Question

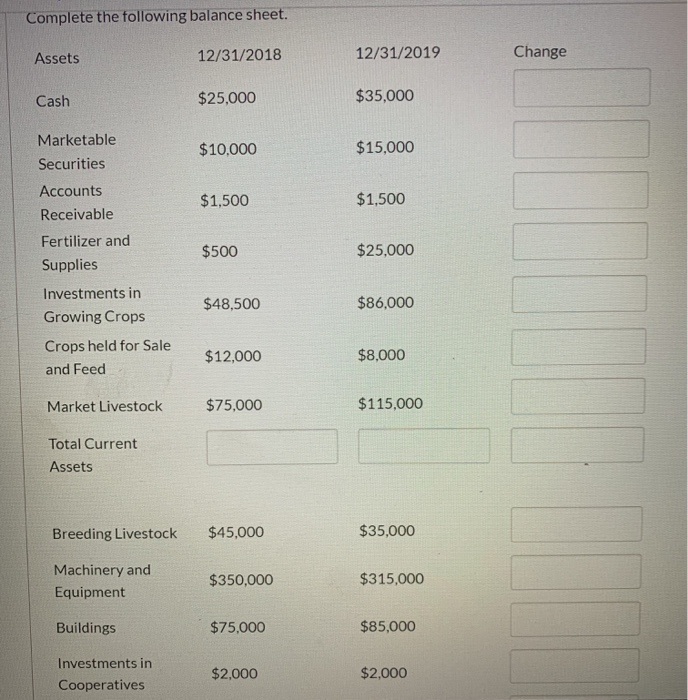

complete the following balance sheet. Assets 12/31/2018 12/31/2019 Change Cash $25,000 $35,000 Marketable Securities $10,000 $15,000 Accounts Receivable $1,500 $1,500 Fertilizer and Supplies $500 $25,000

