Answered step by step

Verified Expert Solution

Question

1 Approved Answer

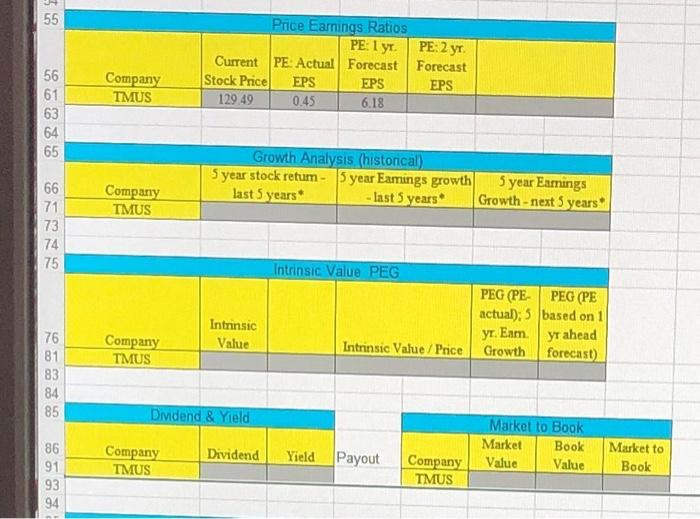

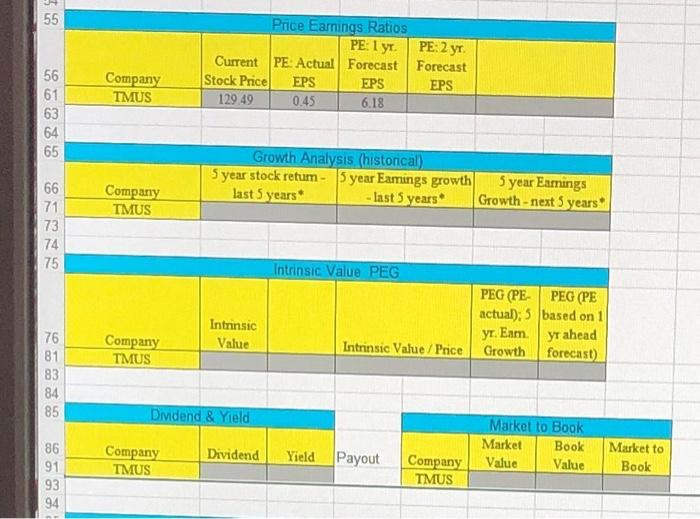

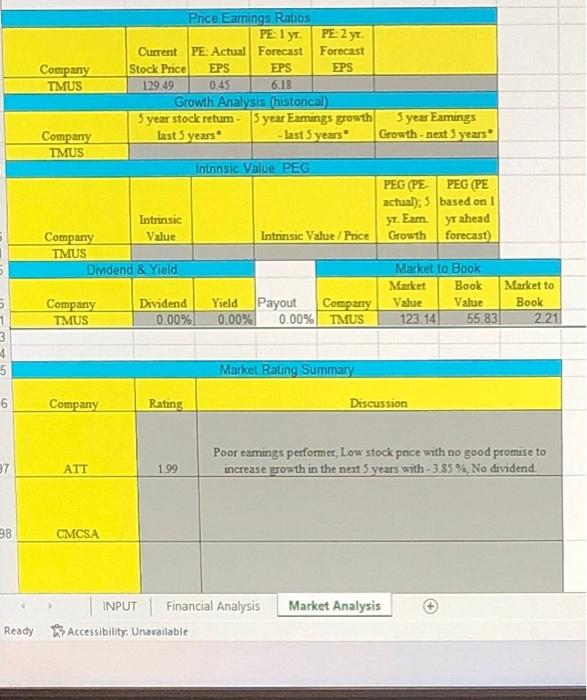

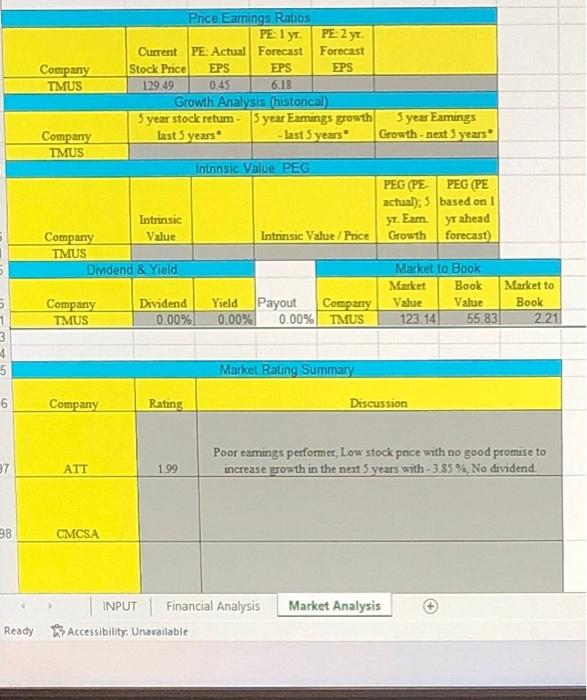

Complete the following for TMUS based on Yahoo finance statistics new image added 55 PE: 1 yr Price Earnings Ratios PE: 2 yr Current PE

Complete the following for TMUS based on Yahoo finance statistics

new image added

55 PE: 1 yr Price Earnings Ratios PE: 2 yr Current PE Actual Forecast Forecast Stock Price EPS EPS EPS 129.49 0.45 6.18 Company TMUS 56 61 63 64 65 Growth Analysis (historical) Syear stock retum - 5 year Eamings growth last 5 years - last 5 years Company TMUS 5 year Eamings Growth - next 5 years 66 71 73 74 75 Intrinsic Value PEG PEG (PE- PEG (PE actual): 5 based on 1 Intrinsic yr. Eam Value yr ahead Company TMUS Intrinsic Value / Price Growth forecast) 76 81 83 84 85 Dividend & Yield Market to Book Market Book Value Value Company TMUS Dividend Yield Payout 86 91 93 94 Market to Book Company TMUS EPS Company TMUS Pnce Earnings Ratios PE 1 yr PE: 2 yr Current PE Actual Forecast Forecast Stock Price EPS EPS 129.49 0.45 Growth Analysis (historical) 5 year stock retum Syear Eamings growth last 5 years - last years 6.18 5 year Eamings Growth -next years Company TMUS Intrinsic Value PEG PEG (PE PEG (PE actual), 5 based on 1 7. Em y ahead Intrinsic Value Price Growth forecast) Intrinsic Company Value TMUS Dividend & Yield Market to Book Market Book Market to Value Value Book 123.14 55.83 2.21 Company TMUS Dividend 0.00% Yield Payout Company 0.00% 0.00% TMUS 3 4 5 Market Rating Summary 6 Company Rating Discussion 07 Poor eamings