Answered step by step

Verified Expert Solution

Question

1 Approved Answer

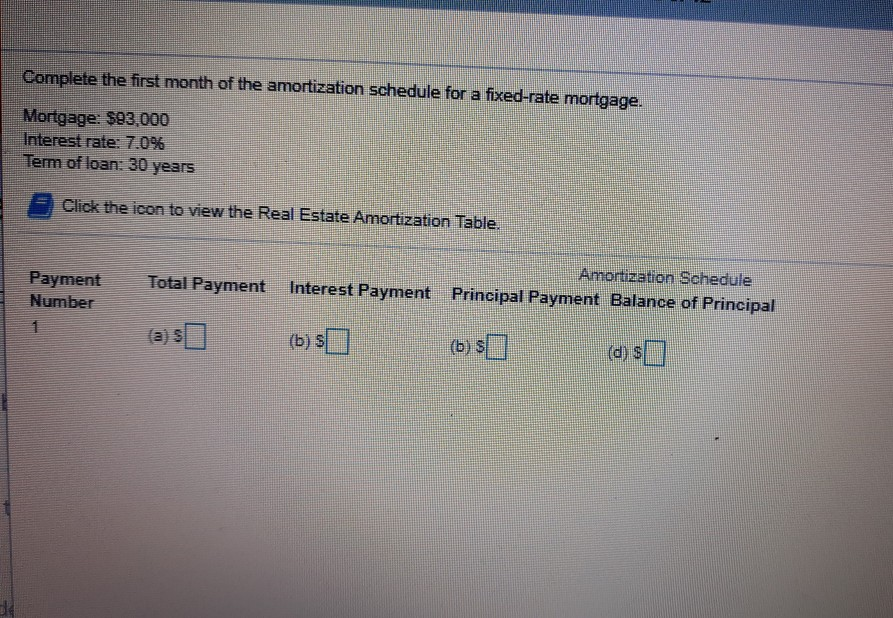

Complete the first month of the amortization schedule for a fixed-rate mortgage. Mortgage: $93.000 Interest rate: 7.0% Term of loan: 30 years = Click the

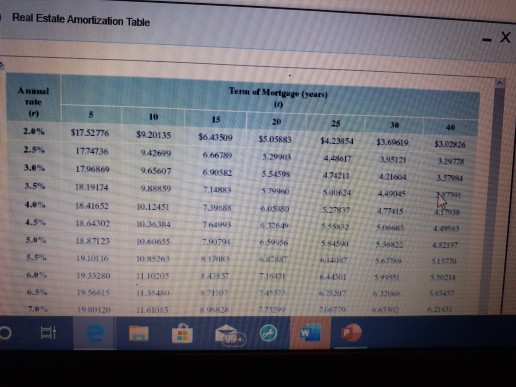

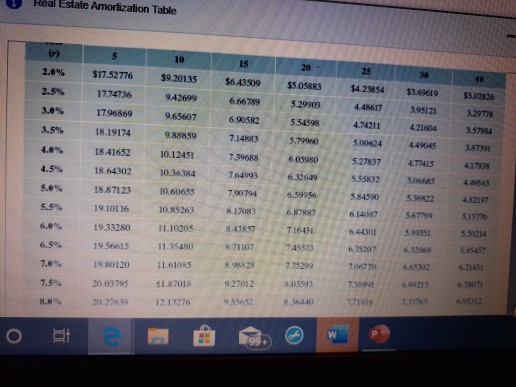

Complete the first month of the amortization schedule for a fixed-rate mortgage. Mortgage: $93.000 Interest rate: 7.0% Term of loan: 30 years = Click the icon to view the Real Estate Amortization Table. Payment Number Amortization Schedule Total Payment Interest Payment Principal Payment Balance of Principal (a)s ) (b)$[] (b) $ (@$0 Real Estate Amortization Table Annual rate Term of Mortgage (Jean) in 2.% 51752776 56.41509 $9.20135 94209 17.74736 6.56789 $3.02826 3.1977 3.0 3.5794 $5.058832 5761 53.69619 5 29903 4. 4 17 3.95121 5.5459 4.74211 4.21604 579900 5.00624 4.49045 6,05980 5.27837 477015 63264 Shox 659056 17191 4.2013 17.96869 0.65607 690582 18.19174 9. 7.TAR 18.41652 10.12451 7.39 18.64302 74993 18.87123 0.00685 - 179 19.10116 123 MINI 19.33280 11 10205 19.56615 11.354 1020120115 SOX 5.6" 5.5% 540 482197 7.16.131 6. 30 Real Estate Amortization Table ir) 2.6% $17.52776 $9.20135 $6.43509 $42654 $5.05883 5.29903 17.74736 17.96869 $3.09826 6.66789 $3.69619 3.95121 4.21604 6.90582 3.5% 18.19174 942699 9.65607 9.88859 10.12451 10.36384 5.54398 5.79960 3.5794 7.1483 4.48045 3.8791 4.17938 4.77415 4.48617 4.74211 5.00624 5.27837 5.55832 5.84590 6140 18.41652 18.64302 18.87123 19.10116 4.4083 4.5% 5.6% 5.5 6.0% 10.60655 7.39688 7.64993 7.90794 8.17083 841857 6,05980 6.326.00 6.59956 6 R7RX7 7.16431 745523 567789 15 10.85263 1L10205 11.35180 6,44301 19.33280 19 56615 19.80120 599551 1107 62527 11.05 82 706779 7.0% 7.5% 8.0 9 27012 7.38991 20.03795 20.276.39 11.87018 12.13276 8.05593 836440 65071 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started