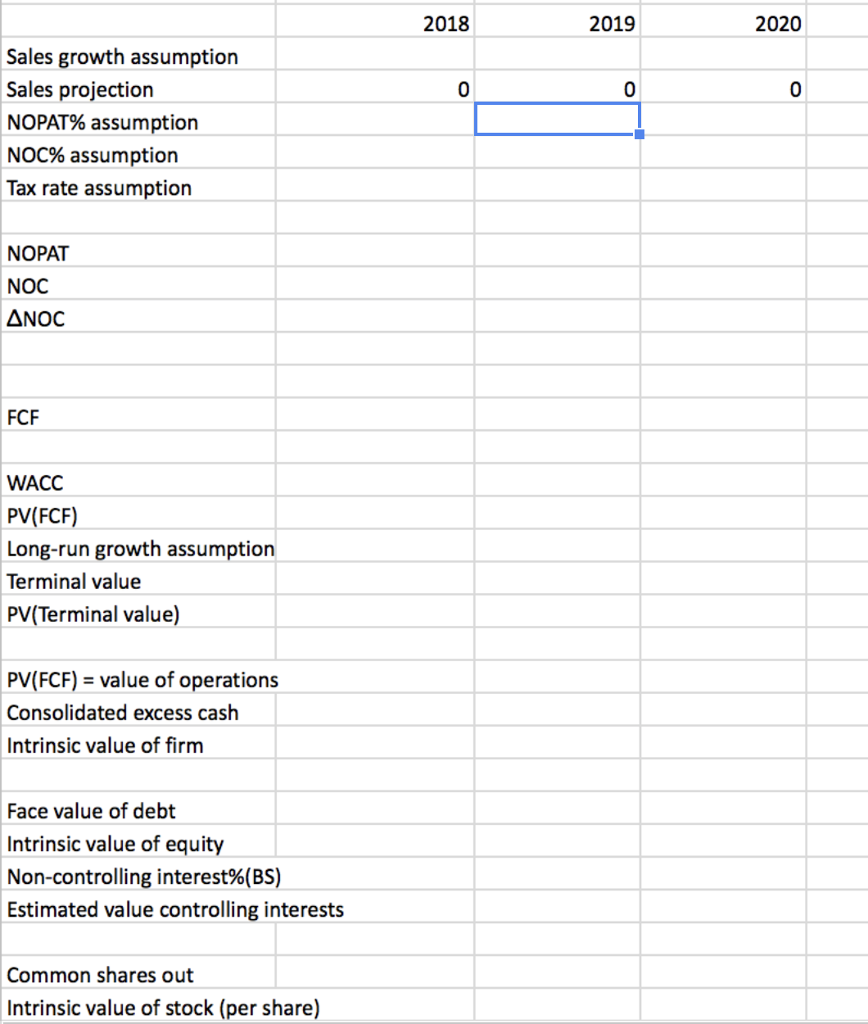

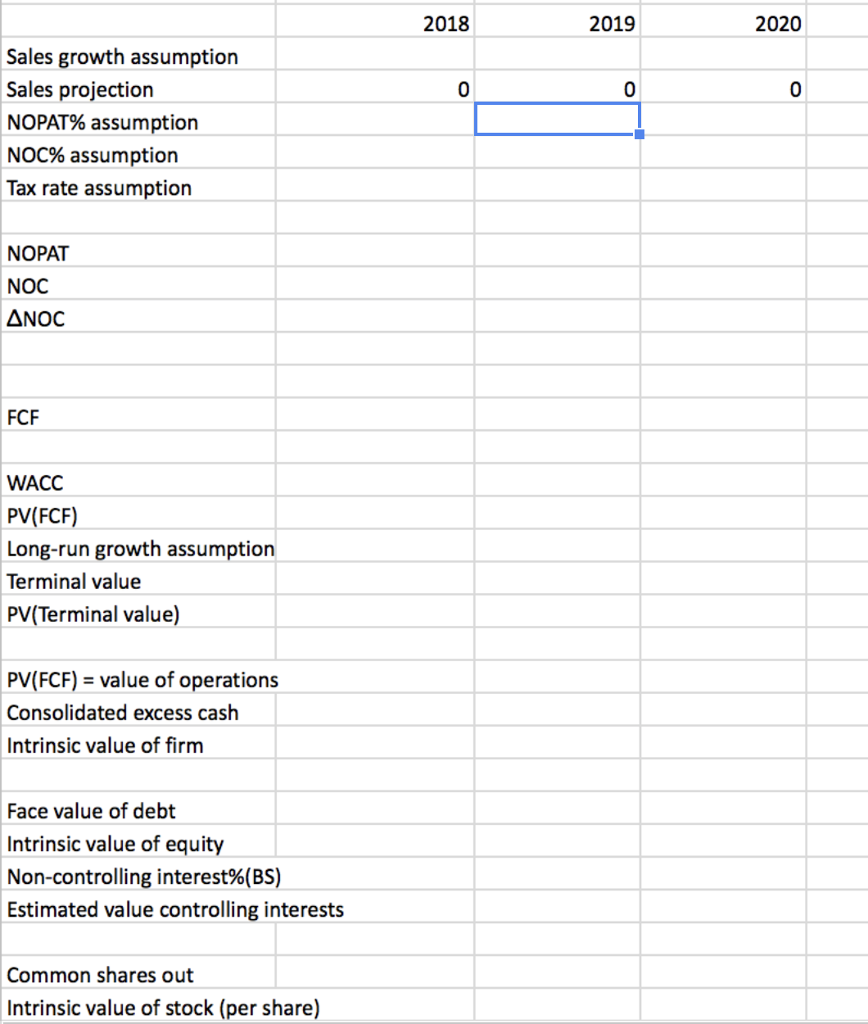

Complete the predictions for the next three years using the cash flow statement provided

