Answered step by step

Verified Expert Solution

Question

1 Approved Answer

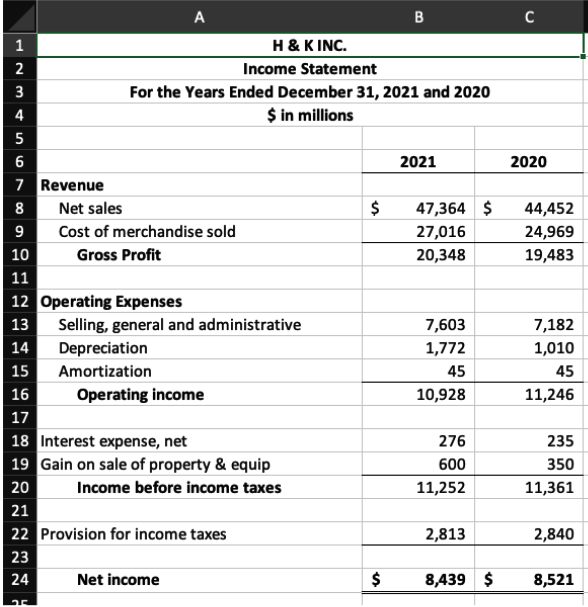

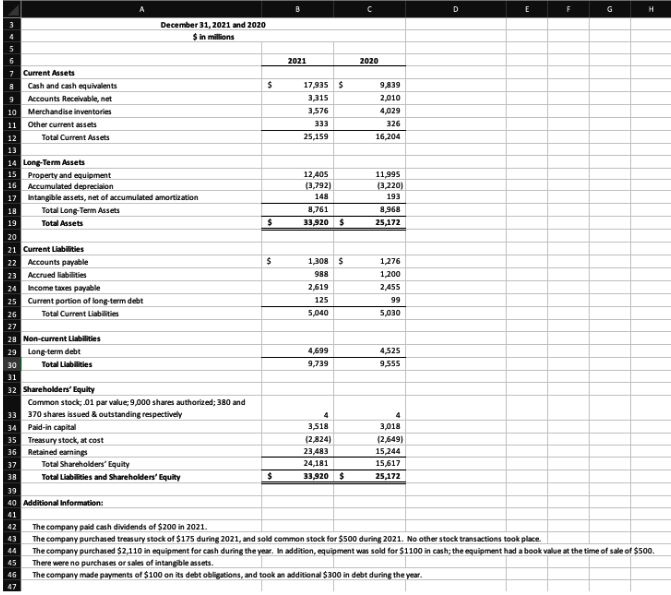

Complete the ratio calculations for 2021 using the income statement and balance sheet D E H December 31, 2021 and 2020 $ in millions 988

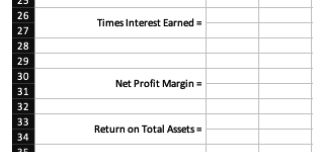

Complete the ratio calculations for 2021 using the income statement and balance sheet

D E H December 31, 2021 and 2020 $ in millions 988 2021 2020 Current Assets Cash and cash equivalents $ 17,935 5 9839 Accounts Receivable, net 3.315 2,010 10 Merchandise inventories 3,576 4,029 11 Other current assets 333 326 12 Total Current Assets 25,159 16,204 13 14 Long-Term Assets 15 Property and equipment 12,405 11,995 16 Accumulated depreciaion (3,792) (3.220) 17 Intangible assets, net of accumulated amortization 148 193 18 Total Long-Term Assets 8,761 8,968 19 Total Assets $ 33,920 $ 25,172 20 21 Current Liabilities 22 Accounts payable $ 1,308 $ 1276 23 Accrued liabilities 1,200 24 Income taxes payable 2,619 2.455 25 Current portion of long-term debt 125 99 26 Total Current Liabilities 5.040 5.030 27 20 Non-current abilities 29 Long-term debt 4,699 4.525 30 Total Liabilities 9,739 9.555 31 32 Shareholders' Equity Common stock 01 par value:9,000 shares authorized; 380 and 33 370 shares issued & outstanding respectively 34 Paid-in capital 3,518 3,018 35 Treasurystock, at cost 12.824) 12.649) 36 Retained earnings 23,483 15 244 37 Total Shareholders' Equity 24,181 15,617 38 Total Liabilities and Shareholders' Equity $ 33,920 $ 25,172 39 40 Additional Information: 41 42 The company paid cash dividends of $200 in 2021 43 The company purchased treasury stock of $175 during 2021, and sold common stock for $500 during 2021. No other stock transactions took place. 44 The company purchased $2,110 in equipment for cash during the year. In addition, equipment was sold for $1100 in cash; the equipment had a book value at the time of sale of $500. 45 There were no purchases or sales of intangible assets. 46 The company made payments of $100 on its debt obligations, and took an additional $300 in debt during the year. 47Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started