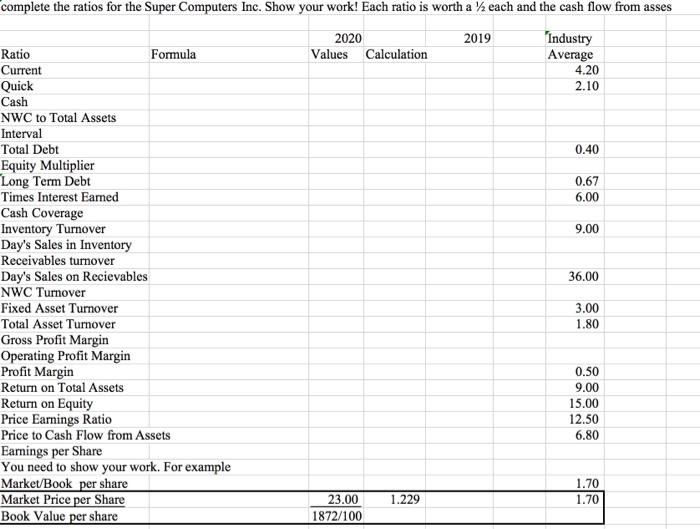

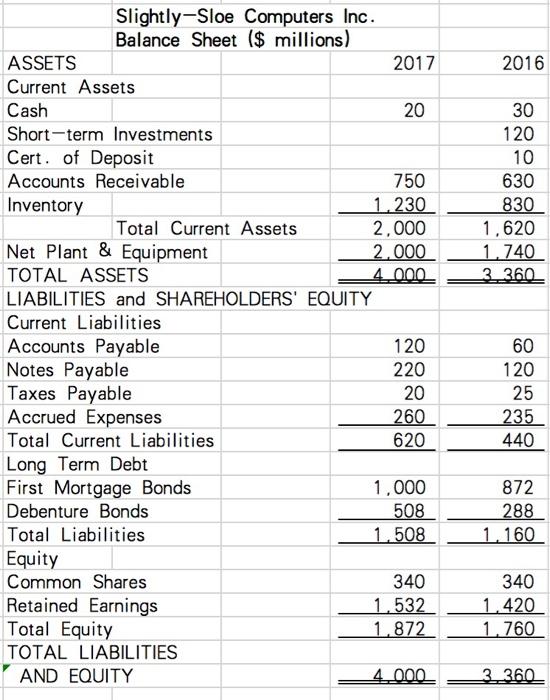

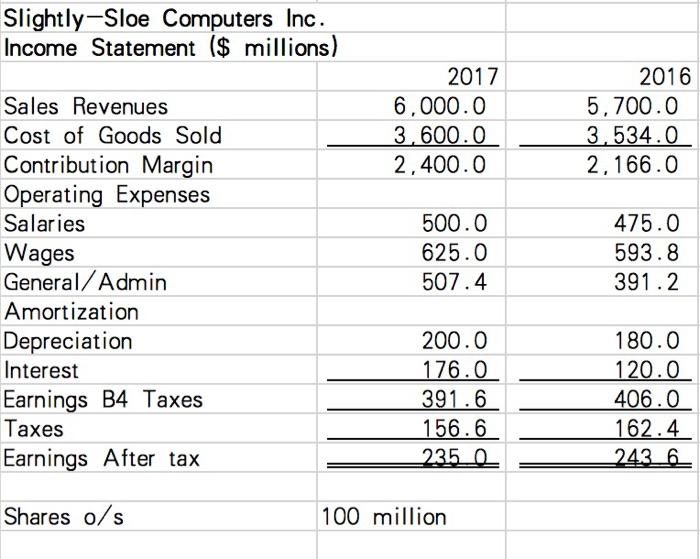

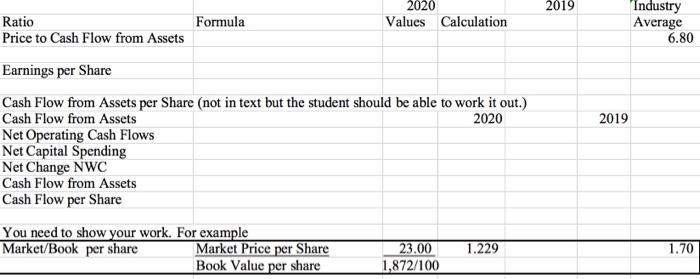

complete the ratios for the Super Computers Inc. Show your work! Each ratio is worth a ' each and the cash flow from asses 2020 2019 Industry Ratio Formula Values Calculation Average Current 4.20 Quick 2.10 Cash NWC to Total Assets Interval Total Debt 0.40 Equity Multiplier Long Term Debt 0.67 Times Interest Earned 6.00 Cash Coverage Inventory Turnover 9.00 Day's Sales in Inventory Receivables turnover Day's Sales on Recievables 36.00 NWC Turnover Fixed Asset Turnover 3.00 Total Asset Turnover 1.80 Gross Profit Margin Operating Profit Margin Profit Margin 0.50 Return on Total Assets 9.00 Return on Equity 15.00 Price Earnings Ratio 12.50 Price to Cash Flow from Assets 6.80 Earnings per Share You need to show your work. For example Market/Book per share 1.70 Market Price per Share 23.00 1.229 1.70 Book Value per share 1872/100 2016 30 120 10 630 830 1,620 1.740 3360 Slightly-Sloe Computers Inc. Balance Sheet ($ millions) ASSETS 2017 Current Assets Cash 20 Short-term Investments Cert. of Deposit Accounts Receivable 750 Inventory 1.230 Total Current Assets 2.000 Net Plant & Equipment 2.000 TOTAL ASSETS 4.000 LIABILITIES and SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable 120 Notes Payable 220 Taxes Payable 20 Accrued Expenses 260 Total Current Liabilities 620 Long Term Debt First Mortgage Bonds 1.000 Debenture Bonds 508 Total Liabilities 1.508 Equity Common Shares 340 Retained Earnings 1.532 Total Equity 1.872 TOTAL LIABILITIES AND EQUITY 4.000 60 120 25 235 440 872 288 1.160 340 1.420 1.760 3360_ Slightly-Sloe Computers Inc. Income Statement ($ millions) 2017 6,000.0 3.600.0 2,400.0 2016 5,700.0 3.534.0 2,166.0 Sales Revenues Cost of Goods Sold Contribution Margin Operating Expenses Salaries Wages General/Admin Amortization Depreciation Interest Earnings B4 Taxes Taxes Earnings After tax 500.0 625.0 507.4 475.0 593.8 391.2 200.0 176.0 391.6 156.6 235_0 180.0 120.0 406.0 162.4 243_6_ Shares o/s 100 million 2019 Formula Ratio Price to Cash Flow from Assets 2020 Values Calculation Industry Average 6.80 2019 Earnings per Share Cash Flow from Assets per Share (not in text but the student should be able to work it out.) Cash Flow from Assets 2020 Net Operating Cash Flows Net Capital Spending Net Change NWC Cash Flow from Assets Cash Flow per Share You need to show your work. For example Market/Book per share Market Price per Share Book Value per share 1.229 1.70 23.00 1,872/100