Answered step by step

Verified Expert Solution

Question

1 Approved Answer

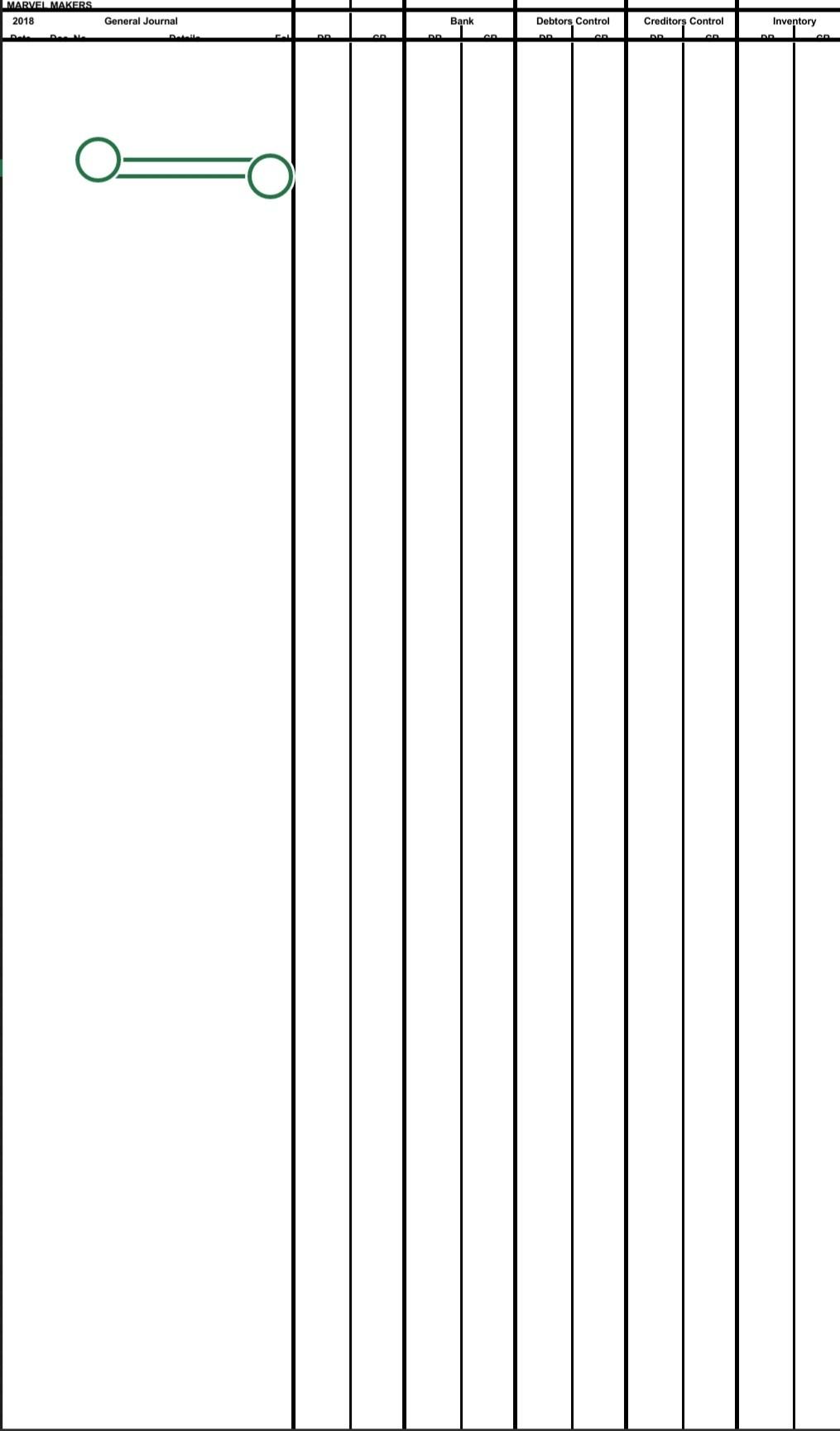

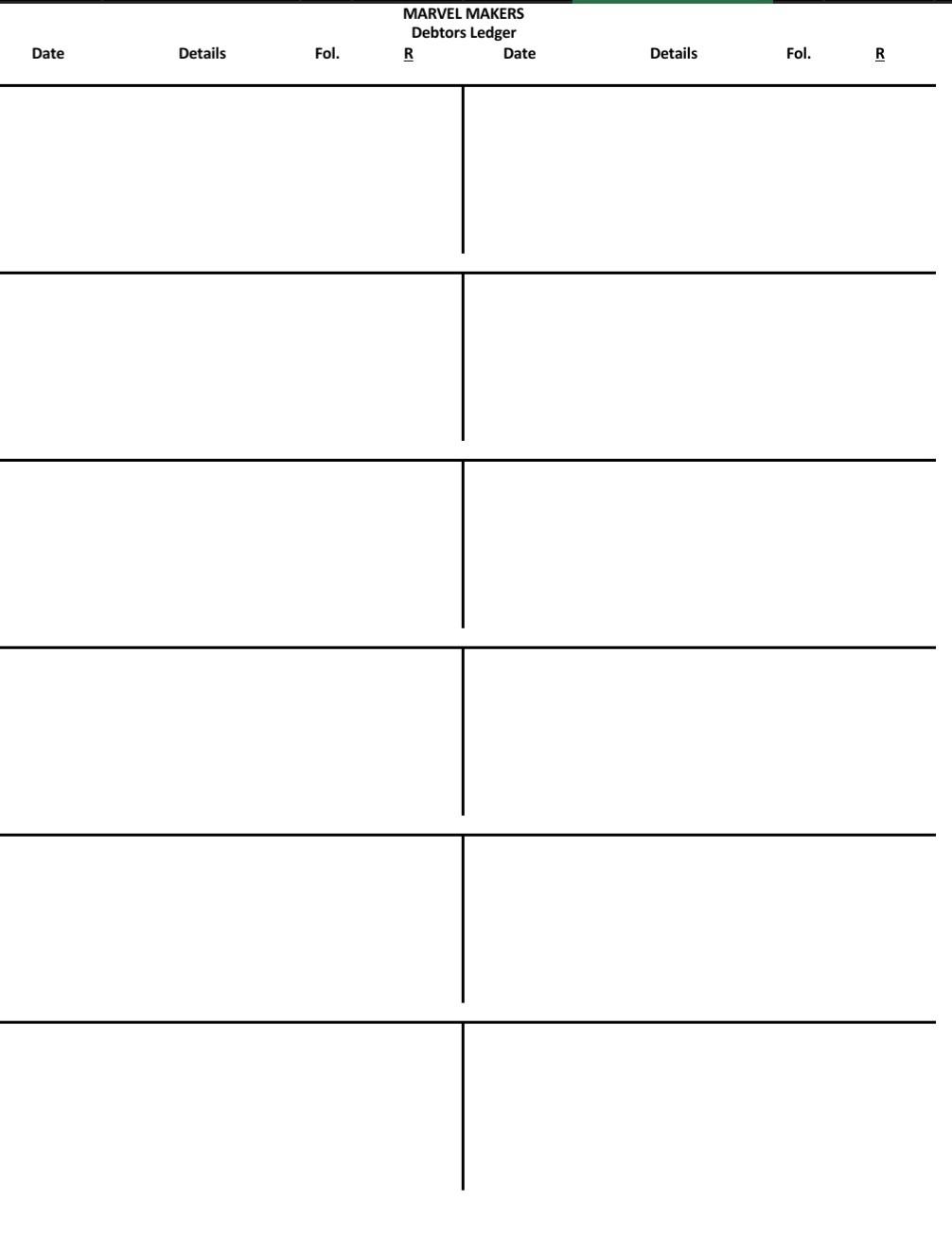

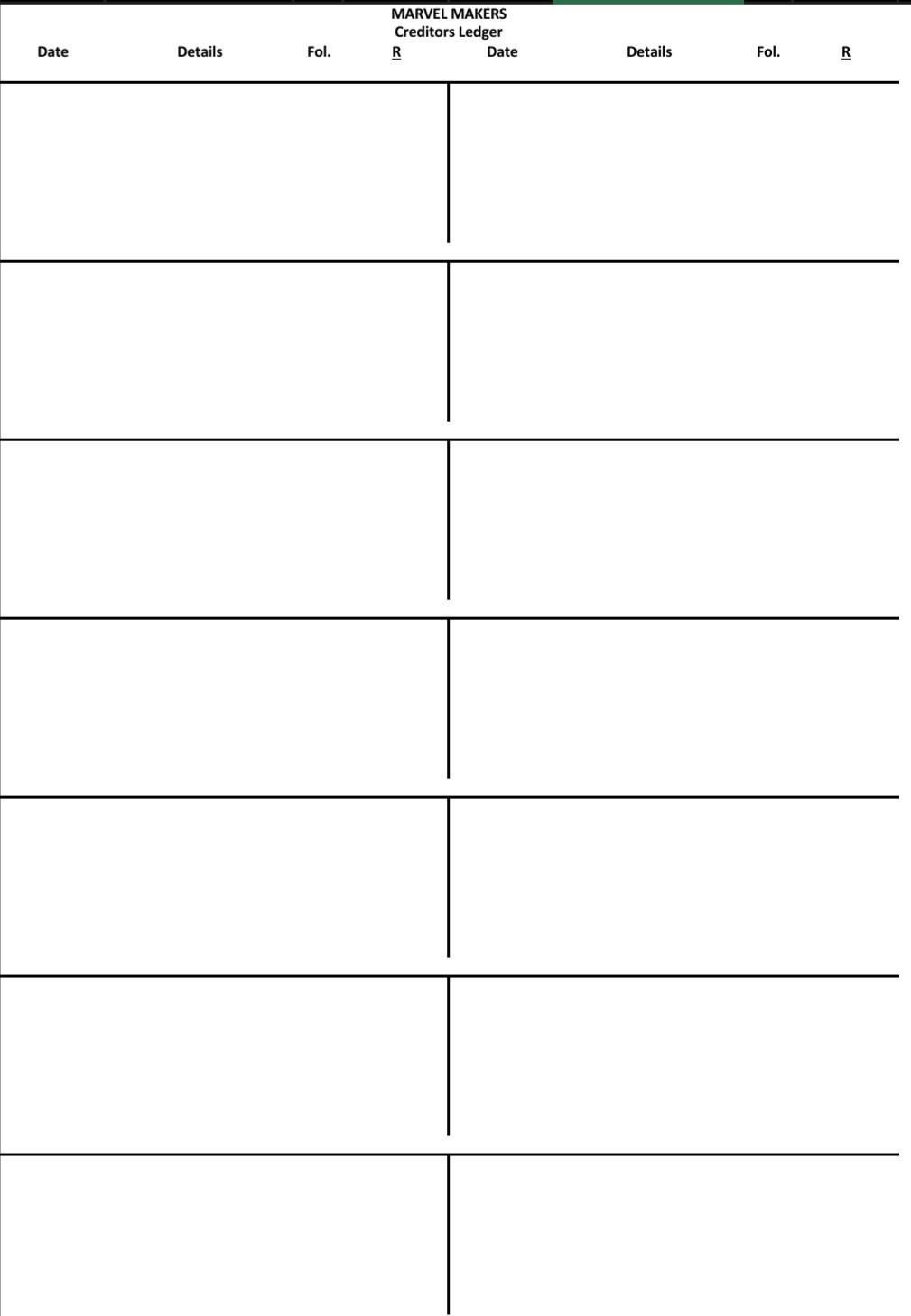

COMPLETE THE General Journal, Creditors ledger and Debtors ledger using the transactions below. SHOW ALL WORKINGS, the format of the journal and ledgers are provided

COMPLETE THE General Journal, Creditors ledger and Debtors ledger using the transactions below. SHOW ALL WORKINGS, the format of the journal and ledgers are provided below

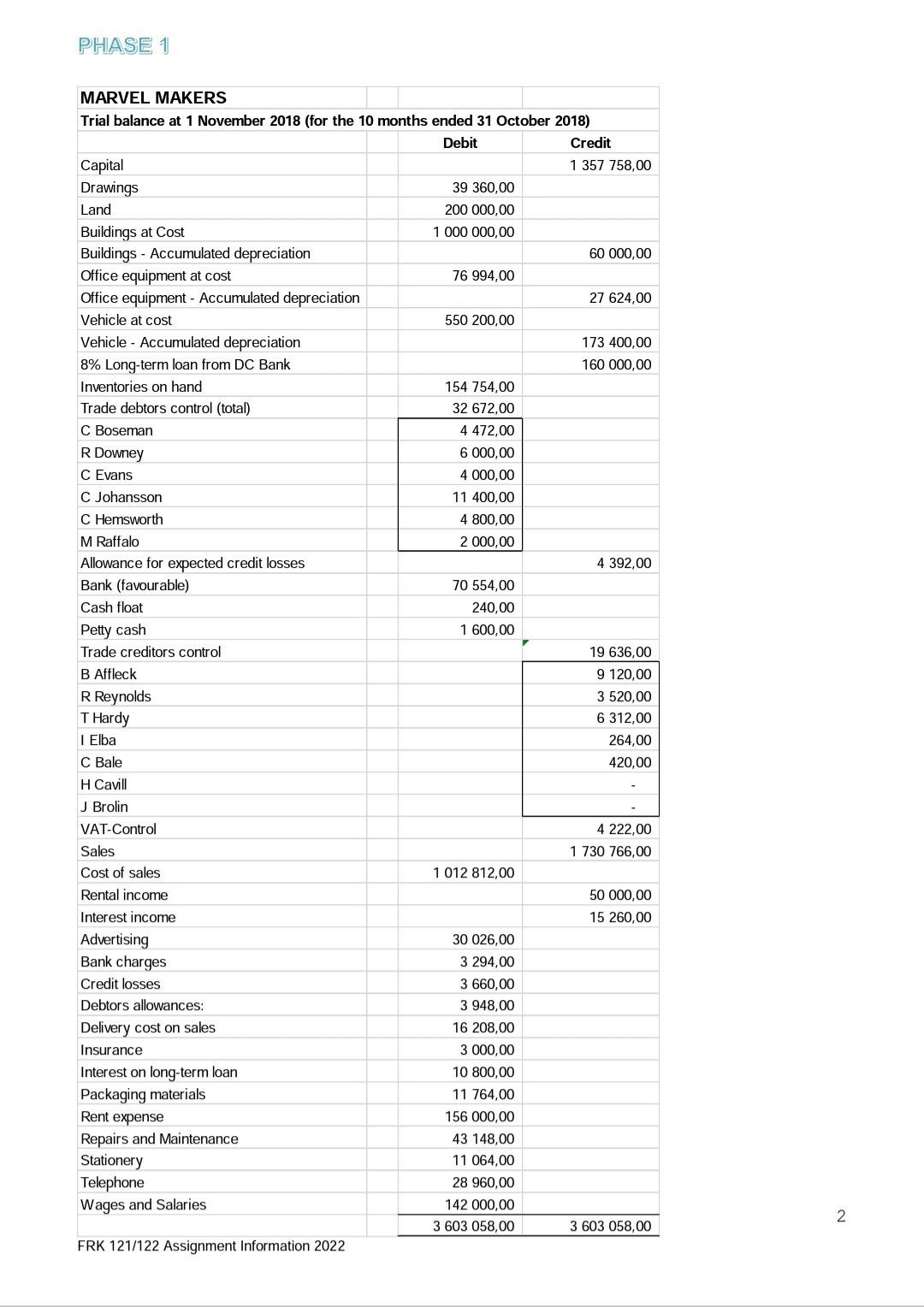

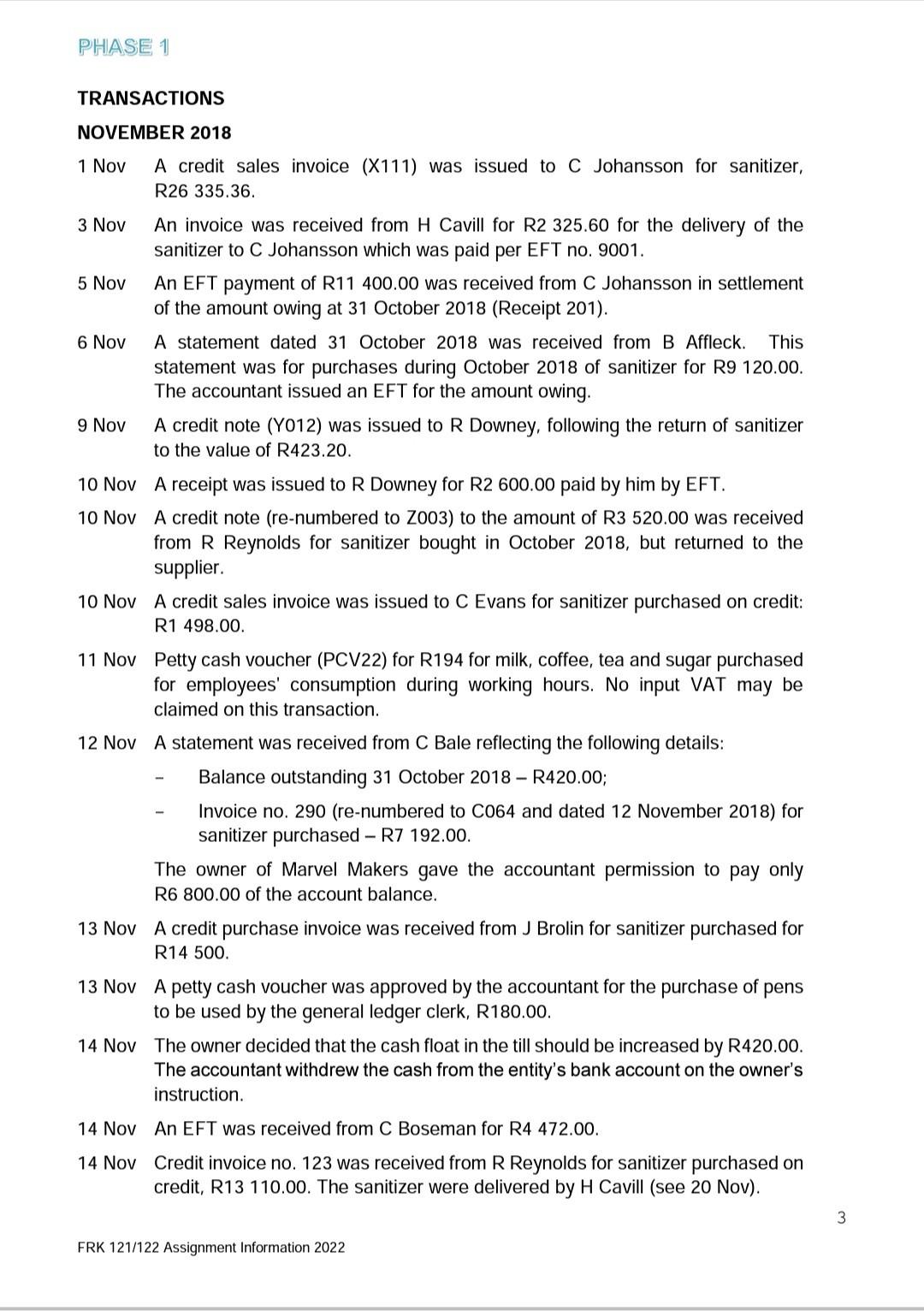

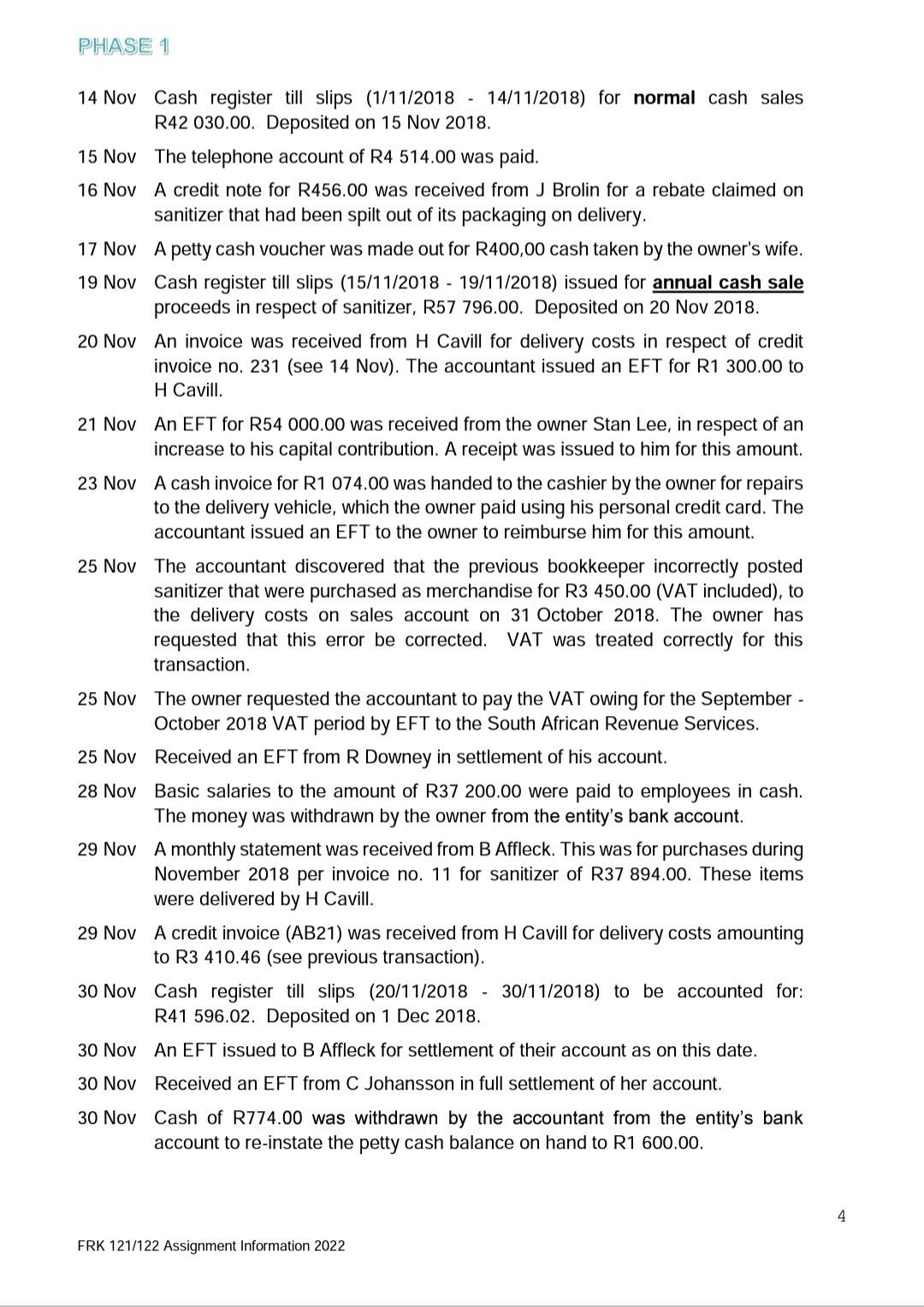

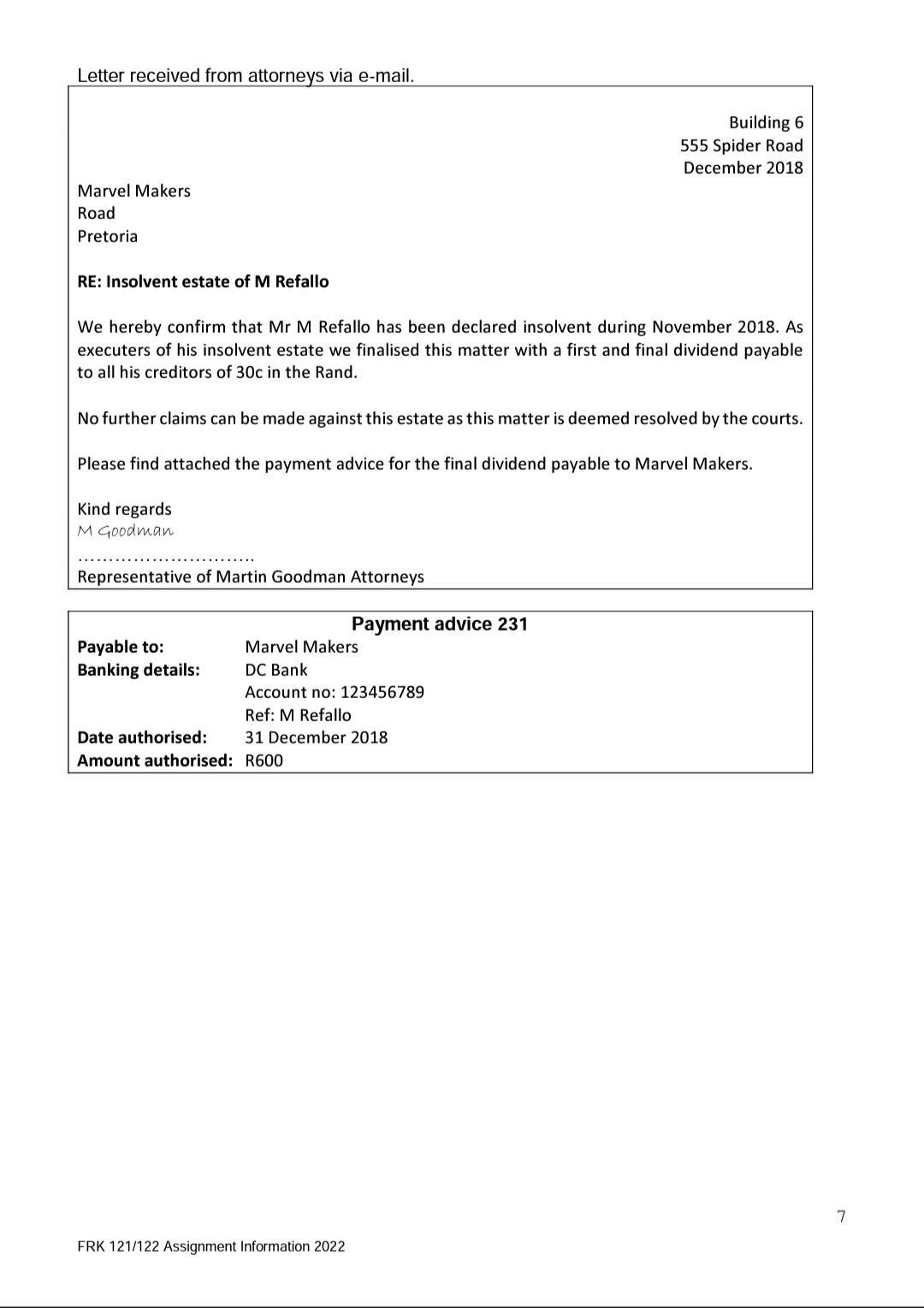

Accounting Cycle Assignment GENERAL INFORMATION: 1. MARVEL MAKERS buys and sells sanitizer. It began trading operations on 1 January 2015 and its financial year end is 31 December. 2. All amounts are paid by EFT, unless otherwise stated. All EFT transactions appear in the entity's bank account on the day following the date of the transaction. 3. The entity uses the perpetual inventory system and maintains a gross profit percentage of 25% (on selling price). 4. During a period in November each year, the entity has an annual sale during which sanitizer is sold at a discount of 20% on normal selling price. The discount is only applied to cash sales concluded during the specified sale period. 