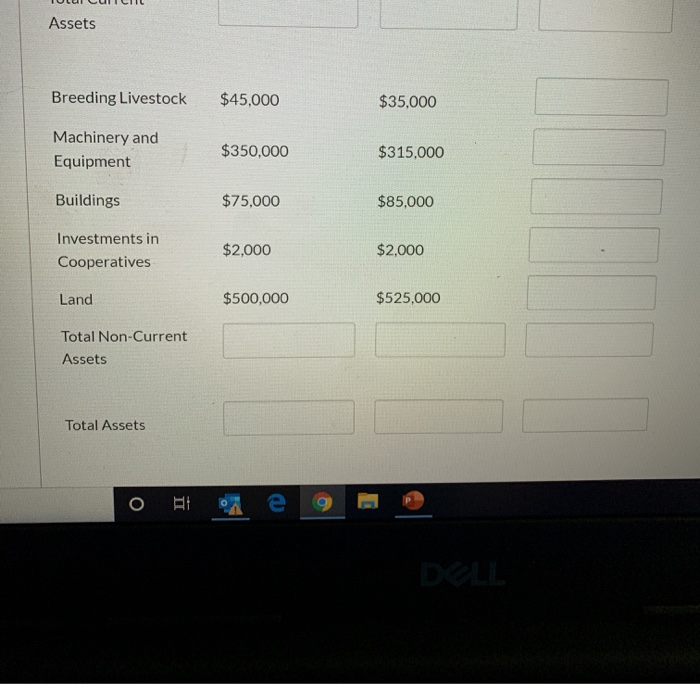

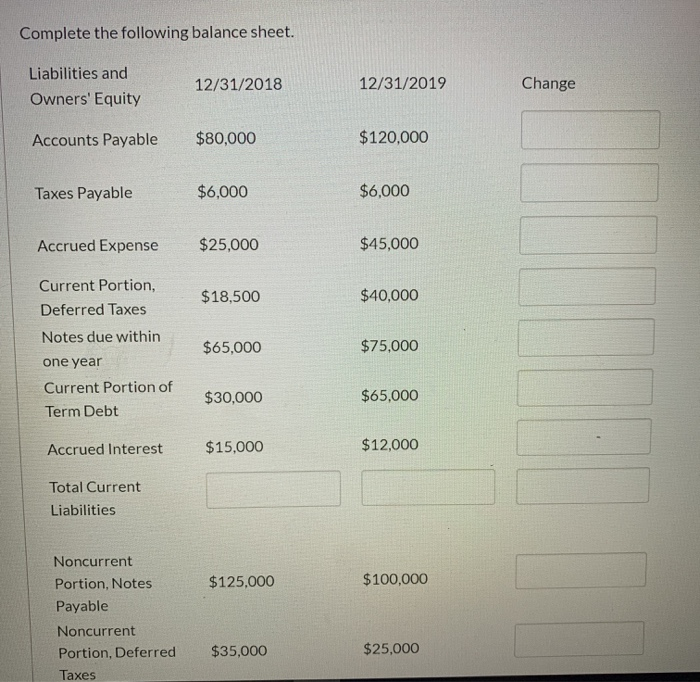

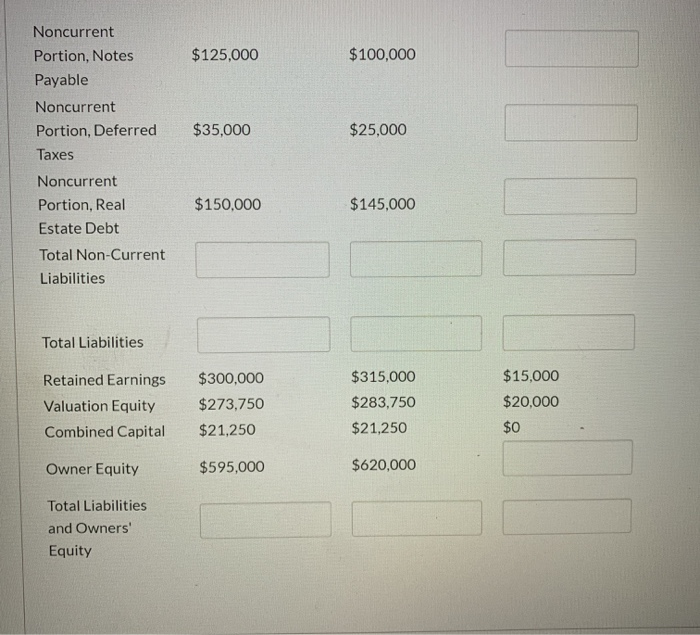

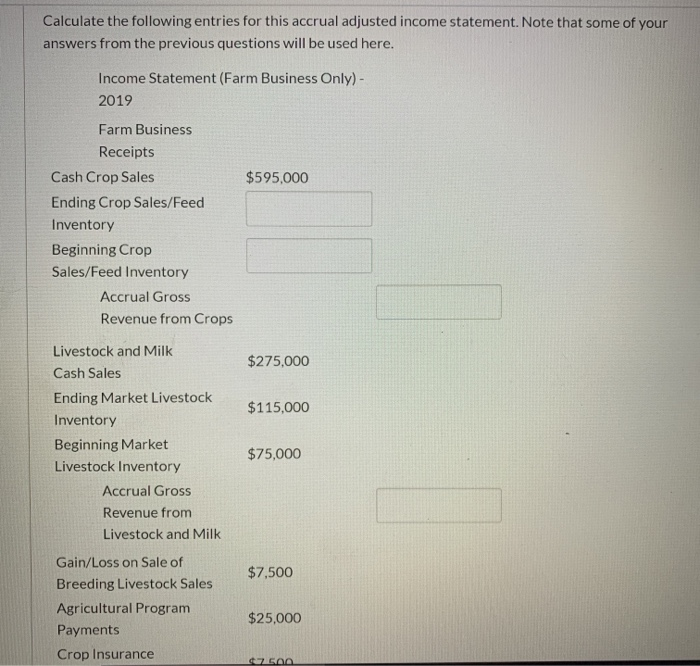

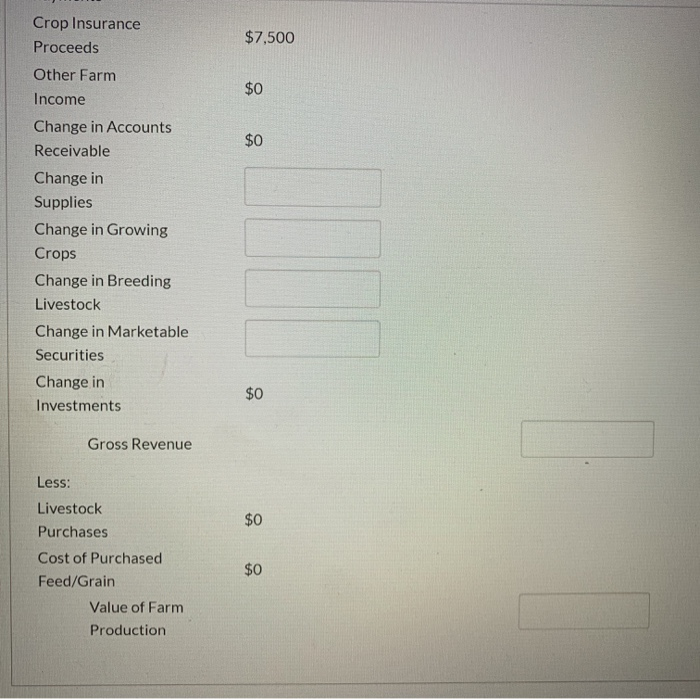

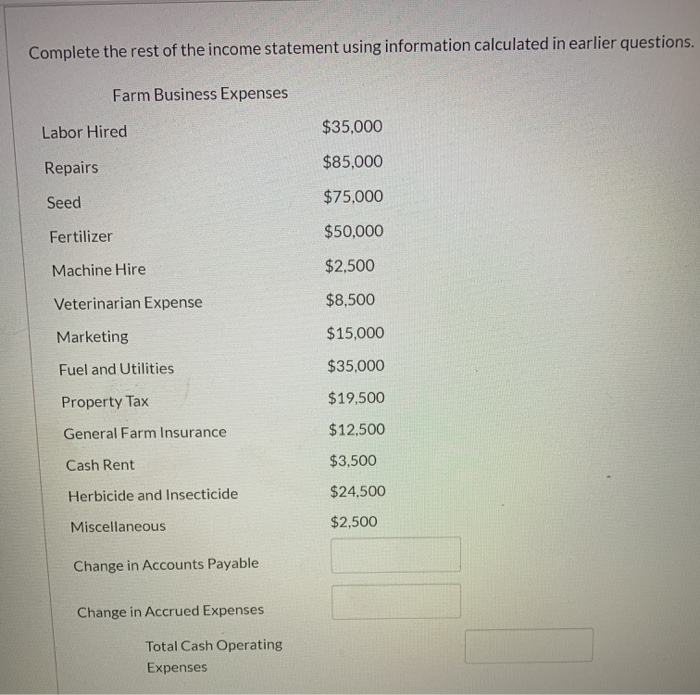

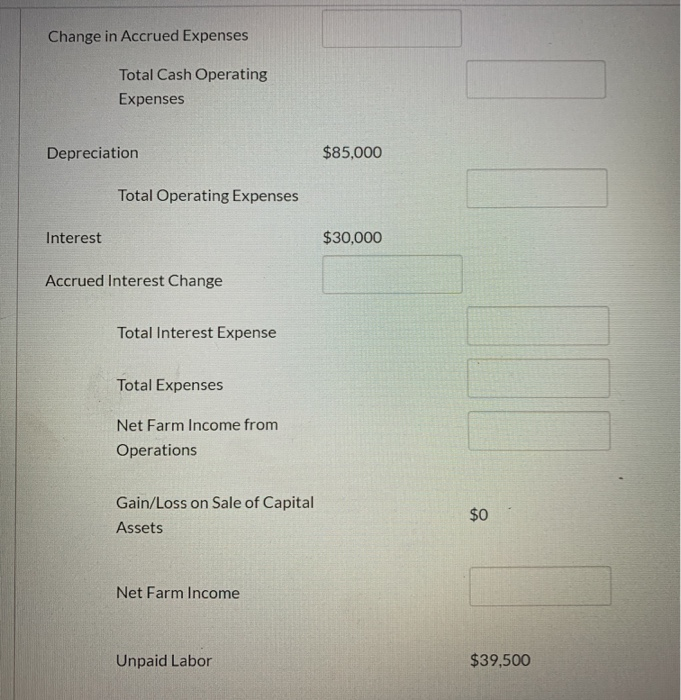

complete the following balance sheet. Assets 12/31/2018 12/31/2019 Change Cash $25,000 $35,000 Marketable Securities $10,000 $15,000 Accounts Receivable $1,500 $1,500 Fertilizer and Supplies $500 $25,000 Investments in Growing Crops $48,500 $86,000 Crops held for Sale and Feed $12,000 $8,000 Market Livestock $75,000 $115,000 Total Current Assets Breeding Livestock $45,000 $35,000 Machinery and Equipment $350,000 $315,000 Buildings $75,000 $85,000 Investments in Cooperatives $2,000 $2,000 Land $500,000 $525,000 Total Non-Current Assets Total Assets Flag this Question Question 211.5 pts Complete the following balance sheet. Liabilities and Owners' Equity 12/31/2018 12/31/2019 Change Accounts Payable $80,000 $120,000 Taxes Payable $6,000 $6,000 Accrued Expense $25,000 $45,000 Current Portion, Deferred Taxes $18,500 $40,000 Notes due within one