and other, net 19 INCOME BEFORE INCOME TAXES 20 Provision for income taxes 144,939 132,886 123,152 16,332 14,994 13,876 55 86 68 5,435 4,737 4,480 (160) (150) (159) 92 178 121 5,367 3.2% 4,765 3.1% 4,442 3.1% 1,308 1,061 1,263 21 Net income including noncontrolling interests 4,059 3,704 3,179 22 Net income attributable to noncontrolling interests (57) (45) (45) 23 NET INCOME ATTRIBUTABLE TO COSTCO $ 4,002 2.4% $ 3,659 2.4% $ 3,134 2.2% 24 NET INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO 25 Basic $ 9.05 $ 8.32 $ 7.15 26 Diluted $ 9.02 $ 8.26 $ 7.09 27 Shares used in calculation (000's) 28 Basic 29 Diluted 442,297 443,901 439,755 442,923 438,515 441,834 30 31 32 Check To See If You Did It Correctly (Must add to 100%) 33 34 35 36 0% 06 0% REVENUE Net sales Membership fees Total revenue OPERATING EXPENSES COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) 52 Weeks Ended August 30, 2020 163,220 $ 52 Weeks Ended September 1, 2019 52 Weeks Ended 3,541 166,761 149,351 $ 3,352 152,703 September 2, 2018 138,434 3,142 141,576 Merchandise costs 144,939 132,886 Selling, general and administrative 16,332 Preopening expenses 55 Operating income OTHER INCOME (EXPENSE) Interest expense Interest income and other, net INCOME BEFORE INCOME TAXES Provision for income taxes 5,435 4,737 14,994 86 123,152 13,876 4,480 68 (160) (150) (159) 92 178 121 5,367 4,765 4,442 1.308- 1,061 1,263 Net income including noncontrolling interests Net income attributable to noncontrolling interests NET INCOME ATTRIBUTABLE TO COSTCO 4,059 3,704 3,179 (57) (45) 4,002 $ 3,659 (45) 3,134 NET INCOME PER COMMON SHARE ATTRIBUTABLE TO COSTCO: Basic Diluted Shares used in calculation (000's) Basic Diluted 9.05 $ 8.32 $ 7.15 9.02 $ 8.26 $ 7.09 442,297 443,901 439,755 442,923 438,515 441,834

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started