5. Assume that all items purchased or sold are received or dispatched correctly unless otherwise told. 6. Cash received is deposited into the entity's bank account as indicated in the transactions provided. 7. The entity is registered for VAT on the invoice basis. All transactions include VAT at the rate of 15% (where applicable) unless otherwise stated. The VAT periods of the entity are as follows: January - February, March - April, May - June, July August, September, - October, November - December. Accept that all suppliers are also registered for VAT. The entity uses a VAT-input, VAT-output and VAT control account. 8. NB: There is NO settlement discount in this assignment. FRK 121/122 Assignment Information 2022 PHAASE 1 PHASE 1 TRANSACTIONS NOVEMBER 2018 1 Nov A credit sales invoice (X111) was issued to C Johansson for sanitizer, R26 335.36. 3 Nov An invoice was received from H Cavill for R2 325.60 for the delivery of the sanitizer to C Johansson which was paid per EFT no. 9001. 5 Nov An EFT payment of R11 400.00 was received from C Johansson in settlement of the amount owing at 31 October 2018 (Receipt 201). 6 Nov A statement dated 31 October 2018 was received from B Affleck. This statement was for purchases during October 2018 of sanitizer for R9 120.00. The accountant issued an EFT for the amount owing. 9 Nov A credit note (Y012) was issued to R Downey, following the return of sanitizer to the value of R423.20. 10 Nov A receipt was issued to R Downey for R2 600.00 paid by him by EFT. 10 Nov A credit note (re-numbered to Z003) to the amount of R3 520.00 was received from R Reynolds for sanitizer bought in October 2018, but returned to the supplier. 10 Nov A credit sales invoice was issued to C Evans for sanitizer purchased on credit: R1 498.00. 11 Nov Petty cash voucher (PCV22) for R194 for milk, coffee, tea and sugar purchased for employees' consumption during working hours. No input VAT may be claimed on this transaction. 12 Nov A statement was received from C Bale reflecting the following details: - Balance outstanding 31 October 2018 - R420.00; - Invoice no. 290 (re-numbered to C064 and dated 12 November 2018) for sanitizer purchased - R7 192.00. The owner of Marvel Makers gave the accountant permission to pay only R6 800.00 of the account balance. 13 Nov A credit purchase invoice was received from J Brolin for sanitizer purchased for R14 500. 13 Nov A petty cash voucher was approved by the accountant for the purchase of pens to be used by the general ledger clerk, R180.00. 14Nov The owner decided that the cash float in the till should be increased by R420.00. The accountant withdrew the cash from the entity's bank account on the owner's instruction. 