Answered step by step

Verified Expert Solution

Question

1 Approved Answer

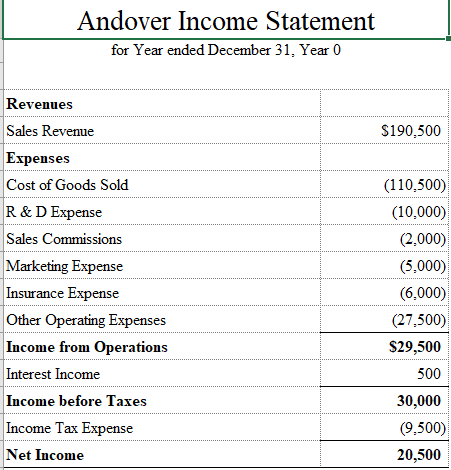

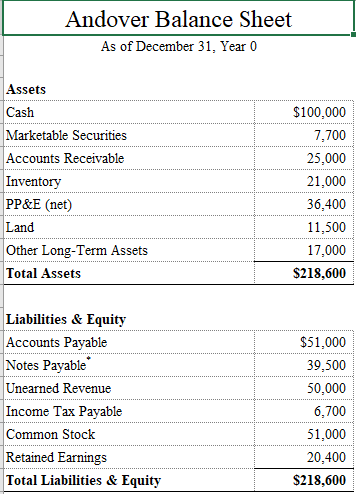

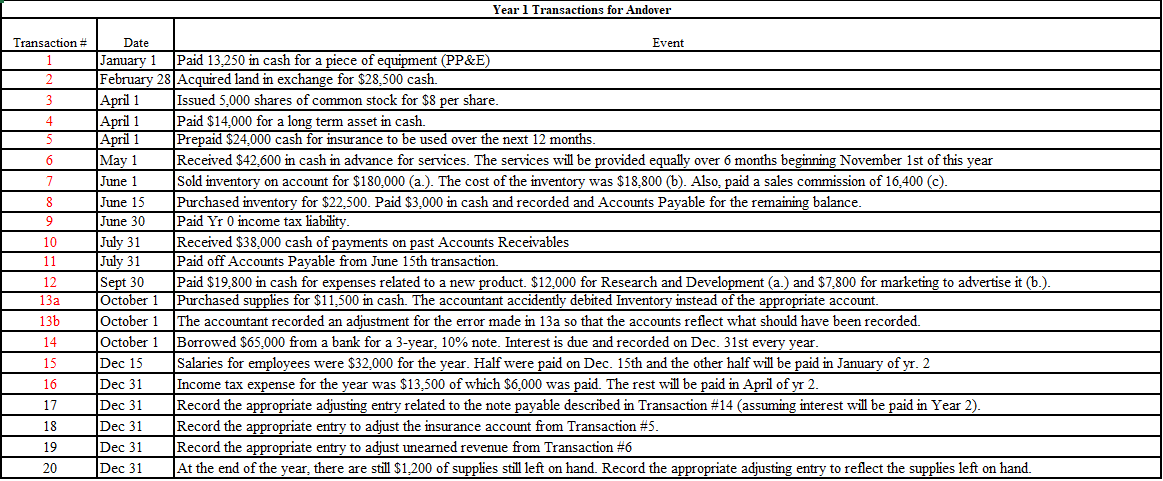

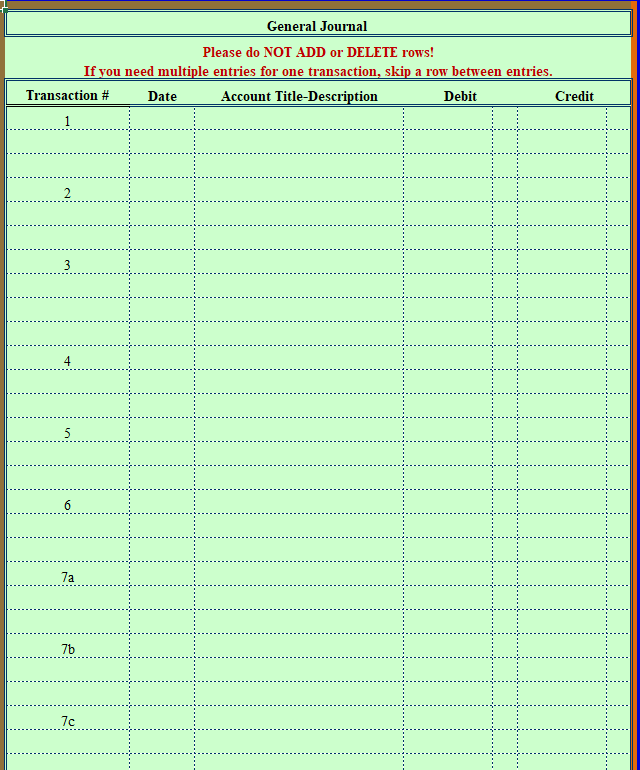

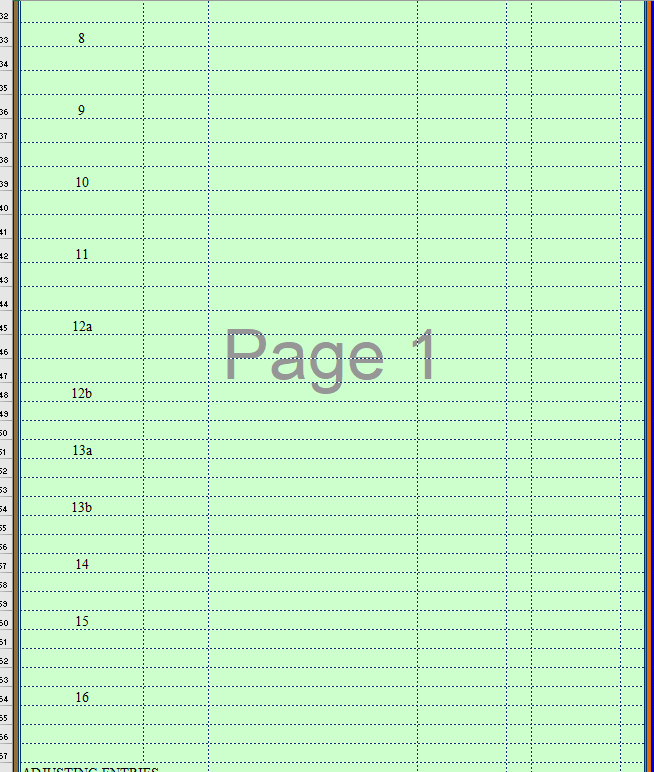

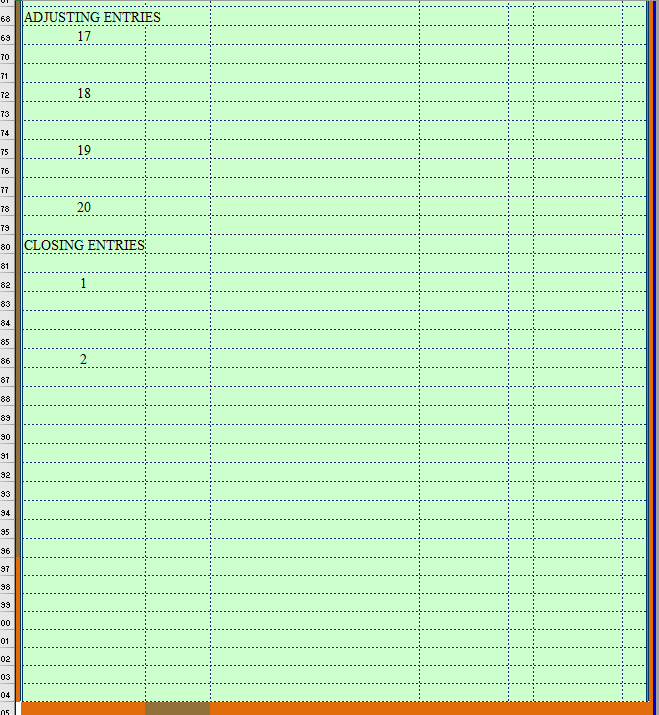

