Answered step by step

Verified Expert Solution

Question

1 Approved Answer

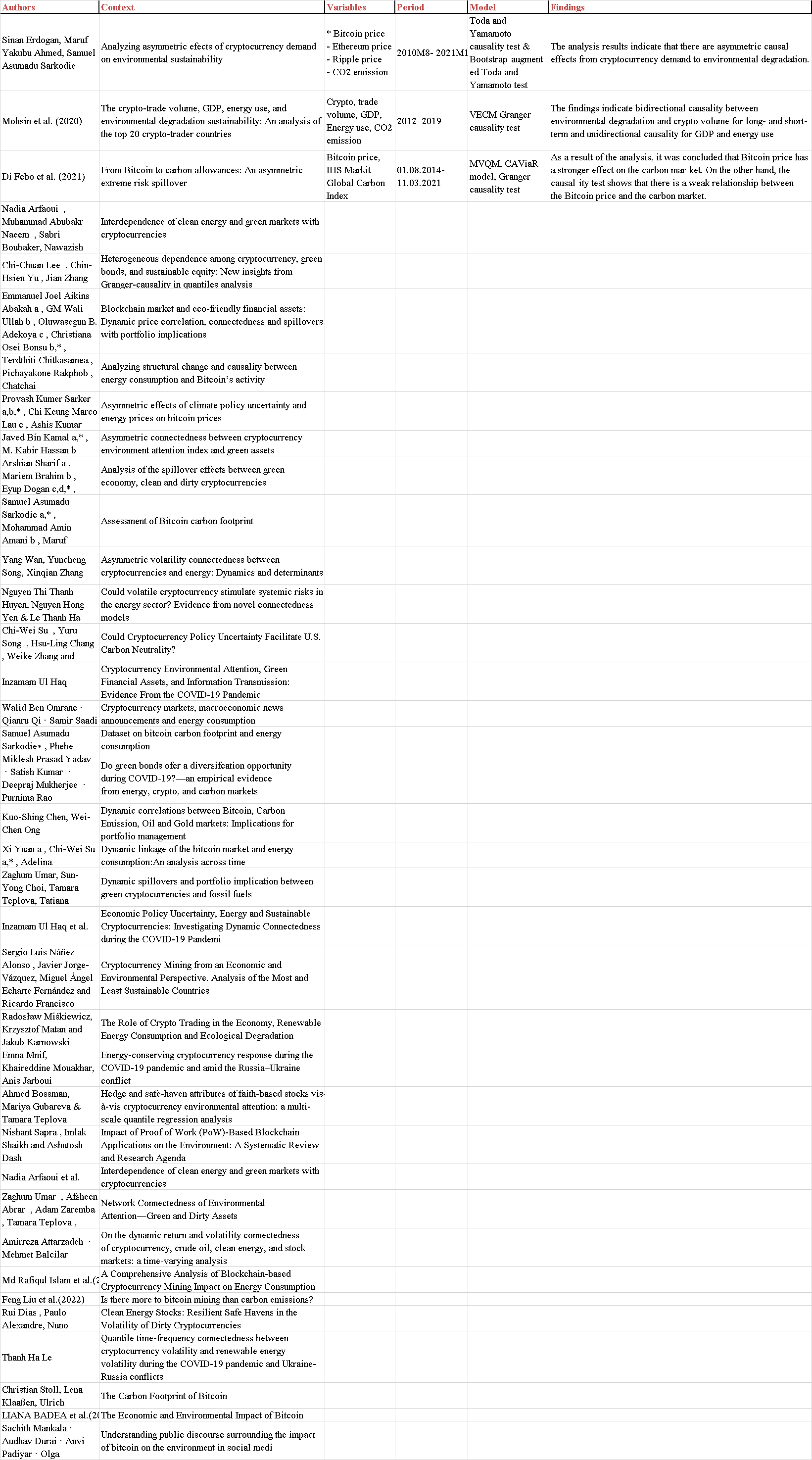

Complete the following table specifically mentioning Variables, Period, Model, Findings of the mentioned articles and authors. Show it in a table format. The first 3

Complete the following table specifically mentioning Variables, Period, Model, Findings of the mentioned articles and authors. Show it in a table format. The first 3 are done for reference.