14 Nov An EFT was received from C Boseman for R4 472.00. 14 Nov Credit invoice no. 123 was received from R Reynolds for sanitizer purchased on credit, R13 110.00. The sanitizer were delivered by H Cavill (see 20 Nov). FRK 121/122 Assignment Information 2022 PHASE 1 14 Nov Cash register till slips (1/11/2018 - 14/11/2018) for normal cash sales R42 030.00. Deposited on 15 Nov 2018. 15 Nov The telephone account of R4 514.00 was paid. 16 Nov A credit note for R456.00 was received from J Brolin for a rebate claimed on sanitizer that had been spilt out of its packaging on delivery. 17 Nov A petty cash voucher was made out for R400,00 cash taken by the owner's wife. 19 Nov Cash register till slips (15/11/2018 - 19/11/2018) issued for annual cash sale proceeds in respect of sanitizer, R57 796.00. Deposited on 20 Nov 2018. 20 Nov An invoice was received from H Cavill for delivery costs in respect of credit invoice no. 231 (see 14 Nov). The accountant issued an EFT for R1 300.00 to H Cavill. 21 Nov An EFT for R54 000.00 was received from the owner Stan Lee, in respect of an increase to his capital contribution. A receipt was issued to him for this amount. 23 Nov A cash invoice for R1 074.00 was handed to the cashier by the owner for repairs to the delivery vehicle, which the owner paid using his personal credit card. The accountant issued an EFT to the owner to reimburse him for this amount. 