Answered step by step

Verified Expert Solution

Question

1 Approved Answer

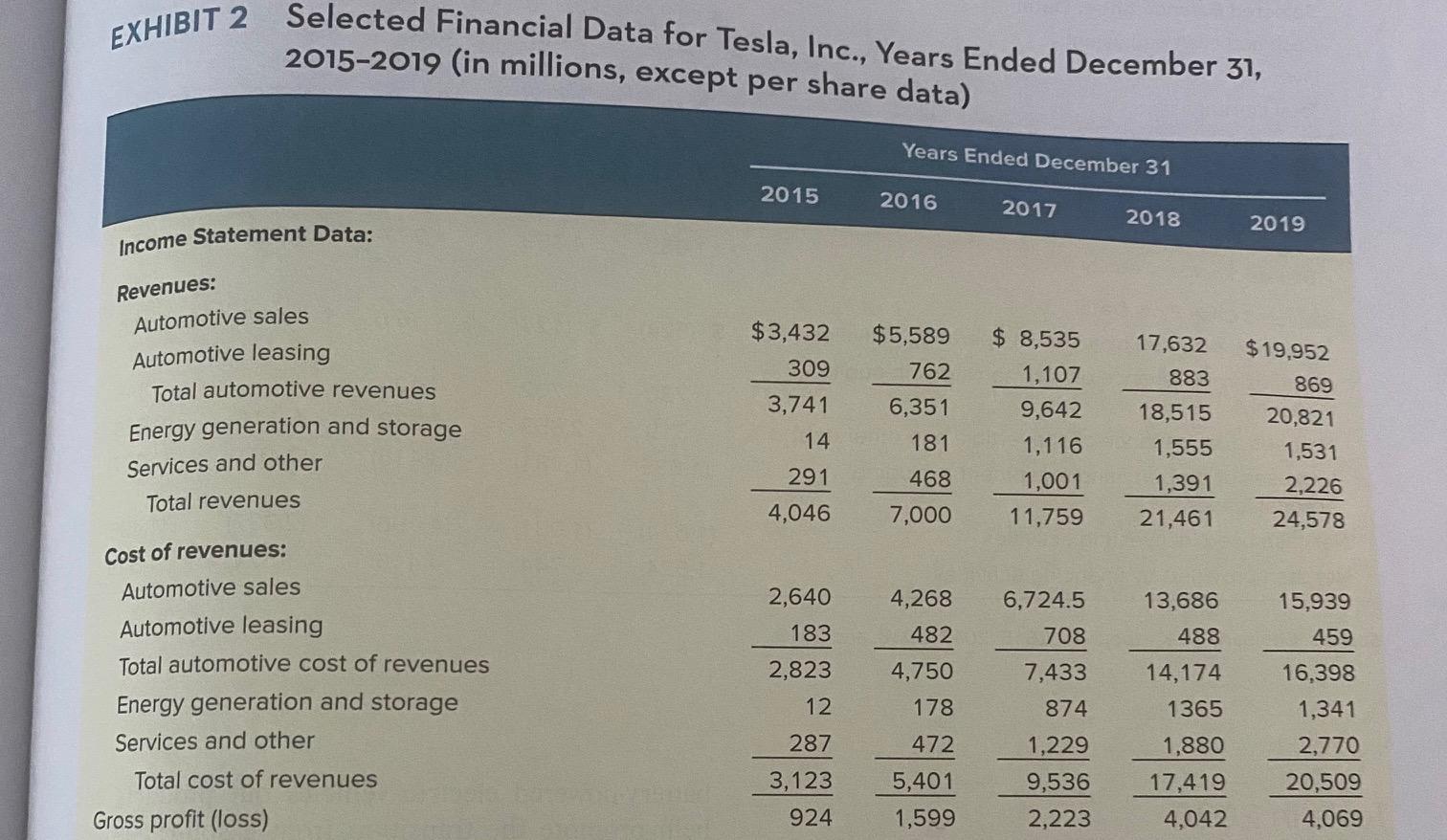

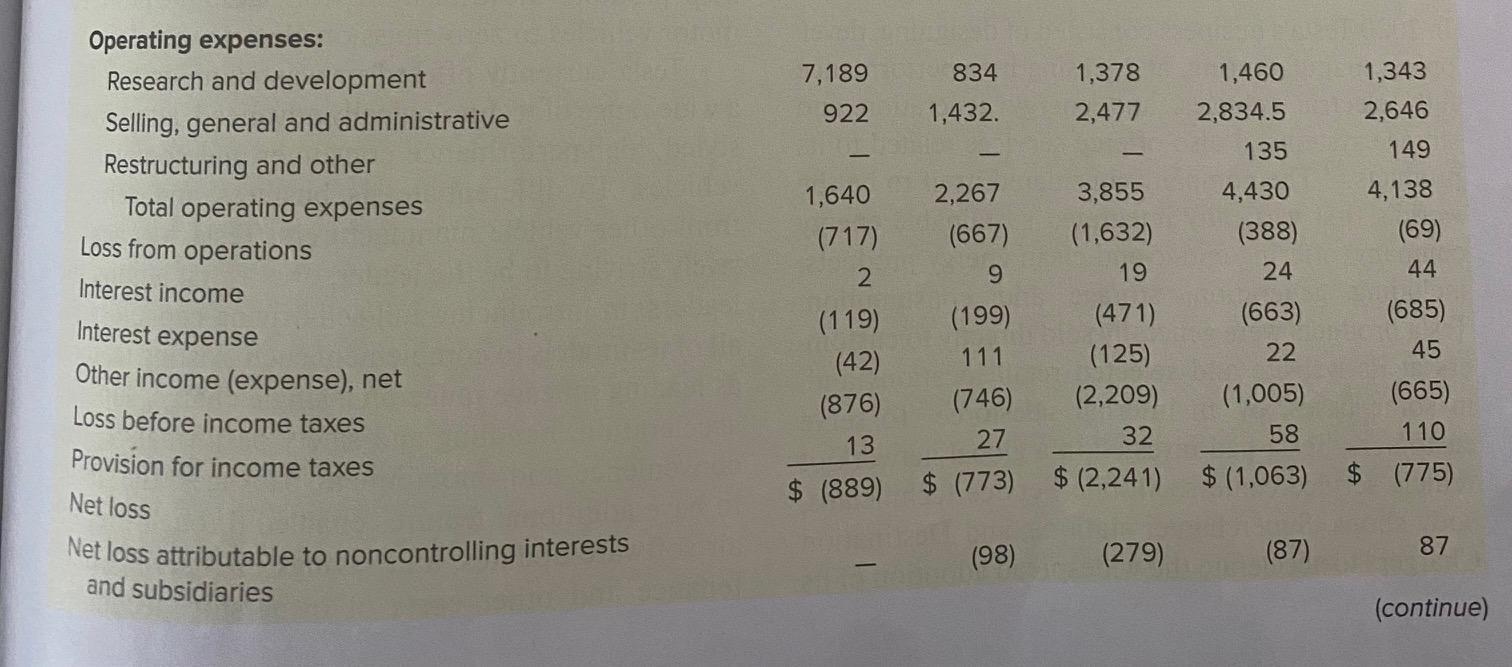

Complete the following calculations for the financial years 2017, 2018, and 2019. Net Profit Margin: Inventory Turnover ROE ROA Debt to equity. EXHIBIT 2 Selected

Complete the following calculations for the financial years 2017, 2018, and 2019.

Net Profit Margin:

Inventory Turnover

ROE

ROA

Debt to equity.

EXHIBIT 2 Selected Financial Data for Tesla, Inc., Years Ended December 31, 2015-2019 (in millions, except per share data) Income Statement Data: Revenues: Automotive sales Automotive leasing Total automotive revenues Energy generation and storage Services and other Total revenues Cost of revenues: Automotive sales Automotive leasing Total automotive cost of revenues Energy generation and storage Services and other Total cost of revenues Gross profit (loss) 2015 $3,432 309 3,741 14 291 4,046 2,640 183 2,823 12 287 3,123 924 Years Ended December 31 2016 $5,589 762 6,351 181 468 7,000 4,268 482 4,750 178 472 5,401 1,599 2017 2018 $ 8,535 17,632 1,107 883 9,642 18,515 1,116 1,555 1,001 1,391 11,759 21,461 6,724.5 708 7,433 874 1,229 9,536 2,223 13,686 488 14,174 1365 1,880 17,419 4,042 2019 $19,952 869 20,821 1,531 2,226 24,578 15,939 459 16,398 1,341 2,770 20,509 4,069

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Tesla Financial Analysis 20172019 Financial Ratio Calculations Net Profit Margin Net Income Total Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started