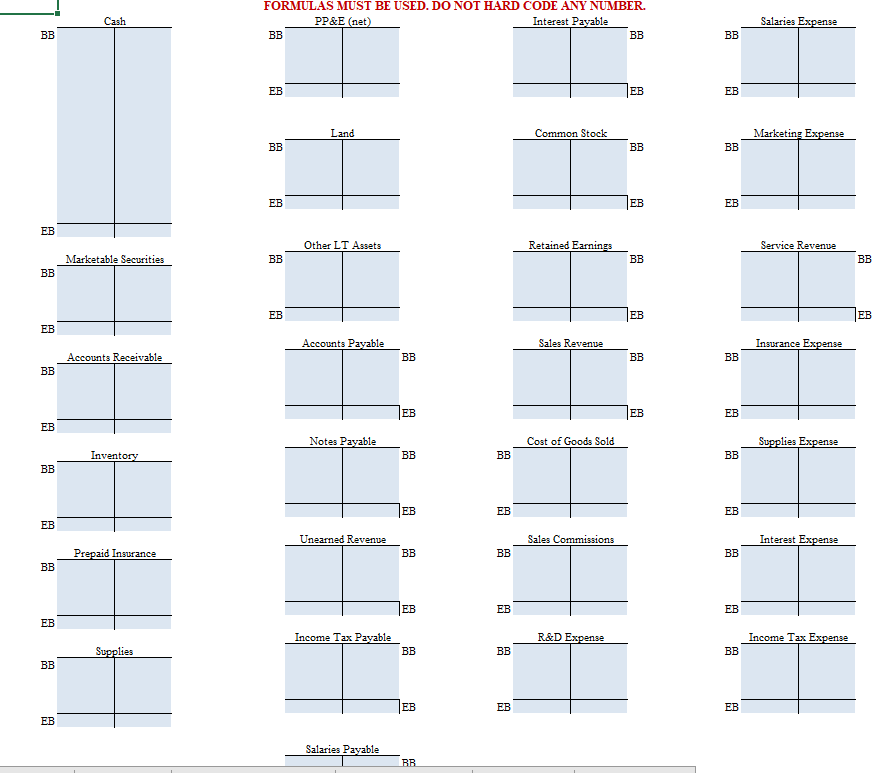

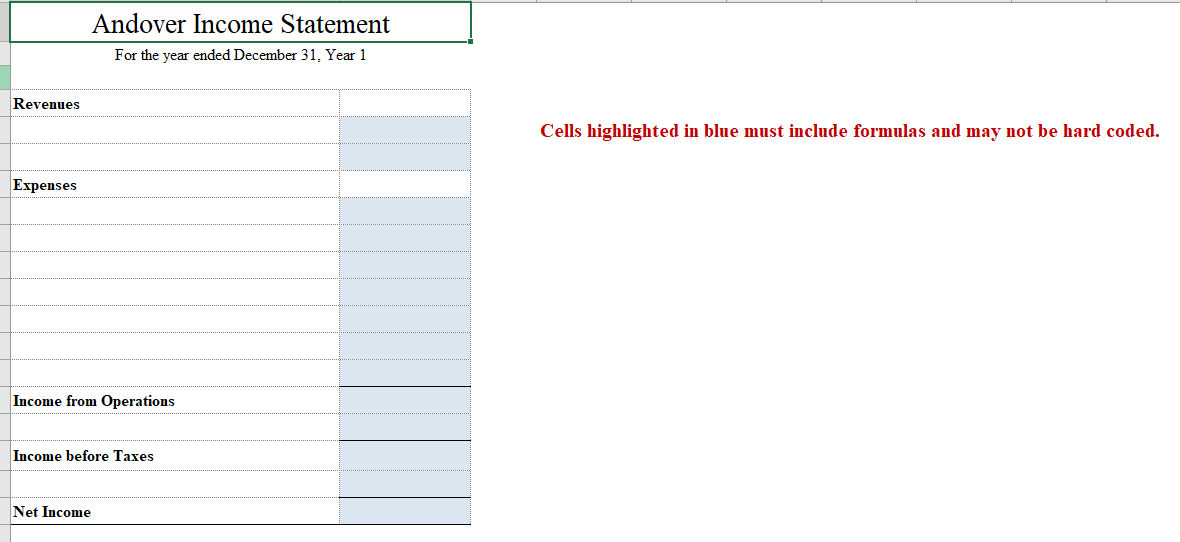

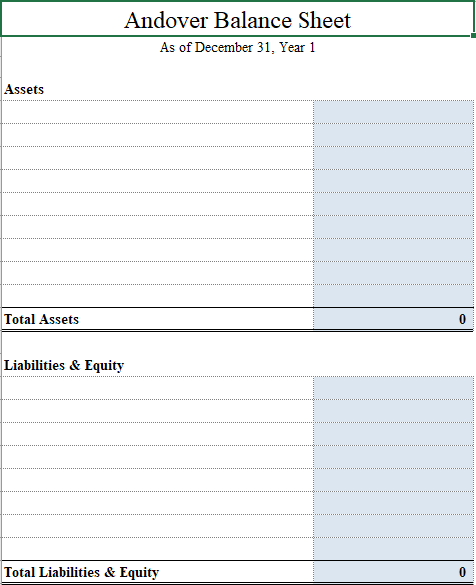

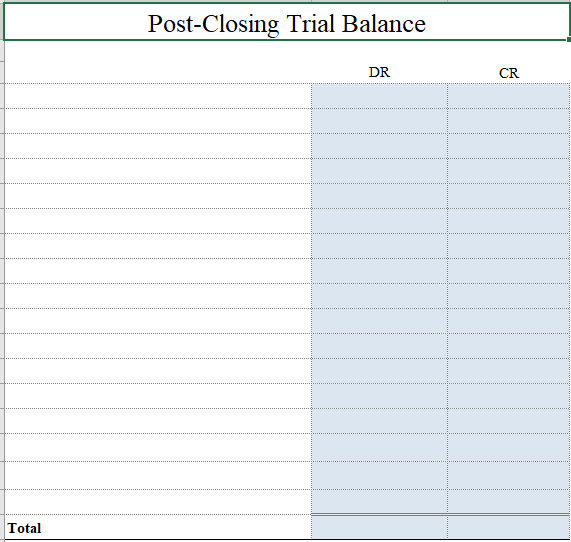

Complete the general journal, T-Accounts, End of year income statment, end of year balance sheet, and post closing trial balance based on the information provided.

Complete the general journal, T-Accounts, End of year income statment, end of year balance sheet, and post closing trial balance based on the information provided. Use the information in the year 0 income statemnet and balance sheet as beginning balances for accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started