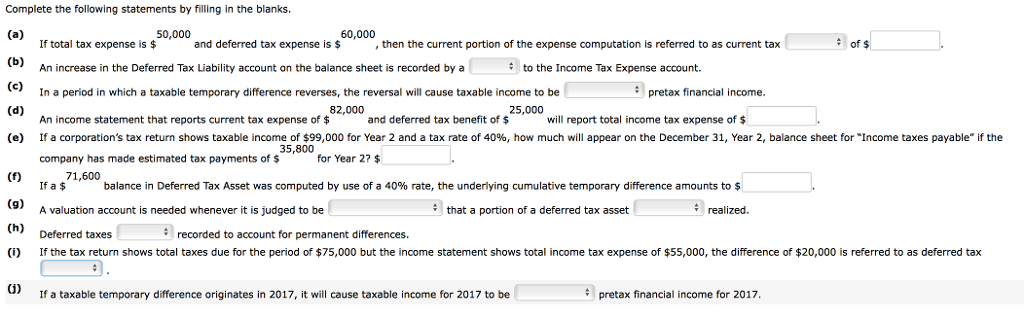

Complete the following statements by filling in the blanks. 50,000 60,000 of $ If total tax expense is $ An increase in the Deferred Tax Liability account on the balance sheet is recorded by a In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be An income statement that reports current tax expense of $ If a corporation's tax return shows taxable income of $99,000 for Year 2 and a tax rate of 40%, how much will appear on the December 31, Year 2, balance sheet for "Income taxes payable" if the company has made estimated tax payments of $ Ifa $ A valuation account is needed whenever it is judged to be and deferred tax expense is $ , then the current portion of the expense computation is referred to as current tax # to the Income Tax Expense account. pretax financial income 82,000 25,000 and deferred tax benefit of will report total income tax expense of $ (e) 35,800 for Year 2?$ 71,600 balance in Deferred Tax Asset was computed by use of a 40% rate, the underlying cumulative temporary difference amounts to $ that a portion of a deferred tax asset realized. Ch) Deferred taxes recorded to account for permanent differences. (i) If the tax return shows total taxes due for the period of $75,000 but the income statement shows total income tax expense of $55,000, the difference of $20,000 is referred to as deferred tax If a taxable temporary difference originates in 2017, it will cause taxable income for 2017 to be pretax financial income for 2017 Complete the following statements by filling in the blanks. 50,000 60,000 of $ If total tax expense is $ An increase in the Deferred Tax Liability account on the balance sheet is recorded by a In a period in which a taxable temporary difference reverses, the reversal will cause taxable income to be An income statement that reports current tax expense of $ If a corporation's tax return shows taxable income of $99,000 for Year 2 and a tax rate of 40%, how much will appear on the December 31, Year 2, balance sheet for "Income taxes payable" if the company has made estimated tax payments of $ Ifa $ A valuation account is needed whenever it is judged to be and deferred tax expense is $ , then the current portion of the expense computation is referred to as current tax # to the Income Tax Expense account. pretax financial income 82,000 25,000 and deferred tax benefit of will report total income tax expense of $ (e) 35,800 for Year 2?$ 71,600 balance in Deferred Tax Asset was computed by use of a 40% rate, the underlying cumulative temporary difference amounts to $ that a portion of a deferred tax asset realized. Ch) Deferred taxes recorded to account for permanent differences. (i) If the tax return shows total taxes due for the period of $75,000 but the income statement shows total income tax expense of $55,000, the difference of $20,000 is referred to as deferred tax If a taxable temporary difference originates in 2017, it will cause taxable income for 2017 to be pretax financial income for 2017