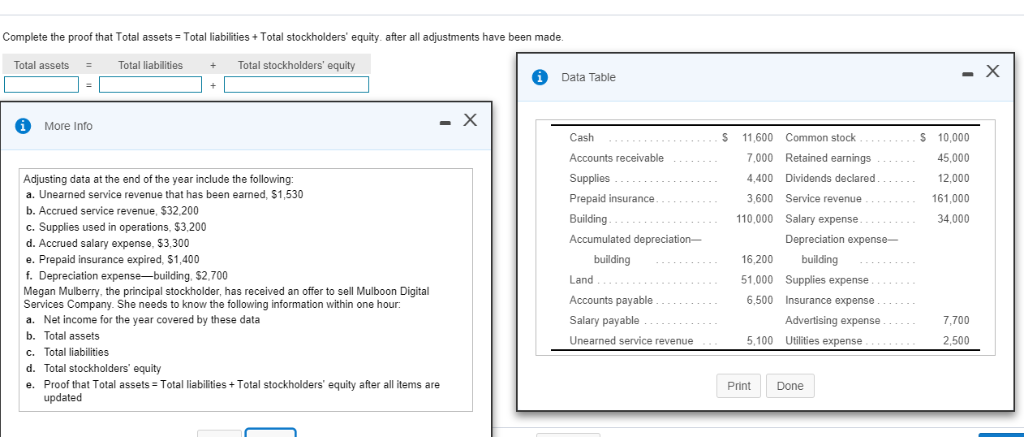

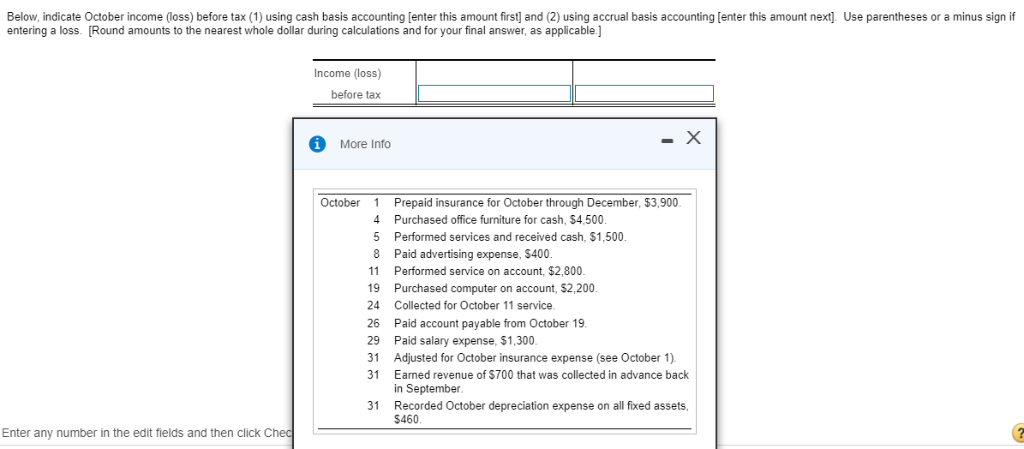

Complete the proof that Total assets-Total labiities+Total stockholders' equity. after all adjustments have been made Total assetsTotal liabilities Total stockholders' equity Data Table More info S 11,600 Common stock 7,000 Retained earnin Accounts receivable Supplies Prepaid insurance Building Accumulated depreciation- S 10,000 45,000 12,000 161,000 34,000 gs 4.400 Dividends declared Adjusting data at the end of the year include the following: a. Unearned service revenue that has been earned, $1,530 b. Accrued service revenue, $32,200 c. Supplies used in operations, $3,200 d. Accrued salary expense, $3,300 e. Prepaid insurance expired, $1,400 f. Depreciation expense-building, $2,700 Megan Mulberry, the principal stockholder, has received an offer to sell Mulboon Digital Services Company. She needs to know the following information within one hour a. Net income for the year covered by these data b. Total assets c. Total liabilities d. Total stockholders' equity e. Proof that Total assets Total liabilities+Total stockholders' equity after all items are 3,600 Service revenue 110,000 Salary expense 16,200 building 1,000 Supplies expense 6,500 Insurance expense building Land Accounts payable Salary payable Unearned service revenue 7,700 2,500 Advertising expense 5,100 Utilities expense Print Done updated Below, indicate October income (loss) before tax (1) using cash basis accounting [enter this amount first] and (2) using accrual basis accounting [enter this amount next]. Use parentheses or a minus sign if entering a loss. Round amounts to the nearest whole dollar during calculations and for your final answer, as applicable] Income (loss) before tax More Info October 1 4 5 8 11 19 24 26 29 31 31 Prepaid insurance for October through December, $3,900 Purchased office furniture for cash, $4,500 Performed services and received cash, $1,500 Paid advertising expense, $400 Performed service on account, $2,800 Purchased computer on account, $2,200 Collected for October 11 service Paid account payable from October 19 Paid salary expense, $1,300 Adjusted for October insurance expense (see October 1). Earned revenue of $700 that was collected in advance back in September 31 Recorded October depreciation expense on all fixed assets $460 Enter any number in the edit fields and then click