Question

Complete the following journal entries Purchase of inventory for resale was $5,000,000. All purchases were made on account. Payments for inventory purchased on account were

Complete the following journal entries

Purchase of inventory for resale was $5,000,000. All purchases were made on account.

Payments for inventory purchased on account were $5,210,000.

Sales of merchandise totaled $11,200,000. Of this amount, 20% of the sales were made on account; the remaining sales were paid in cash.

The cost of the merchandise sold during the year was $4,000,000.

Collections on Accounts Receivable during the year were $2,380,000.

Cash payments to employees during the year, totaled $1,215,000. This was both towards unpaid salaries at the beginning of the year and for salaries earned during 2012.

Paid $100,000 cash for utilities during the year.

During the year $56,000 of customer accounts were written off as uncollectible.

Accrued wages payable at year-end should be $75,000.

On October 1, 2011, $600,000 was paid for a 24-month operating lease for the building. The lease will be expensed evenly over the lease period.

On June 1, 2011, a check for $360,000 was issued for a one-year insurance policy to be expensed evenly over the next 12 months. On June 1, 2012 a check for $480,000 was issued for a one-year insurance policy. The insurance will be expensed evenly over the next 12 months. The payment for the policy purchased in 2012 has not been recorded.

Depreciation expense for the year on the furniture and fixtures is calculated using straight line depreciation. The life of the furniture and fixtures is 10 years and the company estimates a residual value of $5,000.

The company has determined that the allowance for doubtful accounts should be $40,600.

Dividends were declared and paid in the amount of $4,000,000 during the year.

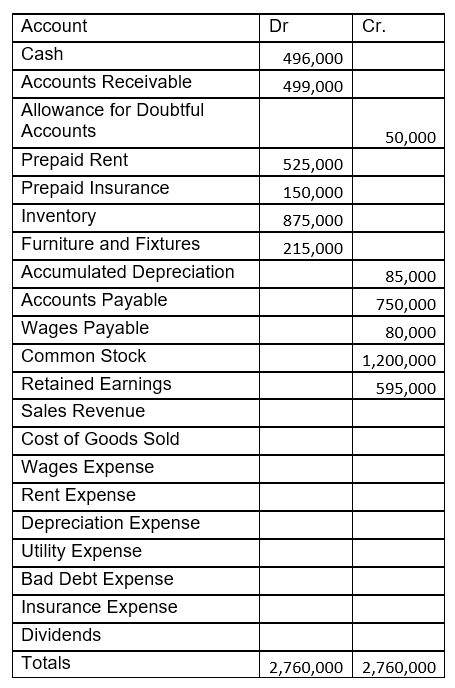

Account Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Rent Prepaid Insurance Inventory Furniture and Fixtures Accumulated Depreciation Accounts Payable Wages Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Wages Expense Rent Expense Depreciation Expense Utility Expense Bad Debt Expense Insurance Expense Dividends Totals Cr 496,000 499,000 50,000 525,000 150,000 875,000 215,000 85,000 750,000 80,000 1,200,000 595,000 2,760,0002,760,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started