Question

Complete the following payroll register for employees of Corby Company for the week ended March 1. Taxable earnings should be computed on the basis of

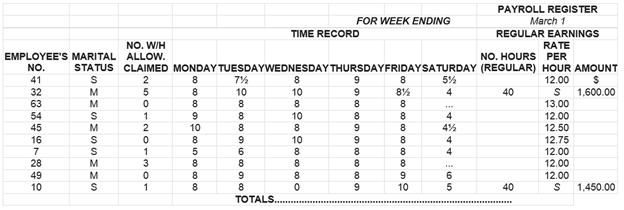

Complete the following payroll register for employees of Corby Company for the week ended March 1. Taxable earnings should be computed on the basis of a 40-hour week with overtime earnings being paid at time and one-half for all hours over 40 each workweek (no overtime for salaried employees). Note: Carry each overtime hourly rate out to 3 decimal places and then round off to 2 decimal places. All employees' wages are subject to the OASDI tax of 6.2% and the HI tax of 1.45%. The supplemental HI rate of 0.9% is not applicable. PR.04.31AT completes the payroll register through Gross Pay. PR.04.32AT completes this problem to arrive at Net Pay PAYROLL REGISTER FOR WEEK ENDING March 1 TIME RECORD REGULAR EARNINGS EMPLOYEE'S NO. MARITAL STATUS NO. W/H ALLOW. CLAIMED MONDAY TUESDAY WEDNESDAY THURSDAY FRIDAY SATURDAY NO. HOURS (REGULAR) RATE PER HOUR AMOUNT

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Warren, Reeve, Duchac

12th Edition

1133952410, 9781133952411, 978-1133952428

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App