performer, Low stock pnce with no good promise to increase growth in the next years with -3.85 %. No dividend. ATT 1.99 38 CMCSA Market Analysis INPUT Financial Analysis Accessibility. Unavailable Ready 55 PE: 1 yr Price Earnings Ratios PE: 2 yr Current PE Actual Forecast Forecast Stock Price EPS EPS EPS 129.49 0.45 6.18 Company TMUS 56 61 63 64 65 Growth Analysis (historical) Syear stock retum - 5 year Eamings growth last 5 years - last 5 years Company TMUS 5 year Eamings Growth - next 5 years 66 71 73 74 75 Intrinsic Value PEG PEG (PE- PEG (PE actual): 5 based on 1 Intrinsic yr. Eam Value yr ahead Company TMUS Intrinsic Value / Price Growth forecast) 76 81 83 84 85 Dividend & Yield Market to Book Market Book Value Value Company TMUS Dividend Yield Payout 86 91 93 94 Market to Book Company TMUS EPS Company TMUS Pnce Earnings Ratios PE 1 yr PE: 2 yr Current PE Actual Forecast Forecast Stock Price EPS EPS 129.49 0.45 Growth Analysis (historical) 5 year stock retum Syear Eamings growth last 5 years - last years 6.18 5 year Eamings Growth -next years Company TMUS Intrinsic Value PEG PEG (PE PEG (PE actual), 5 based on 1 7. Em y ahead Intrinsic Value Price Growth forecast) Intrinsic Company Value TMUS Dividend & Yield Market to Book Market Book Market to Value Value Book 123.14 55.83 2.21 Company TMUS Dividend 0.00% Yield Payout Company 0.00% 0.00% TMUS 3 4 5 Market Rating Summary 6 Company Rating Discussion 07 Poor eamings performer, Low stock pnce with no good promise to increase growth in the next years with -3.85 %. No dividend. ATT 1.99 38 CMCSA Market Analysis INPUT Financial Analysis Accessibility. Unavailable Ready

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started