AuthorsContextVariablesPeriodModelFindingsSinan Erdogan, Maruf Yakubu Ahmed, Samuel Asumadu SarkodieAnalyzing asymmetric efects ofcryptocurrency demand onenvironmental sustainability* Bitcoin price - Ethereum price - Ripple price - CO2 emission2010M8- 2021M1Toda and Yamamoto causality test & Bootstrapaugmented Toda and Yamamoto testThe analysis results indicate that there are asymmetric causal effects from cryptocurrency demand to environmental degradation.Mohsin et al. (2020)The crypto-trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto-trader countriesCrypto, trade volume, GDP, Energy use, CO2 emission20122019VECM Granger causality testThe findings indicate bidirectional causality between environmental degradation and crypto volume for long- and short-term and unidirectional causality for GDP and energy useDi Febo et al. (2021)From Bitcoin to carbon allowances: An asymmetric extreme risk spilloverBitcoin price, IHS Markit Global Carbon Index01.08.2014- 11.03.2021MVQM, CAViaR model, Granger causality testAs a result of the analysis, it was concluded that Bitcoin price has a stronger effect on the carbon market. On the other hand, the causality test shows that there is a weak relationship between the Bitcoin price and the carbon market.Nadia Arfaoui , Muhammad Abubakr Naeem , Sabri Boubaker, Nawazish Mirza , Sitara KarimInterdependence of clean energy and green markets with cryptocurrenciesChi-Chuan Lee , Chin-Hsien Yu , Jian ZhangHeterogeneous dependence among cryptocurrency, green bonds, and sustainable equity: New insights from Granger-causality in quantiles analysisEmmanuel Joel Aikins Abakah a , GM Wali Ullah b , Oluwasegun B. Adekoya c , Christiana Osei Bonsu b,* , Mohammad Abdullah dBlockchain market and eco-friendly financial assets: Dynamic price correlation, connectedness and spillovers with portfolio implicationsTerdthiti Chitkasamea , Pichayakone Rakphob , Chatchai Khiewngamdeea,Analyzing structural change and causality between energy consumption and Bitcoins activityProvash Kumer Sarker a,b,* , Chi Keung Marco Lau c , Ashis Kumar Pradhan dAsymmetric effects of climate policy uncertainty and energy prices on bitcoin pricesJaved Bin Kamal a,* , M. Kabir Hassan bAsymmetric connectedness between cryptocurrency environment attention index and green assetsArshian Sharif a , Mariem Brahim b , Eyup Dogan c,d,* , Panayiotis Tzeremes eAnalysis of the spillover effects between green economy, clean and dirty cryptocurrenciesSamuel Asumadu Sarkodie a,* , Mohammad Amin Amani b , Maruf Yakubu Ahmed c , Phebe Asantewaa Owusu aAssessment of Bitcoin carbon footprintYang Wan, Yuncheng Song, Xinqian ZhangAsymmetric volatility connectedness between cryptocurrencies and energy: Dynamics and determinantsNguyen Thi Thanh Huyen, Nguyen Hong Yen & Le Thanh HaCould volatile cryptocurrency stimulate systemic risks in the energy sector? Evidence from novel connectedness modelsChi-Wei Su , Yuru Song , Hsu-Ling Chang , Weike Zhang and Meng QinCould Cryptocurrency Policy Uncertainty Facilitate U.S. Carbon Neutrality?Inzamam Ul HaqCryptocurrency Environmental Attention, Green Financial Assets, and Information Transmission: Evidence From the COVID-19 PandemicWalid Ben Omrane Qianru Qi Samir SaadiCryptocurrency markets, macroeconomic news announcements and energy consumptionSamuel Asumadu Sarkodie , Phebe Asantewaa OwusuDataset on bitcoin carbon footprint and energy consumptionMikleshPrasadYadav SatishKumar DeeprajMukherjee PurnimaRaoDo green bonds ofer adiversifcation opportunity duringCOVID19?an empirical evidence fromenergy, crypto, andcarbon marketsKuo-Shing Chen, Wei-Chen OngDynamic correlations between Bitcoin, Carbon Emission, Oil and Gold markets: Implications for portfolio managementXi Yuan a , Chi-Wei Su a,* , Adelina Dumitrescu Peculea bDynamic linkage of the bitcoin market and energy consumption:An analysis across timeZaghum Umar, Sun-Yong Choi, Tamara Teplova, Tatiana SokolovaDynamic spillovers and portfolio implication between green cryptocurrencies and fossil fuelsInzamam Ul Haq et al.Economic Policy Uncertainty, Energy and Sustainable Cryptocurrencies: Investigating Dynamic Connectedness during the COVID-19 PandemiSergio Luis Nez Alonso , Javier Jorge-Vzquez, Miguel ngel Echarte Fernndez and Ricardo Francisco Reier ForradellasCryptocurrency Mining from an Economic and Environmental Perspective. Analysis of the Most and Least Sustainable CountriesRadosaw Mikiewicz, Krzysztof Matan and Jakub KarnowskiThe Role of Crypto Trading in the Economy, Renewable Energy Consumption and Ecological DegradationEmna Mnif, Khaireddine Mouakhar, Anis JarbouiEnergy-conserving cryptocurrency response during the COVID-19 pandemic and amid the RussiaUkraine conflictAhmed Bossman, Mariya Gubareva & Tamara TeplovaHedge and safe-haven attributes of faith-based stocks vis--vis cryptocurrency environmental attention: a multi-scale quantile regression analysisNishant Sapra , Imlak Shaikh and Ashutosh DashImpact of Proof of Work (PoW)-Based Blockchain Applications on the Environment: A Systematic Review and Research AgendaNadia Arfaoui et al.Interdependence of clean energy and green markets with cryptocurrenciesZaghum Umar , Afsheen Abrar , Adam Zaremba , Tamara Teplova , Xuan Vinh VoNetwork Connectedness of Environmental AttentionGreen and Dirty AssetsAmirreza Attarzadeh Mehmet BalcilarOn thedynamic return andvolatility connectedness ofcryptocurrency, crude oil, clean energy, andstock markets: atimevarying analysisMd Rafiqul Islam et al.(2022)A Comprehensive Analysis of Blockchain-based Cryptocurrency Mining Impact on Energy ConsumptionFeng Liu et al.(2022)Is there more to bitcoin mining than carbon emissions?Rui Dias , Paulo Alexandre, Nuno Teixeira and Mariana ChambinoClean Energy Stocks: Resilient Safe Havens in the Volatility of Dirty CryptocurrenciesThanh Ha LeQuantile time-frequency connectedness between cryptocurrency volatility and renewable energy volatility during the COVID-19 pandemic and Ukraine-Russia conflictsChristian Stoll, Lena Klaaen, Ulrich Gallersdo rferThe Carbon Footprint of BitcoinLIANA BADEA et al.(2021)The Economic and Environmental Impact of BitcoinSachith Mankala Audhav Durai Anvi Padiyar Olga Gkountouna Ron MahabirUnderstanding public discourse surrounding theimpact ofbitcoin ontheenvironment insocial media