25 Nov The accountant discovered that the previous bookkeeper incorrectly posted sanitizer that were purchased as merchandise for R3 450.00 (VAT included), to the delivery costs on sales account on 31 October 2018. The owner has requested that this error be corrected. VAT was treated correctly for this transaction. 25 Nov The owner requested the accountant to pay the VAT owing for the September October 2018 VAT period by EFT to the South African Revenue Services. 25 Nov Received an EFT from R Downey in settlement of his account. 28 Nov Basic salaries to the amount of R37 200.00 were paid to employees in cash. The money was withdrawn by the owner from the entity's bank account. 29 Nov A monthly statement was received from B Affleck. This was for purchases during November 2018 per invoice no. 11 for sanitizer of R37 894.00. These items were delivered by H Cavill. 29 Nov A credit invoice (AB21) was received from H Cavill for delivery costs amounting to R3 410.46 (see previous transaction). 30 Nov Cash register till slips (20/11/2018 - 30/11/2018) to be accounted for: R41 596.02. Deposited on 1 Dec 2018. 30 Nov An EFT issued to B Affleck for settlement of their account as on this date. 30 Nov Received an EFT from C Johansson in full settlement of her account. 30 Nov Cash of R774.00 was withdrawn by the accountant from the entity's bank account to re-instate the petty cash balance on hand to R1 600.00. FRK 121/122 Assignment Information 2022 DECEMBER 2018 3 Dec Credit sales invoice issued to C Johansson for purchases of sanitizer for R16 600.00. C Johansson transported the sanitizer herself. 6 Dec Invoice 975 was received from I Elba for sanitizer purchased on credit for R9 250.00. 7 Dec Petty cash voucher issued for R166.00 in respect of delivery costs on certain cash sales. 8 Dec Petty cash voucher issued for purchase of stationery of R120.00. 9 Dec A credit note was received from C Bale amounting to R164.00 due to sanitizer that was over-charged on their invoice. 11 Dec Received invoice no. 72F9 from T Hardy for credit purchases of sanitizer for R13 550.00. 12 Dec Invoice AB35 was received from H Cavill for delivery costs of 10% (including VAT) on sanitizer purchased from T Hardy (see previous transaction). 13 Dec A petty cash voucher issued for repairs to an office chair for R194.00. 15 Dec An EFT was issued for R3 732.00 to pay the telephone account. 15 Dec Cash register till rolls (1/12/2018 - 15/12/2018) for cash sales R41 186.00. Deposited 17 Dec 2018. 15 Dec EFTs issued to: THardyJBrolinIElbaRReynoldsR18000.00;R12000.00;andR8000.00.R10400.00; None of these payments were in settlement of the suppliers accounts. 17 Dec Petty cash vouchers for wages for R536.00. 17 Dec A credit sales invoice was issued to C Boseman for sales of R4 912.00 in respect of sanitizer. 