Question

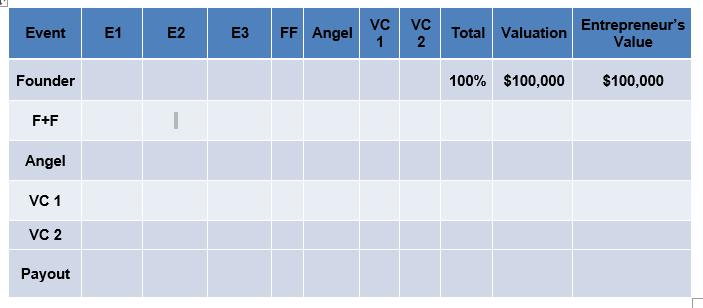

Complete the following table based on these events. Calculate the ownership percentages and entrepreneur values during various funding stages. What were the payout values a.

Complete the following table based on these events. Calculate the ownership percentages and entrepreneur values during various funding stages. What were the payout values

a. Three entrepreneurs, E1 (30%), E2 (20%), E3 (50%) invest $100,000 (100%) in a new venture. They agree to maintain the 30/20/50 percentage breakdown. That is among the three the relative percentage breakdown will remain the same.

b. When the firm's product sales increase faster than expected family and friends invest another $300,000 based on the firm's revised $800,000 valuation.

c. Success continues and the partners decide that they need to invest in a new warehouse in the United States which represents a new opportunity for the firm. The partners agree to provide an Angel investor with 20% of the firm based on a $2 million valuation.

d. The next day the Angel investor convinces some VCs with deeper pockets to also participate in the venture for another 30% at the same $2 million valuation.

e. With the firm doing so well the VCs realize that the firm should enter overseas markets before a competitor makes its move and invest another $2 million the following year when the firm's valuation has reached $5 million.

Event E1 VC VC E2 E3 FF Angel 1 2 Total Valuation Entrepreneur's Value Founder F+F Angel VC 1 VC 2 Payout 100% $100,000 $100,000

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started