AuthorsContextVariablesPeriodModelFindingsSinan Erdogan, Maruf Yakubu Ahmed, Samuel Asumadu SarkodieAnalyzing asymmetric efects ofcryptocurrency demand onenvironmental sustainability* Bitcoin price - Ethereum price - Ripple price - CO2 emission2010M8- 2021M1Toda and Yamamoto causality test & Bootstrapaugmented Toda and Yamamoto testThe analysis results indicate that there are asymmetric causal effects from cryptocurrency demand to environmental degradation.Mohsin et al. (2020)The crypto-trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto-trader countriesCrypto, trade volume, GDP, Energy use, CO2 emission20122019VECM Granger causality testThe findings indicate bidirectional causality between environmental degradation and crypto volume for long- and short-term and unidirectional causality for GDP and energy useDi Febo et al. (2021)From Bitcoin to carbon allowances: An asymmetric extreme risk spilloverBitcoin price, IHS Markit Global Carbon Index01.08.2014- 11.03.2021MVQM, CAViaR model, Granger causality testAs a result of the analysis, it was concluded that Bitcoin price has a stronger effect on the carbon market. On the other hand, the causality test shows that there is a weak relationship between the Bitcoin price and the carbon market.Nadia Arfaoui , Muhammad Abubakr Naeem , Sabri Boubaker, Nawazish Mirza , Sitara KarimInterdependence of clean energy and green markets with cryptocurrenciesChi-Chuan Lee , Chin-Hsien Yu , Jian ZhangHeterogeneous dependence among cryptocurrency, green bonds, and sustainable equity: New insights from Granger-causality in quantiles analysisEmmanuel Joel Aikins Abakah a , GM Wali Ullah b , Oluwasegun B. Adekoya c , Christiana Osei Bonsu b,* , Mohammad Abdullah dBlockchain market and eco-friendly financial assets: Dynamic price correlation, connectedness and spillovers with portfolio implicationsTerdthiti Chitkasamea , Pichayakone Rakphob , Chatchai Khiewngamdeea,Analyzing structural change and causality between energy consumption and Bitcoins activityProvash Kumer Sarker a,b,* , Chi Keung Marco Lau c , Ashis Kumar Pradhan dAsymmetric effects of climate policy uncertainty and energy prices on bitcoin pricesJaved Bin Kamal a,* , M. Kabir Hassan bAsymmetric connectedness between cryptocurrency environment attention index and green assetsArshian Sharif a , Mariem Brahim b , Eyup Dogan c,d,* , Panayiotis Tzeremes eAnalysis of the spillover effects between green economy, clean and dirty cryptocurrenciesSamuel Asumadu Sarkodie a,* , Mohammad Amin Amani b , Maruf Yakubu Ahmed c , Phebe Asantewaa Owusu aAssessment of Bitcoin carbon footprintYang Wan, Yuncheng Song, Xinqian ZhangAsymmetric volatility connectedness between cryptocurrencies and energy: Dynamics and determinantsNguyen Thi Thanh Huyen, Nguyen Hong Yen & Le Thanh HaCould volatile cryptocurrency stimulate systemic risks in the energy sector? Evidence from novel connectedness modelsChi-Wei Su , Yuru Song , Hsu-Ling Chang , Weike Zhang and Meng QinCould Cryptocurrency Policy Uncertainty Facilitate U.S. Carbon Neutrality?Inzamam Ul HaqCryptocurrency Environmental Attention, Green Financial Assets, and Information Transmission: Evidence From the COVID-19 