Answered step by step

Verified Expert Solution

Question

1 Approved Answer

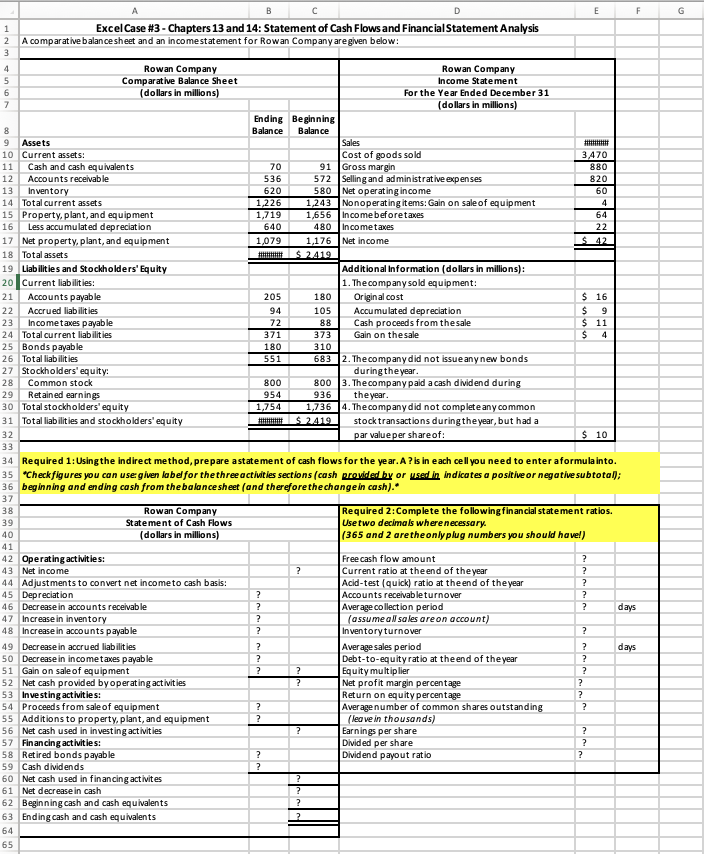

Complete the requirements using cell references or Excel formulas only ( i . e . no hard - keyed numbers should be entered, with the

Complete the requirements using cell references or Excel formulas only ie no hardkeyed numbers should be entered, with the exception of for the average collection and sales period calculations and for any basic averages

Please provide the cell refrence formulas for each blank. I've provided it down below for easy copypaste into excel.

Excel Case # Chapters and : Statement of Cash Flows and Financial Statement Analysis

A comparative balance sheet and an income statement for Rowan Company are given below:

Rowan Company Rowan Company

Comparative Balance Sheet Income Statement

dollars in millions For the Year Ended December

dollars in millions

"Ending

Balance" "Beginning

Balance"

Assets Sales $

Current assets: Cost of goods sold

Cash and cash equivalents Gross margin

Accounts receivable Selling and administrative expenses

Inventory Net operating income

Total current assets Nonoperating items: Gain on sale of equipment

Property, plant, and equipment Income before taxes

Less accumulated depreciation Income taxes

Net property, plant, and equipment Net income $

Total assets $ $

Liabilities and Stockholders' Equity Additional Information dollars in millions:

Current liabilities: The company sold equipment:

Accounts payable Original cost $

Accrued liabilities Accumulated depreciation $

Income taxes payable Cash proceeds from the sale $

Total current liabilities Gain on the sale $

Bonds payable

Total liabilities The company did not issue any new bonds

Stockholders' equity: during the year.

Common stock The company paid a cash dividend during

Retained earnings the year.

Total stockholders' equity The company did not complete any common

Total liabilities and stockholders' equity $ $ stock transactions during the year, but had a

par value per share of: $

Required : Using the indirect method, prepare a statement of cash flows for the year. A is in each cell you need to enter a formula into.

Check figures you can use: given label for the three activities sections cash provided by or used in indicates a positive or negative subtotal;

beginning and ending cash from the balance sheet and therefore the change in cash

Rowan Company Required : Complete the following financial statement ratios.

Statement of Cash Flows Use two decimals where necessary.

dollars in millions and are the only plug numbers you should have!

Operating activities: Free cash flow amount

Net income Current ratio at the end of the year

Adjustments to convert net income to cash basis: Acidtest quick ratio at the end of the year

Depreciation Accounts receivable turnover

Decrease in accounts receivable Average collection period days

Increase in inventory assume all sales are on account

Increase in accounts payable Inventory turnover

Decrease in accrued liabilities Average sales period days

Decrease in income taxes payable Debttoequity ratio at the end of the year

Gain on sale of equipment Equity multiplier

Net cash provided by operating activities Net profit margin percentage

Investing activities: Return on equity percentage

Proceeds from sale of equipment Average number of common shares outstanding

Additions to property, plant, and equipment leave in thousands

Net cash used in investing activities Earnings per share

Financing activities: Divided per share

Retired bonds payable Dividend payout ratio

Cash dividends

Net cash used in financing activites

Net decrease in cash

Beginning cash and cash equivalents

Ending cash and cash equivalents

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started