Question

Complete the following using the attached EXCEL spreadsheet. Use cell formulas wherever possible. IF YOU DO ALL THE CALCULATIONS USING A CALCULATOR AND MERELY TYPE

Complete the following using the attached EXCEL spreadsheet. Use cell formulas wherever possible. IF YOU DO ALL THE CALCULATIONS USING A CALCULATOR AND MERELY TYPE IN THE NUMBERS IT WILL BE IMPOSSIBLE TO RECEIVE MORE THAN 70% ON THIS ASSIGNMENT, SINCE THIS DEFEATS THE PURPOSE OF A SPREADSHEET.

1. Complete EXCEL Spreadsheet Exercise .

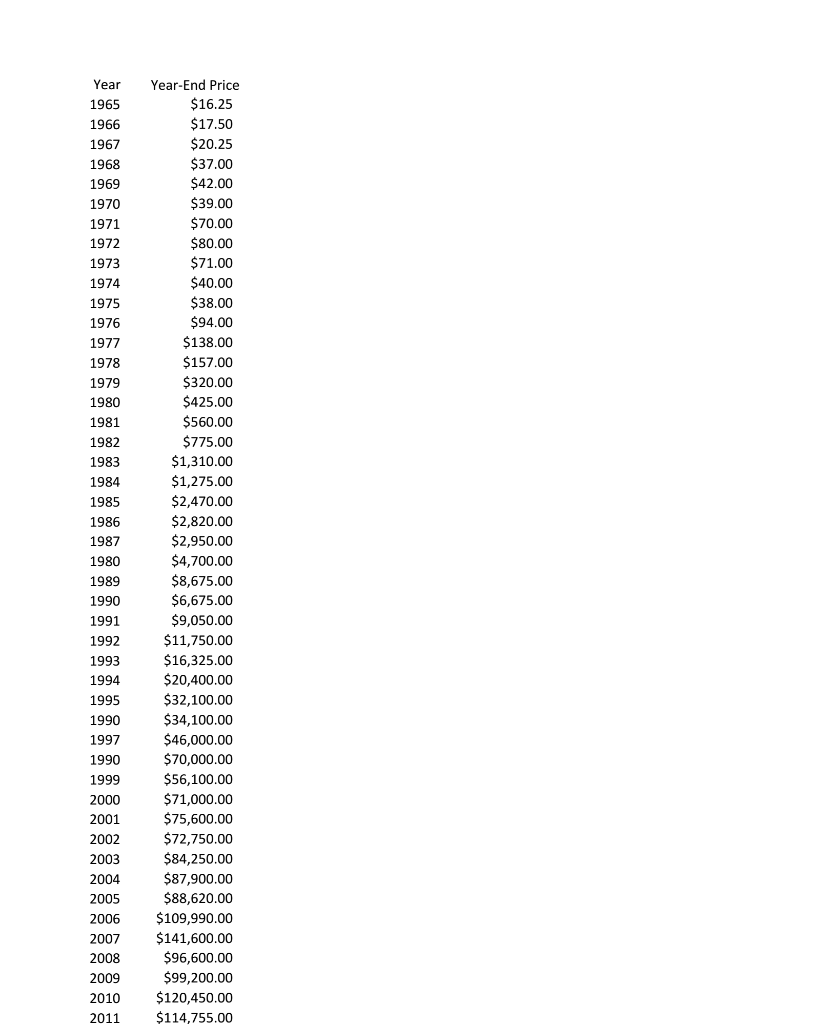

| 6.1 Warren Buffett, arguably the most famous investor in the United States, is the CEO of Berkshire Hathaway | ||||

| (BRK), a company that has enjoyed great success in terms of its stock price. The actual year-end stock | ||||

| prices for BRK-A from 1965 through 2011 are in the file attached to this assignment. (Yes, these are the actual stock prices, believe it or not.) | ||||

| a. Calculate the return relatives for each year starting in 1966. Use two decimal places. | ||||

| b. Calculate the arithmetic and geometric means for these return relatives, using three decimal places. | ||||

| c. Calculate the cumulative wealth index for 1966-2011, assuming an initial investment of $1,000 and $10,000. State the answers without decimal places. |

2. Complete EXCEL Spreadsheet

6.3 Coca-Cola's (ticker symbol = KO) December ending prices (adjusted for stock splits and dividends) and its

annual dividend are given below. This information can be obtained from a source such as Yahoo! Finance. Place

these data in a spreadsheet for columns A through C. Use three decimal places and calculate results in decimal form (not

percentages). You will need the 2000 price to calculate the 2001 return. For each year 20012010:

a. Calculate as column D the return relative for the price change only.

b. Calculate as column E the return based on price change only.

c. Calculate as column F the return relative based on total return (price change and dividends).

d. Calculate as column G the return based on total return (price change and dividends).

e. Calculate the arithmetic and geometric means for 2001-2010 for price change only and for total return.

f. Calculate the ending wealth as of December 31, 2010, for $1 invested in Coca-Cola stock at the beginning

of 2001.

g. Calculate the standard deviation of the returns for the years 2001-2010. (Note: Use the total returns and not

the return relatives.)

Coca-Cola ending prices and dividends

2010 $64.39, $1.76; 2009 $54.10, $1.64; 2008 $41.52, $1.52; 2007 $54.70, $1.36; 2006 $41.93, $1.24; 2005 $34.06,

$1.12; 2004 $34.29, $1.00; 2003 $40.88, $0.88; 2002 $34.61, $0.80; 2001 $36.62, $0.72; 2000 $46.80

1) excel spreadsheet for number one below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started