PandemicWalid Ben Omrane Qianru Qi Samir SaadiCryptocurrency markets, macroeconomic news announcements and energy consumptionSamuel Asumadu Sarkodie , Phebe Asantewaa OwusuDataset on bitcoin carbon footprint and energy consumptionMikleshPrasadYadav SatishKumar DeeprajMukherjee PurnimaRaoDo green bonds ofer adiversifcation opportunity duringCOVID19?an empirical evidence fromenergy, crypto, andcarbon marketsKuo-Shing Chen, Wei-Chen OngDynamic correlations between Bitcoin, Carbon Emission, Oil and Gold markets: Implications for portfolio managementXi Yuan a , Chi-Wei Su a,* , Adelina Dumitrescu Peculea bDynamic linkage of the bitcoin market and energy consumption:An analysis across timeZaghum Umar, Sun-Yong Choi, Tamara Teplova, Tatiana SokolovaDynamic spillovers and portfolio implication between green cryptocurrencies and fossil fuelsInzamam Ul Haq et al.Economic Policy Uncertainty, Energy and Sustainable Cryptocurrencies: Investigating Dynamic Connectedness during the COVID-19 PandemiSergio Luis Nez Alonso , Javier Jorge-Vzquez, Miguel ngel Echarte Fernndez and Ricardo Francisco Reier ForradellasCryptocurrency Mining from an Economic and Environmental Perspective. Analysis of the Most and Least Sustainable CountriesRadosaw Mikiewicz, Krzysztof Matan and Jakub KarnowskiThe Role of Crypto Trading in the Economy, Renewable Energy Consumption and Ecological DegradationEmna Mnif, Khaireddine Mouakhar, Anis JarbouiEnergy-conserving cryptocurrency response during the COVID-19 pandemic and amid the RussiaUkraine conflictAhmed Bossman, Mariya Gubareva & Tamara TeplovaHedge and safe-haven attributes of faith-based stocks vis--vis cryptocurrency environmental attention: a multi-scale quantile regression analysisNishant Sapra , Imlak Shaikh and Ashutosh DashImpact of Proof of Work (PoW)-Based Blockchain Applications on the Environment: A Systematic Review and Research AgendaNadia Arfaoui et al.Interdependence of clean energy and green markets with cryptocurrenciesZaghum Umar , Afsheen Abrar , Adam Zaremba , Tamara Teplova , Xuan Vinh VoNetwork Connectedness of Environmental AttentionGreen and Dirty AssetsAmirreza Attarzadeh Mehmet BalcilarOn thedynamic return andvolatility connectedness ofcryptocurrency, crude oil, clean energy, andstock markets: atimevarying analysisMd Rafiqul Islam et al.(2022)A Comprehensive Analysis of Blockchain-based Cryptocurrency Mining Impact on Energy ConsumptionFeng Liu et al.(2022)Is there more to bitcoin mining than carbon emissions?Rui Dias , Paulo Alexandre, Nuno Teixeira and Mariana ChambinoClean Energy Stocks: Resilient Safe Havens in the Volatility of Dirty CryptocurrenciesThanh Ha LeQuantile time-frequency connectedness between cryptocurrency volatility and renewable energy volatility during the COVID-19 pandemic and Ukraine-Russia conflictsChristian Stoll, Lena Klaaen, Ulrich Gallersdo rferThe Carbon Footprint of BitcoinLIANA BADEA et al.(2021)The Economic and Environmental Impact of BitcoinSachith Mankala Audhav Durai Anvi Padiyar Olga Gkountouna Ron MahabirUnderstanding public discourse surrounding theimpact ofbitcoin ontheenvironment insocial media Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started