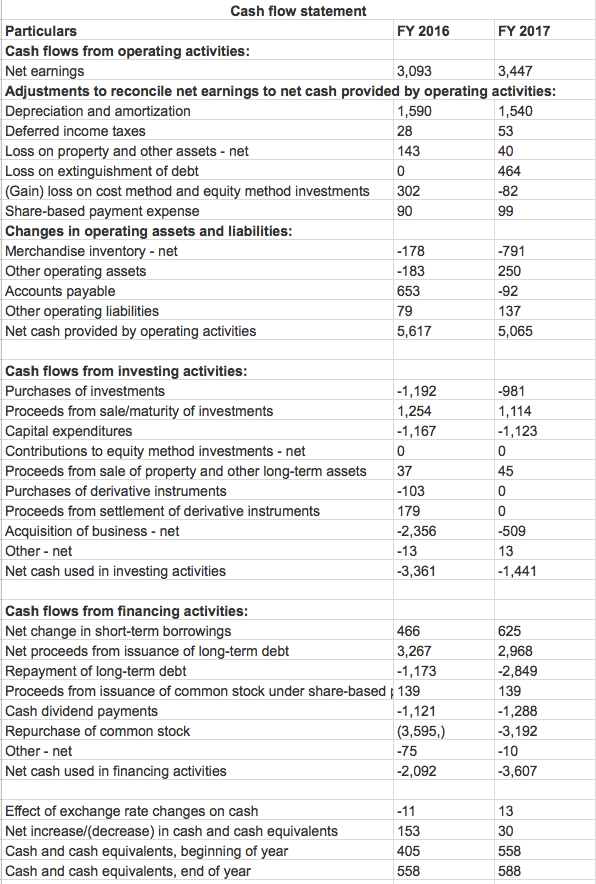

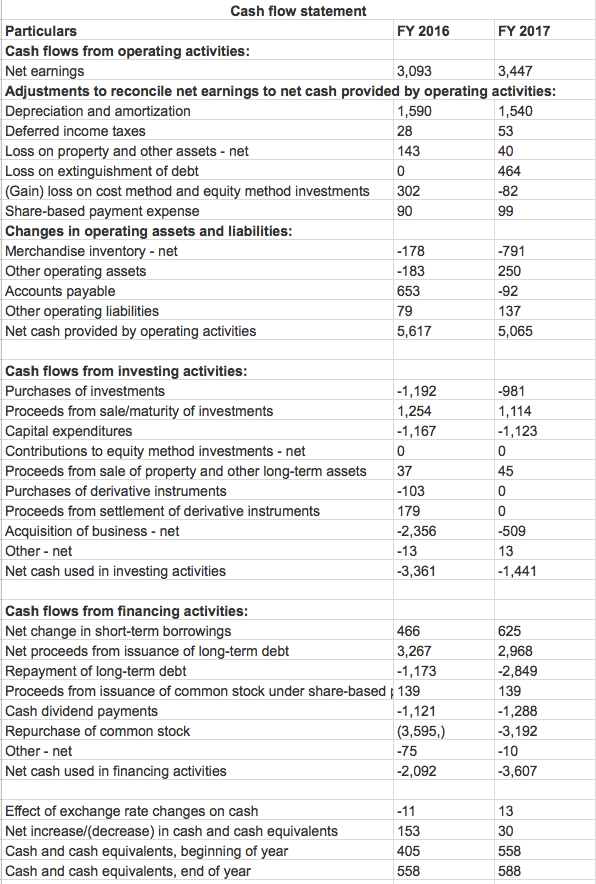

Cash flow statement Particulars Cash flows from operating activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization Deferred income taxes Loss on property and other assets net Loss on extinquishment of debt (Gain) loss on cost method and equity method investments 302 Share-based payment expense Changes in operating assets and liabilities Merchandise inventory -net Other operating assets Accounts payable Other operating liabilities Net cash provided by operating activities FY 2016 FY 2017 3,093 3,447 1,590 28 143 1,540 53 40 464 -82 90 -178 -183 653 79 5,617 791 250 -92 137 5,065 Cash flows from investing activities Purchases of investments Proceeds from sale/maturity of investments Capital expenditures Contributions to equity method investments-net Proceeds from sale of property and other long-term ats Purchases of derivative instruments Proceeds from settlement of derivative instruments Acquisition of business net Other net Net cash used in investing activities -1,192 1,254 1,167 1,114 1,123 37 45 -103 179 -2,356 -13 3,361 -509 13 1,441 Cash flows from financing activities Net change in short-term borrowings Net proceeds from issuance of long-term debt Repayment of long-term debt Proceeds from issuance of common stock under share-based139 Cash dividend payments Repurchase of common stock Other net Net cash used in financing activities 625 2,968 2,849 139 -1,288 3,192 -10 3,607 466 3,267 1,173 1,121 (3,595,) -75 2,092 Effect of exchange rate changes on cash Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 153 405 558 13 30 558 