Answered step by step

Verified Expert Solution

Question

1 Approved Answer

COMPLETE THE REQUIREMENTS 1 TO 4. 1. explain why the account title in every entry in the journal book is being debited or credited. 2.

COMPLETE THE REQUIREMENTS 1 TO 4. 1. explain why the account title in every entry in the journal book is being debited or credited.

2. post entries to the general ledger (complete format)

3. prepare trial balance using chart of accounts

4. prepare statement of profit and loss of income statement

THANK YOU THANK YOU

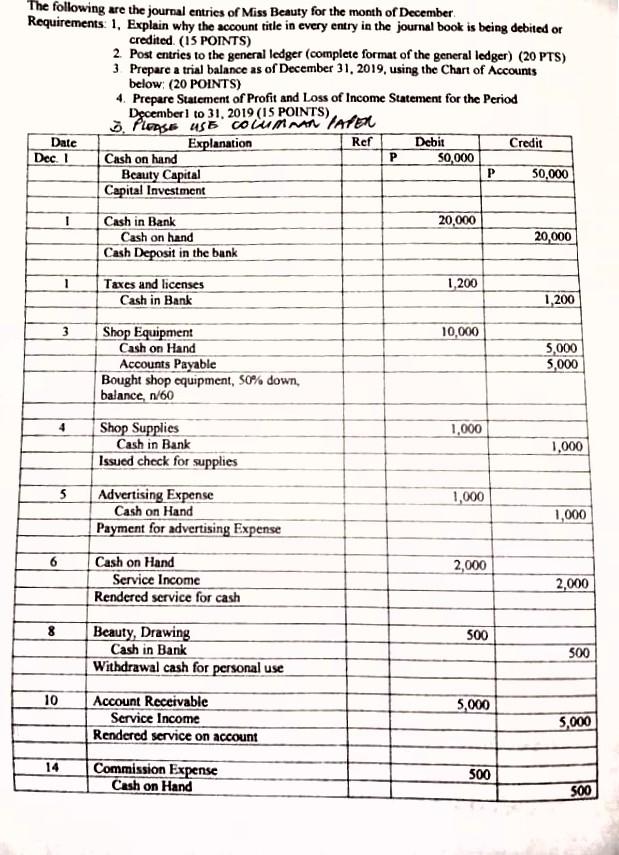

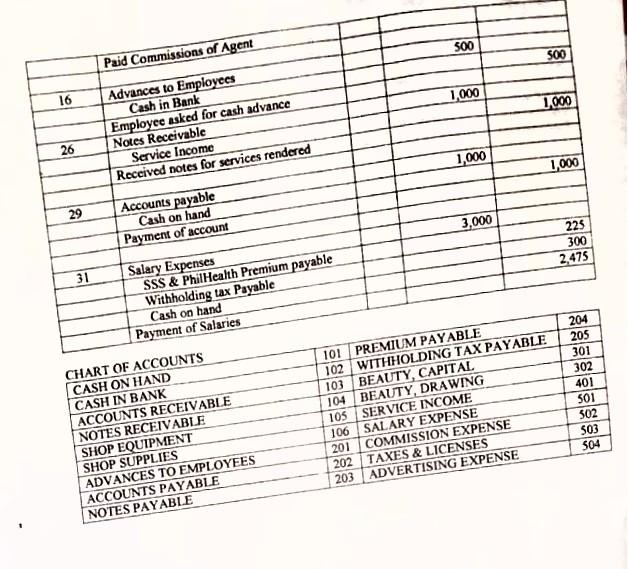

The following are the journal entries of Miss Beauty for the month of December Requirements: 1. Explain why the account title in every entry in the journal book is being debited or credited. (15 POINTS) 2. Post entries to the general ledger (complete format of the general ledger) (20 PTS) 3 Prepare a trial balance as of December 31, 2019, using the Chart of Accounts below (20 POINTS) 4. Prepare Statement of Profit and Loss of Income Statement for the Period December 1 to 31, 2019 (15 POINTS) Please usb Counter Date Explanation Debit Credit Dec 1 Cash on hand 50,000 Bcauty Capital 50,000 Capital Investment Ref P P 1 20,000 Cash in Bank Cash on hand Cash Deposit in the bank 20,000 1 1,200 Taxes and licenses Cash in Bank 1,200 3 10,000 Shop Equipment Cash on Hand Accounts Payable Bought shop equipment, 50% down, balance, 1/60 5,000 5,000 1,000 Shop Supplies Cash in Bank Issued check for supplies 1,000 5 1,000 Advertising Expense Cash on Hand Payment for advertising Expense 1,000 6 2,000 Cash on Hand Service Income Rendered service for cash 2,000 8 500 Beauty, Drawing Cash in Bank Withdrawal cash for personal use 500 10 5,000 Account Receivable Service Income Rendered service on account 5,000 Commission Expense Cash on Hand 500 500 500 500 Paid Commissions of Agent 1,000 1,000 225 300 2.475 16 Advances to Employees Cash in Bank Employee asked for cash advance 26 Notes Receivable 1,000 Service Income Received notes for services rendered 29 Accounts payable 1,000 Cash on hand Payment of account 31 Salary Expenses 3,000 SSS & PhilHealth Premium payable Withholding tax Payable Cash on hand Payment of Salaries CHART OF ACCOUNTS CASH ON HAND 101 PREMIUM PAYABLE CASH IN BANK 102 WITHHOLDING TAX PAYABLE ACCOUNTS RECEIVABLE 103 BEAUTY, CAPITAL NOTES RECEIVABLE 104 BEAUTY, DRAWING SHOP EQUIPMENT 105 SERVICE INCOME SHOP SUPPLIES 106 SALARY EXPENSE ADVANCES TO EMPLOYEES 201 COMMISSION EXPENSE ACCOUNTS PAYABLE 202 TAXES & LICENSES NOTES PAYABLE 203 ADVERTISING EXPENSE 204 205 301 302 401 501 502 503 504Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started