Question

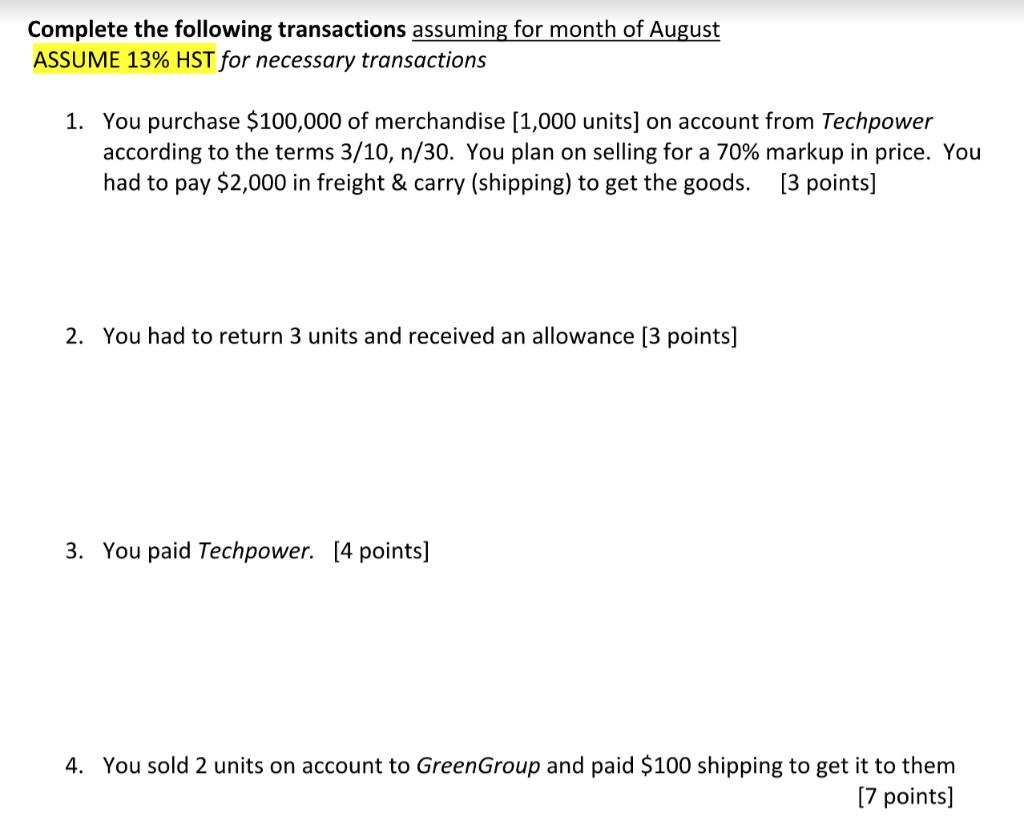

Complete the following transactions assuming for month of August ASSUME 13% HST for necessary transactions 1. You purchase $100,000 of merchandise [1,000 units] on

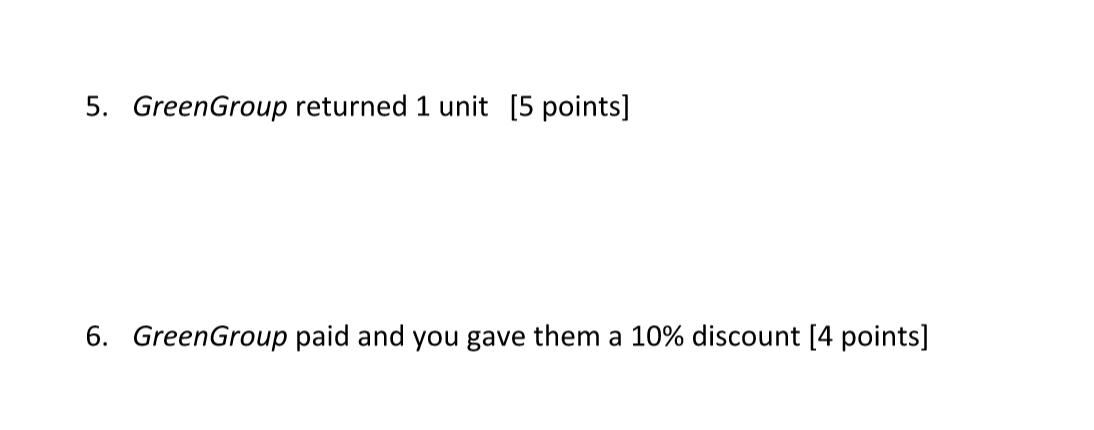

Complete the following transactions assuming for month of August ASSUME 13% HST for necessary transactions 1. You purchase $100,000 of merchandise [1,000 units] on account from Techpower according to the terms 3/10, n/30. You plan on selling for a 70% markup in price. You had to pay $2,000 in freight & carry (shipping) to get the goods. [3 points] 2. You had to return 3 units and received an allowance [3 points] 3. You paid Techpower. [4 points] 4. You sold 2 units on account to GreenGroup and paid $100 shipping to get it to them (7 points] 5. GreenGroup returned 1 unit [5 points] 6. GreenGroup paid and you gave them a 10% discount [4 points]

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries in the books 1 Purchases Ac Dr 100000 HST Tax Ac Dr 13000 Fright Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Edmonds, old, Mcnair, Tsay

2nd edition

9780077392659, 978-0-07-73417, 77392655, 0-07-734177-5, 73379557, 978-0073379555

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App