Answered step by step

Verified Expert Solution

Question

1 Approved Answer

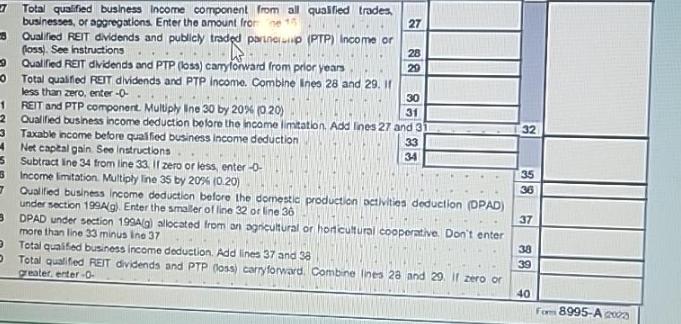

Complete the portion of form 8 9 9 5 - A part 1 V to calculate Julia's QBI deduction. 7 1 2 3 4 Total

Complete the portion of form A part V to calculate Julia's QBI deduction.

7 1 2 3 4 Total qualified business Income component from all qualified trades, businesses, or aggregations. Enter the amount from me 15 Qualified REIT dividends and publicly traded partnerup (PTP) Income or (loss). See instructions Qualified REIT dividends and PTP (loss) carryforward from prior years Total qualified REIT dividends and PTP income. Combine lines 28 and 29. If less than zero, enter -0- REIT and PTP component. Multiply line 30 by 20 % (020) Qualified business income deduction before the income limitation. Add lines 27 and 311 Taxable income before qualified business income deduction Net capital gain. See Instructions 5 Subtract line 34 from line 33. If zero or less, enter-0- 3 Income limitation Multiply line 35 by 20% (0.20) 27 28 29 3 30 31 33 34 7 Qualified business income deduction before the domestic production activities deduction (DPAD) under section 199A(g) Enter the smaller of line 32 or line 36 3DPAD under section 199A(g) allocated from an agricultural or horticultural cooperative. Don't enter more than line 33 minus line 37 Total qualified business income deduction. Add lines 37 and 38 Total qualified REIT dividends and PTP (loss) carryforward. Combine Ines 28 and 29. If zero or greater, enter-O- 32 35 36 37 38 39 40 Form 8995-A2025

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Based on the provided information here are the concise calculations for Julias Qualified Business In...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started