year $65,000 $75,000 Current Portion of Term Debt $30,000 $65,000 Accrued Interest $15,000 $12,000 Total Current Liabilities Noncurrent Portion, Notes Payable $125,000 $100,000 Noncurrent Portion, Deferred Taxes $35,000 $25,000 Noncurrent Portion, Real Estate Debt $150,000 $145,000 Total Non-Current Liabilities Total Liabilities Retained Earnings $300,000 $315,000 $15,000 Valuation Equity $273,750 $283,750 $20,000 Combined Capital $21,250 $21,250 $0 Owner Equity $595,000 $620,000 Total Liabilities and Owners' Equity Flag this Question Question 310 pts Calculate the following entries for this accrual adjusted income statement. Note that some of your answers from the previous questions will be used here. Income Statement (Farm Business Only) - 2019 Farm Business Receipts Cash Crop Sales $595,000 Ending Crop Sales/Feed Inventory Beginning Crop Sales/Feed Inventory Accrual Gross Revenue from Crops Livestock and Milk Cash Sales $275,000 Ending Market Livestock Inventory $115,000 Beginning Market Livestock Inventory $75,000 Accrual Gross Revenue from Livestock and Milk Gain/Loss on Sale of Breeding Livestock Sales $7,500 Agricultural Program Payments $25,000 Crop Insurance Proceeds $7,500 Other Farm Income $0 Change in Accounts Receivable $0 Change in Supplies Change in Growing Crops Change in Breeding Livestock Change in Marketable Securities Change in Investments $0 Gross Revenue Less: Livestock Purchases $0 Cost of Purchased Feed/Grain $0 Value of Farm Production Flag this Question Question 410 pts Complete the rest of the income statement using information calculated in earlier questions. Farm Business Expenses Labor Hired $35,000 Repairs $85,000 Seed $75,000 Fertilizer $50,000 Machine Hire $2,500 Veterinarian Expense $8,500 Marketing $15,000 Fuel and Utilities $35,000 Property Tax $19,500 General Farm Insurance $12,500 Cash Rent $3,500 Herbicide and Insecticide $24,500 Miscellaneous $2,500 Change in Accounts Payable Change in Accrued Expenses Total Cash Operating Expenses Depreciation $85,000 Total Operating Expenses Interest $30,000 Accrued Interest Change Total Interest Expense Total Expenses Net Farm Income from Operations Gain/Loss on Sale of Capital Assets $0 Net Farm Income Unpaid Labor $39,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started