Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete the Following: Prepare the Profit and Loss Appropriation account Prepare the partners' current accounts in columnar form Prepare the partnership Balance Sheet as of

Complete the Following:

- Prepare the Profit and Loss Appropriation account

- Prepare the partners' current accounts in columnar form

- Prepare the partnership Balance Sheet as of 30 June 2019

- Prepare a cash flow statement for the period ending 30th June 2019

- Write an email to your manager (teacher) to obtain verification and authorization so that you have clear guidelines and approval to prepare the financial statements in accordance with the organizational requirements.

- During an internal audit, it was discovered that the cash sales amounting to $151000 shown in the above ledger is an incorrect figure and the correct figure for cash sales is $162000. You are required to prepare an amended ledger and prepare the final bank balance.

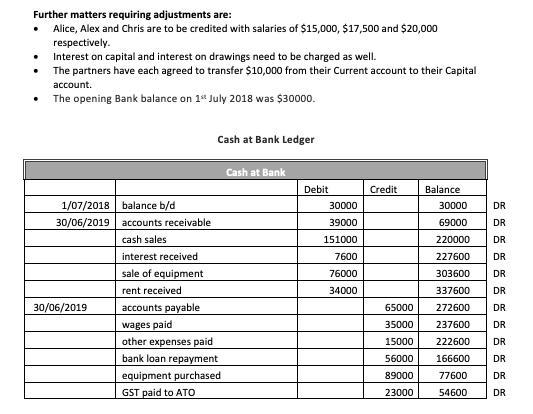

You are working as one of the employees of Complete Business Services and you are contacted by the partnership business for Alice, Alex and Chris seeking accounting consultation. They have provided you the following trial balance from their accounting system for the year ended 30 June 2019: Extract of Accounting Policies and Procedures: Partnership Business of Alice, Alex and Chris There are 3 partners in the business and operating under partnership structures. Alice, Alex and Chris are the partners in the business engaged in trading activity of garments. They are sharing profits and losses equally. Interest is to be credited on fixed capitals at 5% p.a. Interest is to be charged on drawings at 10% p.a. From the Trial Balance and the Cash at Bank Ledger below, collect and compile the following data together with the additional information and prepare the financial statements in line with accounting standards. Trial Balance as on 30th June 2019 + Account Names Accounts Receivable Allowance for doubtful debts Accounts Payable Inventory Fixtures and Fittings Accumulated depreciation Motor Vehicles Accumulated depreciation Bank Profit and Loss (Net Profit) Capital - Alice - Alex - Chris Current Alice - Alex - Chris Drawings - Alice. - Alex - Chris $ $ $ $ $ $ $ $ $ Debit 194,000.00 94,870.00 24,400.00 115,100.00 54,600.00 20,000.00 15,000.00 8,000.00 525,970.00 $ $ $ $ $ $ $ $ $ $ $ $ Credit 16,000.00 149,330.00 1,440.00 37,000.00 98,200.00 90,000.00 60,000.00 50,000.00 14,000.00 8,000.00 2,000.00 525,970.00

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started