588 Cash flow statement Particulars Cash flows from operating activities Net earnings Adjustments to reconcile net earnings to net cash provided by operating activities Depreciation and amortization Deferred income taxes Loss on property and other assets net Loss on extinquishment of debt (Gain) loss on cost method and equity method investments 302 Share-based payment expense Changes in operating assets and liabilities Merchandise inventory -net Other operating assets Accounts payable Other operating liabilities Net cash provided by operating activities FY 2016 FY 2017 3,093 3,447 1,590 28 143 1,540 53 40 464 -82 90 -178 -183 653 79 5,617 791 250 -92 137 5,065 Cash flows from investing activities Purchases of investments Proceeds from sale/maturity of investments Capital expenditures Contributions to equity method investments-net Proceeds from sale of property and other long-term ats Purchases of derivative instruments Proceeds from settlement of derivative instruments Acquisition of business net Other net Net cash used in investing activities -1,192 1,254 1,167 1,114 1,123 37 45 -103 179 -2,356 -13 3,361 -509 13 1,441 Cash flows from financing activities Net change in short-term borrowings Net proceeds from issuance of long-term debt Repayment of long-term debt Proceeds from issuance of common stock under share-based139 Cash dividend payments Repurchase of common stock Other net Net cash used in financing activities 625 2,968 2,849 139 -1,288 3,192 -10 3,607 466 3,267 1,173 1,121 (3,595,) -75 2,092 Effect of exchange rate changes on cash Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year 153 405 558 13 30 558 588