20 Dec Invoice no. 72 received from B Affleck for purchases on credit of sanitizer R41 312.00. 21 Dec The owner informed the accountant that he had taken sanitizer with a cost of R12 260.00 (excluding VAT) for his own use. 24 Dec Cash register till slips (16/12/2018 - 24/12/2018) for cash sales of: R44 464.00. Deposited 27 Dec 2018. 24 Dec The owner withdrew cash of R48 286.00 from the entity's bank account to pay employee salaries. 5 FRK 121/122 Assignment Information 2022 29 Dec The owner instructed the accountant to calculate interest at 8% per annum on the balance owing by C Hemsworth which had been in arrears for 7 months at this date. 30 Dec An EFT of R6 000.00 was issued to the owner, for his personal cell phone account. 31 Dec A proof of payment via EFT was received for R600.00 from Martin Goodman Attorneys. Refer to letter received from the attorneys. 31 Dec Received an invoice from T Hardy for R4 020.00 in respect of office equipment purchased. The current residual value is estimated to be R1 020.00. 31 Dec Cash register till slips (27/12/2018 - 31/12/2018) for cash sales of: R64 108.00. Deposited 2 Jan 20X8. 31 Dec A direct deposit was received from Ragnarock Attorneys for R4 000.00 in respect of an amount that they collected for the account of L Loki. According to the accounting records, this amount had been written off as irrecoverable in a prior period. 31 Dec A EFT for R4 560.00 was issued for advertisements which appeared in local magazines during December 2018. 31 Dec Issued a credit sales invoice to R Downey for purchases of sanitizer R2 996.00. Invoice AB52 was subsequently received from H Cavill for the delivery costs of 10% (including VAT) on the value of the sanitizer sold to R Downey. 31 Dec Cash of R1 016.00 was withdrawn by the accountant from the entity's bank account to re-instate the petty cash balance on hand to R1 600.00. 31 Dec Stan Lee, the owner has been discussing the sale of some office equipment with his close friend and they decided to finalise the deal before year-end. The equipment was initially purchased on 1 April 2015 for R16 000.00, and was sold to Tony Stark for R10 000.00 on 1 December 2018. No entry has been made for this transaction. Tony Stark is not registered as a VAT vendor, and agreed to pay the amount due before the end of June 2019. - All of the office equipment items on the asset register, except those purchased during the current year, were purchased and ready for use on 1 April 2015. - Office equipment is depreciated at 15% per annum in accordance with the reducing balance method. FRK 121/122 Assignment Information 2022 FRK 121/122 Assignment Information 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started